You’re Not Too Late — But You Do Need to Be Smarter

Buying term life insurance in your 20s or 30s is usually straightforward — low premiums, easy approvals, and plenty of plan choices.

But once you cross 40, the game changes.

Your financial responsibilities are heavier. Premiums rise. Medical checks get stricter. And if you’re not careful, you could end up with the wrong plan or an overpriced one.

If you’re over 40 and looking to secure your family’s future, here’s what you need to keep in mind — and how to make the smartest decision.

Yes, Premiums Are Higher — But They’re Still Worth It

It’s no secret: the older you get, the more you pay. But the jump isn’t as steep as most people fear — especially if you’re healthy and act quickly.

Here’s a rough idea for a ₹1 crore cover (non-smoker):

| Age | Monthly Premium (Estimate) |

|---|---|

| 30 | ₹700 – ₹900 |

| 40 | ₹1,500 – ₹1,800 |

| 45 | ₹2,000 – ₹2,500 |

Premiums tend to double every 8–10 years, so locking in your rate in your early 40s can save lakhs over time.

Medical Tests Are Mandatory — And That’s Okay

After 40, insurers want a clearer picture of your health. You’ll likely need to undergo:

- Blood and urine tests

- ECG

- Blood pressure, diabetes & cholesterol check

- Treadmill Test (TMT), if you opt for high coverage or have a family history

Good to know: These tests are typically arranged by the insurer and conducted at home or a diagnostic lab — free of charge.

Be honest. Hiding a condition might help you get a cheaper premium, but it could lead to claim rejection later.

Pick a Term That Matches Your Life Stage — Not Your Ego

When you’re younger, a 30–35-year policy might make sense.

But now? You need to align your coverage with your working years and remaining liabilities.

Ask yourself:

- When do I plan to retire — 60? 65?

- Will my home loan be paid off by then?

- Will my kids be financially independent in 15 years?

Example: If you’re 42 and planning to retire at 60, a 15–18 year term is enough. No need to pay extra for a 30-year policy you won’t need.

Don’t Pick ₹1 Crore at Random — Calculate Your Ideal Cover

The right life cover should reflect your income, liabilities, and financial goals.

Here’s a simple formula:

Life cover = (Annual income × Remaining earning years) + Outstanding loans – Existing savings

Example:

- Income: ₹10 lakh/year

- Remaining work years: 18

- Home loan: ₹20 lakh

- Savings: ₹5 lakh

Ideal cover: ₹10L × 18 + ₹20L – ₹5L = ₹1.95 crore

So, don’t just go with a round number. Do the math. Your family’s future deserves accuracy.

Transparency Is Your Best Friend — Especially Now

At 40+, your health history becomes a crucial factor. Don’t fudge details — even minor omissions can cost your family big later.

Disclose:

- Existing health issues

- Medications you’re taking

- Family medical history

- Smoking, alcohol, or lifestyle risks

Remember: insurers verify everything through underwriting and medical reports. It’s better to be open than to risk a denied claim.

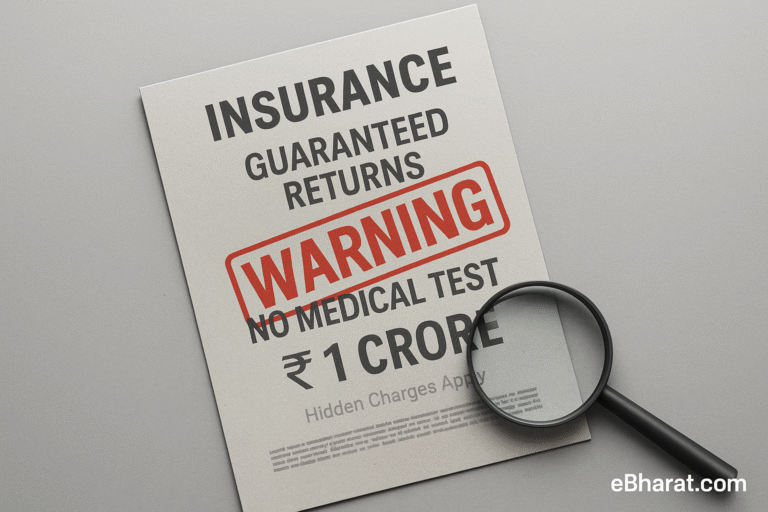

Thinking of Return of Premium (ROP)? Read This First

ROP plans promise to return your premiums if you survive the term — sounds great, right?

But there’s a catch: the cost.

Comparison:

- Pure Term Plan: ₹1,800/month

- ROP Plan: ₹3,500–₹4,000/month

💡 Better option: Buy a pure term plan and invest the rest (say ₹1,500/month) in a SIP. Over 20 years, that could grow into ₹10–15 lakh — far more than an ROP refund.

Choose ROP only if you’re uncomfortable with the idea of “no return.” Otherwise, stick to pure term for real value.

Final Word: Term Insurance After 40 Isn’t Too Late — Just Plan It Smartly

Buying term insurance at 40+ is not a lost opportunity — it’s a smart step if you do it right.

Here’s your checklist:

- Lock in a realistic cover based on income and debt

- Choose a term aligned to your retirement age

- Be 100% honest with medical and lifestyle details

- Avoid overpaying for riders or flashy features

- Compare premiums across 3–4 top IRDAI-approved insurers

A good term plan isn’t about impressing anyone. It’s about giving your family certainty when life takes an unexpected turn.