In India, life insurance is often treated like a seasonal item — something people suddenly remember around February or March, right before tax declarations are due. Advisors start calling. Offices circulate “investment declarations.” And insurance policies fly off the shelves — not because people want protection, but because they want deductions.

And that’s the problem.

While saving tax is a great bonus, buying life insurance only to save tax can leave your family underprotected and your money underperforming.

Let’s understand why this happens — and what you should do instead.

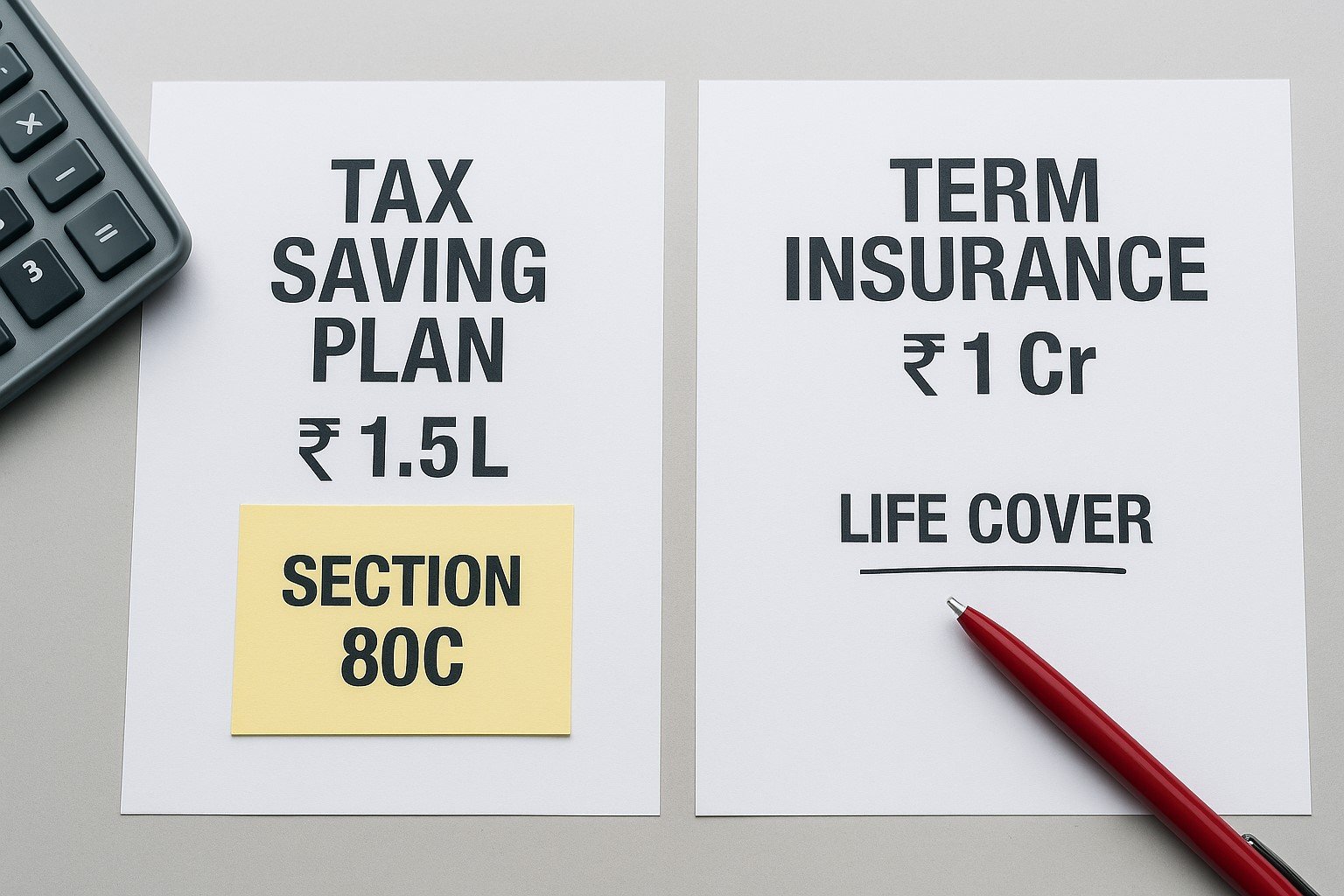

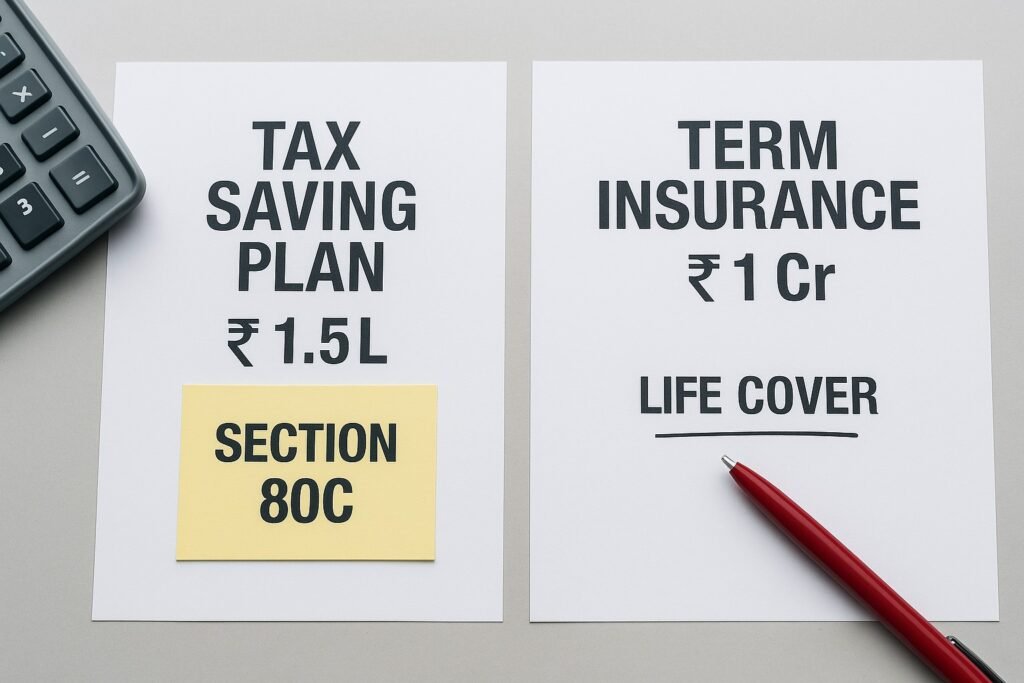

The Tax Angle: What You Actually Get

Yes, life insurance premiums are eligible for tax benefits:

- Section 80C lets you claim up to ₹1.5 lakh deduction on premiums paid.

- Section 10(10D) ensures maturity proceeds (under eligible plans) are tax-free.

Sounds great, right?

But here’s where it goes wrong.

The Trap: When Tax Becomes the Only Reason

Most salaried taxpayers, especially first-time buyers, rush to pick a policy by March — without understanding it. The result?

- You end up with a low-cover endowment plan that mixes insurance with savings

- You lock yourself into long-term commitments (15–20 years!) for tiny returns

- The sum assured is often just ₹1–5 lakh — nowhere near what your family would need if something happened to you

- You ignore term plans because they don’t offer maturity payouts — even though they offer 10X the coverage for 1/10th the cost

It’s like buying a parachute based on how much cashback it gives — not whether it opens when you need it.

The Real Reason to Buy Life Insurance

Life insurance isn’t an investment. It’s income replacement.

If your monthly income suddenly stopped tomorrow, how would your family survive?

That’s what insurance is meant to solve.

A ₹50 lakh or ₹1 crore term plan ensures that your loved ones can pay rent, school fees, or EMIs — even if you’re not around.

But since these term plans don’t offer “returns”, many people skip them. They choose “tax-saving” over real protection.

A Smarter Way: Tax + Real Security

You don’t have to ignore tax benefits. Just don’t let them make the decision for you.

Here’s a better approach:

Need income protection? Get a term plan — even if it has no maturity benefit

Want tax + saving? Choose PPF, ELSS, or even NPS — they offer better returns and flexibility

Already bought a small traditional plan? Don’t buy another — instead, top up with real insurance

Use the tax season to review your financial risk, not just your deductions.

Final Thought

Buying life insurance just to save tax is like buying shoes that look nice but don’t fit.

Sure, you get a deduction. But your family is still exposed.

Your money is still locked in a low-growth plan.

And your peace of mind? Still missing.

So before you say yes to another “zero tax” pitch, pause and ask:

“If I’m not around tomorrow, will this policy truly protect my family?”

If the answer is no — it’s time to rethink, not just reinvest.