Not every insurance agent you meet is officially licensed.

Some may be genuine and trained, but others could be selling without IRDAI approval — which can lead to fraud, mis-selling, or policy disputes later.

The good news? It takes just 2 minutes to check if your insurance agent is IRDAI-certified using a free government database.

Why You Should Check Your Insurance Agent’s License

When you buy a policy — whether life insurance, health insurance, motor, or investment-linked — you are trusting someone with your family’s financial future.

Buying from an unauthorized agent can lead to:

- Fake policies that never get issued by the insurer

- Mis-selling of high-commission plans that don’t suit your needs

- Policy lapses if the agent doesn’t submit your premium

- No accountability — unlicensed agents cannot be tracked by IRDAI

Tip: Always deal with a certified agent, broker, or POSP — their details are recorded in the IRDAI system and they are bound by regulations.

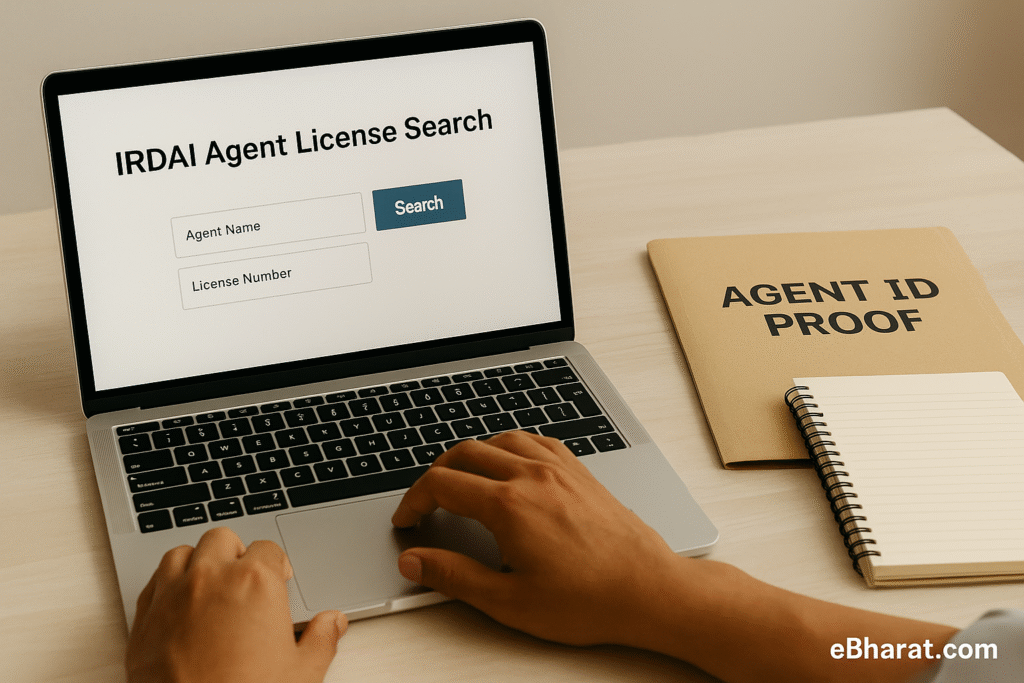

Step-by-Step: How to Check an Insurance Agent’s License

Step 1: Visit the Official IRDAI Website

Go to: www.irdai.gov.in

Step 2: Go to the Agent Verification Section

- Look for “Intermediary / Agent / Broker” in the main menu

- Click on “List of Licensed Agents” or “Agency Database”

Step 3: Enter the Agent’s Details

You can search by:

- Full Name

- Agent/License Code

- PAN Number

Step 4: Verify the Information

The search result will show:

- IRDAI License Number

- License Validity (Issue & Expiry Dates)

- Tied Insurer Name (e.g., LIC, HDFC Life)

- Registered Location

If the agent is listed, they’re officially authorized. If no record is found — do not buy from them.

Optional: Double-Check With the Insurance Company

If you still have doubts:

- Call the insurance company’s customer care

- Provide the agent’s code or name

- Ask if they are authorized to sell policies on behalf of the insurer

Why It’s Important to Check

Verifying an agent protects you from:

- Fake policies that never get issued

- Mis-selling high-commission plans not suited to your needs

- Policy lapses due to poor servicing or non-payment

- Ghost agents who disappear after the first premium

Only a registered agent is accountable under IRDAI’s regulations. Others? They’re ghosts with no official trail.

What If They Say They’re From a “Partner” Company?

It’s common for agents to say they represent XYZ Financial Services instead of directly naming LIC or SBI Life.

That’s fine if the partner firm is licensed as a:

- Corporate Agent

- Insurance Broker

- POSP (Point of Sale Person)

Here’s what you should ask:

- Are you certified as a POSP?

- Which insurance company are you tied to?

- Can I have your IRDAI license number?

You can also verify companies or firms (not just individuals) using IRDAI’s corporate license lookup.

Final Word

When it comes to life or health insurance, who you buy from matters just as much as the plan itself.

- Don’t trust a business card or a WhatsApp profile picture.

- Always ask for the IRDAI license and verify it.

- Spend 2 minutes today — it could save you years of regret tomorrow.

Insurance is a long-term promise. Make sure it’s backed by someone you can actually trust.

Want to check multiple policies and manage them in one place?

Use Insurance+ — India’s digital tool for comparing, tracking, and renewing insurance in seconds.

Thinking of becoming a certified insurance agent?

Apply to Join Our Agent Network — Start earning commissions legally as an IRDAI-certified POSP.