A Government-Backed Safety Net for India’s Informal Workers

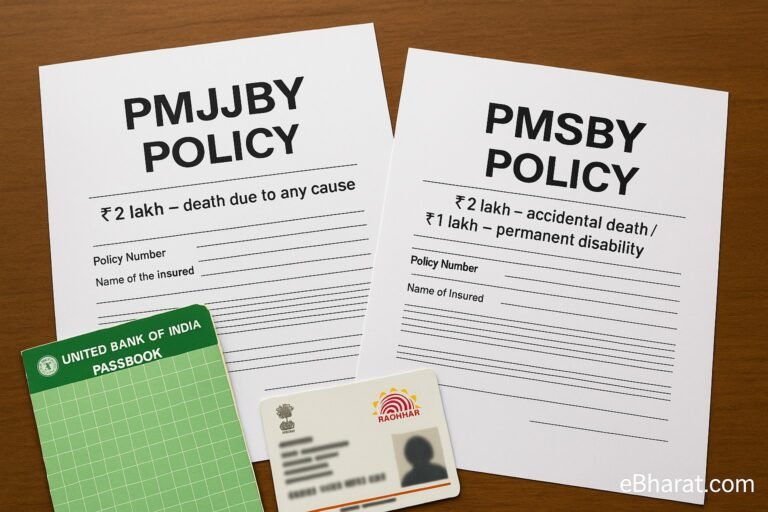

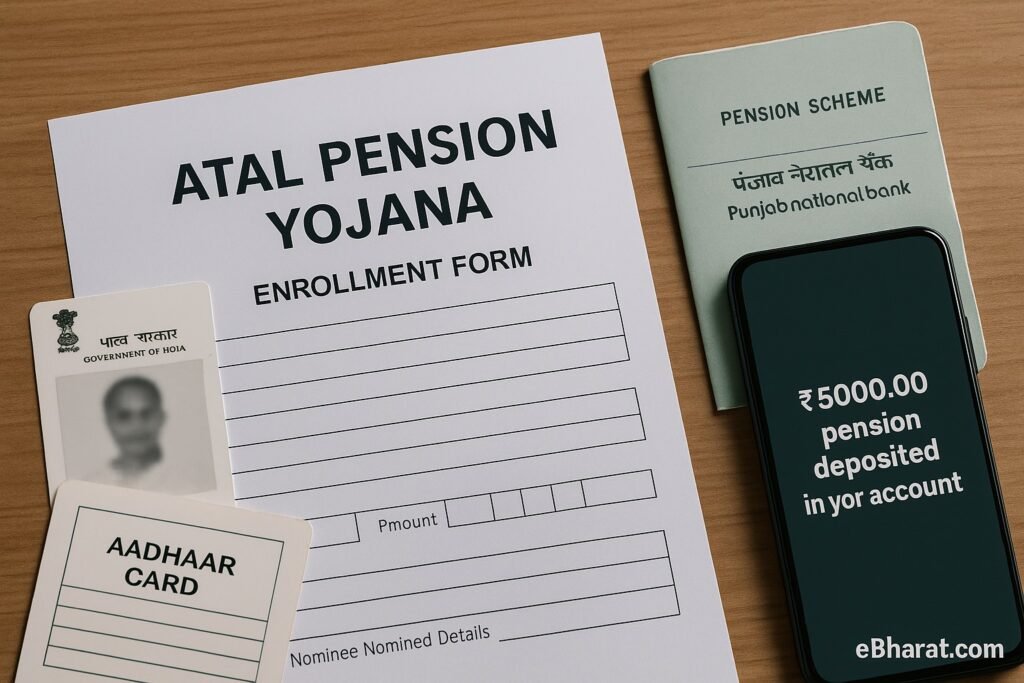

The Atal Pension Yojana (APY) is one of India’s most important social security schemes — especially for people who don’t have any formal retirement plan.

Launched in 2015, APY gives guaranteed monthly pensions ranging from ₹1,000 to ₹5,000 after retirement. And in 2025, it’s still going strong — with improved digital access and simplified enrolment across India.

But is it right for you?

Let’s break it down in simple language.

What Is the Atal Pension Yojana?

Atal Pension Yojana is a government-guaranteed pension plan meant for low-income and informal sector workers — like daily wage labourers, domestic help, small vendors, farmers, and gig workers.

Here’s how it works:

- You contribute monthly from your bank account until you turn 60

- After 60, you receive a guaranteed fixed monthly pension

- If you pass away, your spouse continues receiving the same pension

- After both pass away, your nominee receives the accumulated corpus (lump sum)

It’s simple, auto-debited, and completely backed by the Government of India.

Who Can Enroll in 2025?

You’re eligible if:

- You’re 18 to 40 years old

- You have a savings bank account

- You do NOT file income tax (as per the latest rules)

- You’re not already enrolled in NPS or EPF

So if you’re a small shopkeeper, gig worker, driver, or rural youth — and don’t file taxes — APY is designed for you.

How Much Pension Will You Get?

Your monthly pension depends on your age when you join and the contribution amount.

| Monthly Pension\ | Monthly Contribution\ | Contribution Period |

|---|---|---|

| ₹1,000 | ₹126 | 30 years |

| ₹2,000 | ₹248 | 30 years |

| ₹3,000 | ₹374 | 30 years |

| ₹4,000 | ₹497 | 30 years |

| ₹5,000 | ₹620 | 30 years |

All contributions are auto-debited from your linked bank account.

What Happens After You Turn 60?

Once you hit 60:

- Contributions stop

- Your monthly pension starts — for life

- If you pass away, your spouse continues receiving the same pension

- When both die, your nominee gets the lump sum corpus

- Corpus ranges between ₹1.7 lakh to ₹8.5 lakh, depending on your chosen pension

It’s a complete 3-level security model for your family.

What If You Miss Payments?

Don’t worry — the system is forgiving, but not forever.

- Late fees range from ₹1 to ₹10/month

- 6 months of non-payment → Account may freeze

- 12–24 months of inactivity → Risk of deactivation

- You can request reactivation through your bank

Stay consistent — even a small monthly contribution adds up in the long run.

Is APY Still Worth It in 2025?

Here’s the real question: Should you enroll?

YES – If you’re:

- A worker in the informal/unorganised sector

- Someone with no EPF, NPS, or PPF

- Looking for a guaranteed retirement income, not risky investments

- A rural youth wanting future security for your family

NO – If you’re:

- Already filing income tax

- A salaried employee with EPF or corporate NPS

- Expecting high market returns (APY is not a wealth creator)

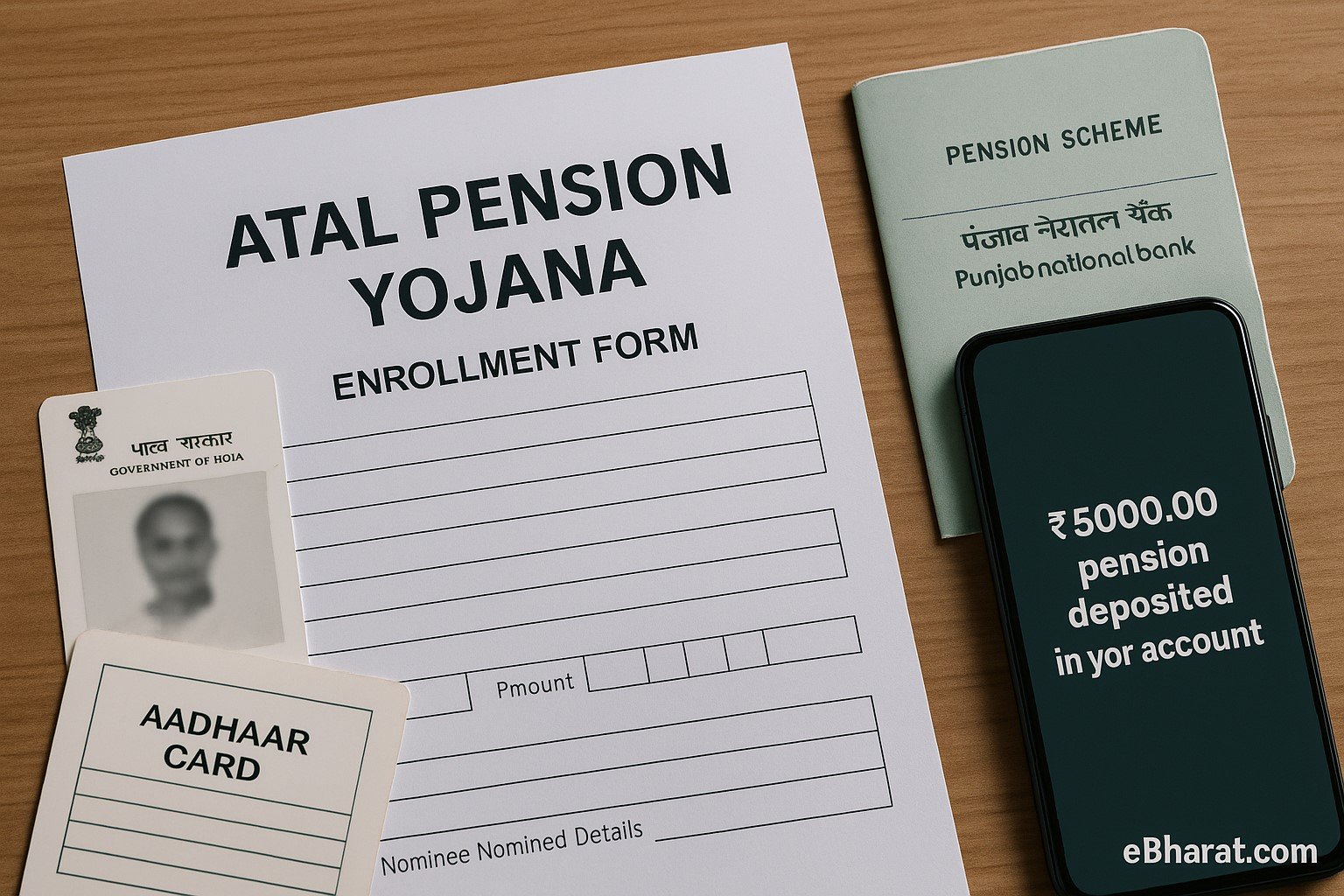

Where & How to Apply for APY

You can enroll through:

- Any bank branch (SBI, PNB, HDFC, etc.)

- Your bank’s net banking portal

- Jan Seva Kendras / CSC / e-Mitra centres

Documents needed:

- Aadhaar card

- Age proof (PAN, Voter ID, etc.)

- Savings bank account with auto-debit enabled

Application is instant, and contribution starts from next month.

Final Word: Why APY Is Still a Good Deal

The Atal Pension Yojana is not flashy — but it’s solid. It’s low-cost, low-risk, and high on peace of mind.

It won’t make you rich, but it will guarantee income when you’re older and need it most.

It’s perfect for drivers, labourers, farmers, gig workers, and rural youth — anyone without a pension scheme.

So if you’re eligible, don’t wait — sign up, set your monthly auto-debit, and sleep peacefully knowing your future is protected.