Yes, They Can — And Here’s Why It Matters

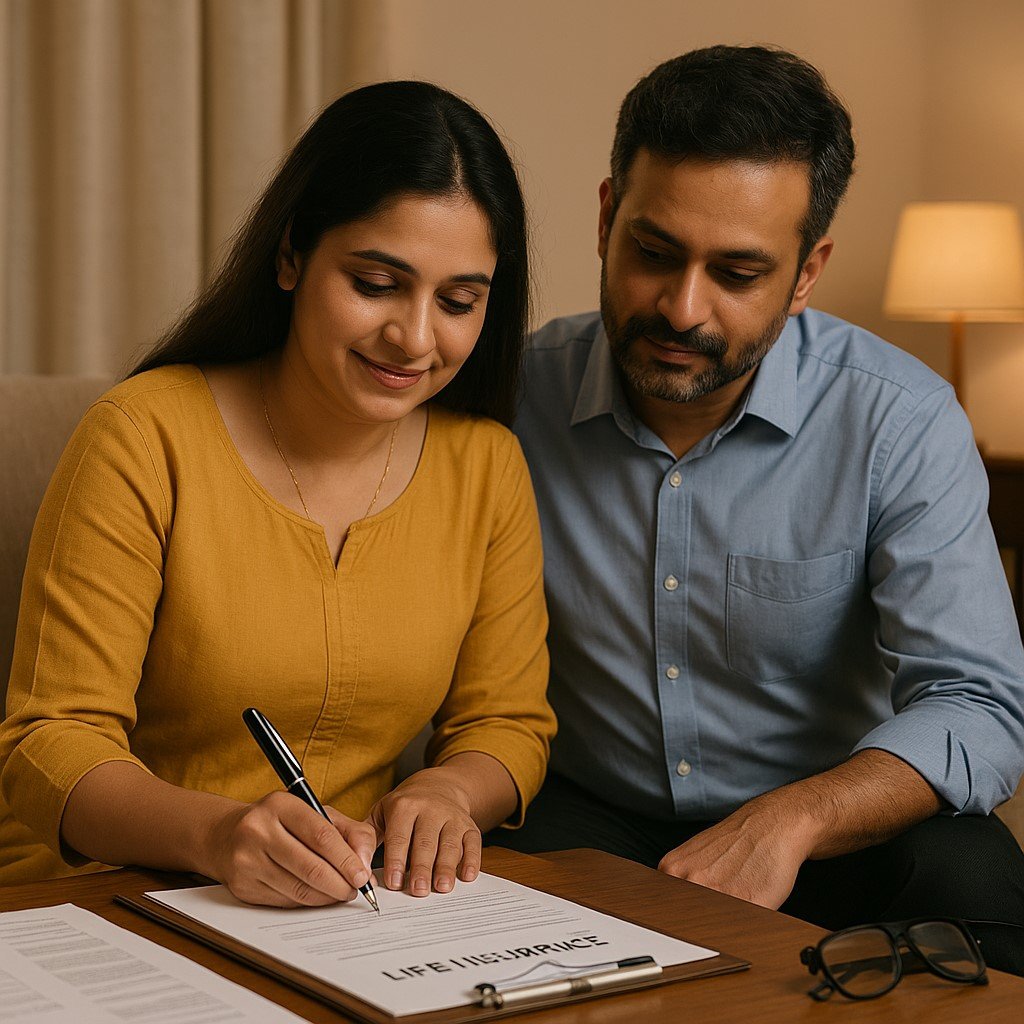

In most Indian households, the contribution of a homemaker goes far beyond what meets the eye.

From managing the household to raising children, taking care of elderly parents, and ensuring the family runs smoothly — a housewife plays a vital role. Yet, many families overlook one simple but powerful form of protection: life insurance for housewives.

If you’re wondering whether a housewife can get life insurance without a salary or income proof — the answer is a clear yes. Let’s break it down.

Why Should Housewives Have Life Insurance?

Even if she doesn’t bring home a paycheck, the loss of a homemaker would have a huge emotional and financial impact.

Think about it:

- Who will care for the children?

- Who will manage the household on a daily basis?

- Will there be additional childcare or help expenses?

A life insurance policy helps a family stay financially stable if something unexpected happens — and gives peace of mind that loved ones will be protected.

Can a Housewife Get Life Insurance Without Income?

Yes, she can. Several insurance companies now offer policies to non-working spouses. While traditional term insurance is based on income, many insurers allow coverage based on the earning partner’s financial profile.

However, there are a few conditions and limitations to keep in mind — especially regarding the cover amount and type of plan.

What Type of Life Insurance Is Available for Housewives?

Here are four options typically offered by insurers:

1. Joint Life Insurance Plans

A single policy that covers both husband and wife. If either spouse passes away, the benefit is paid out to the surviving partner.

2. Spouse Add-On in Term Plans

Some term plans allow the working partner to include their non-earning spouse as a co-insured. Premiums are slightly higher but both lives are covered.

3. Independent Life Insurance (for Housewives)

Some insurers offer independent policies for homemakers, usually with a smaller sum assured like ₹5 lakh to ₹25 lakh. Eligibility is based on the earning spouse’s income.

4. Women-Centric Insurance Plans

These are specially designed for women and may include maternity benefits, premium waivers during pregnancy complications, or child education support in case of death.

What Documents Are Needed?

Even without income proof, most insurers will ask for:

- KYC Documents – Aadhaar, PAN, Voter ID

- Marriage Certificate or Spouse Declaration

- Husband’s Income Proof – Salary slips, ITR, or bank statement

- Address Proof

- Basic Health Declaration

👉 Medical tests may be requested based on the coverage amount or age of the applicant — but for smaller policies, many plans are no-medical.

How Much Life Cover Can a Housewife Get?

It depends on the earning spouse’s income and cover.

General guidelines:

- If husband earns ₹8–₹10 lakh annually, housewife may get cover of ₹10–₹25 lakh

- If husband holds a ₹1 crore policy, insurers might allow up to 50% of that sum assured for the non-working spouse

Always check insurer-specific limits, as they may vary.

Best Life Insurance Plan Types for Housewives

If a pure term plan isn’t available or seems limited, these options are great alternatives:

- Endowment or Money-Back Plans – Savings + Protection

- Micro-Insurance Products – Lower sum assured, easier eligibility

- Unit Linked Insurance Plans (ULIPs) – Low entry investment + insurance

- Joint Term Plans – Affordable and efficient

Some insurers also allow policy conversions — where you can start with a small cover and upgrade later when financials allow.

What About Claims? Are They Honoured?

Absolutely — as long as:

- The application was filled honestly

- Health declarations were truthful

- Premiums were paid on time

The nominee (usually husband or child) will receive the full sum assured as per policy terms. Even non-earning spouses go through standard underwriting — so transparency is key.

Final Word: Insurance Isn’t Just for Earners

A housewife may not earn a monthly salary, but she brings irreplaceable value to the family.

Her absence would create both emotional loss and financial disruption — from caregiving to home management.

So yes, homemakers can and should be insured.

If you’re a husband, consider adding life insurance for your wife.

If you’re a homemaker yourself, speak to a trusted advisor about your options.

Because protecting your family’s future — and your own contribution — is always worth it.