In 2025, buying insurance in India is easier than ever.

You can log on to a website, compare plans, and buy in 10 minutes — or you can sit with a trusted insurance advisor who walks you through every detail.

But which is better — online insurance purchase or buying through an agent?

The answer depends on your needs, your confidence with financial products, and the type of policy you want.

Let’s break it down so you can make the smartest choice for your situation.

When It Makes Sense to Buy Insurance Online (Direct)

If you’re confident, clear about what you want, and looking for a straightforward plan, online insurance is fast, transparent, and often cheaper.

Advantages of Buying Insurance Online:

- Lower Premiums – No agent commission added to the price.

- Exclusive Discounts – Many insurers and aggregator sites offer online-only discounts or promo codes.

- Easy Comparisons – Use comparison tools to check premiums, benefits, and claim settlement ratios side by side.

- Instant Policy Issuance – Great for term insurance and basic health insurance without complex underwriting.

- No Pressure Sales – You buy when you’re ready, not when someone is pushing you.

Best for:

- Salaried professionals

- Tech-savvy millennials

- First-time buyers looking for pure term plans or basic health cover

Example: If you just need a ₹1 crore term plan without riders, buying online via Insurance+ can save both time and money.

When a Trusted Advisor Is the Smarter Choice

Insurance isn’t always simple.

If you’re buying a long-term savings plan, child education plan, pension policy, or ULIP, having a qualified advisor can save you from costly mistakes.

Benefits of Buying Through an Insurance Advisor:

- Personalized Advice – They match plans to your income, goals, and family needs.

- Help With Paperwork & KYC – Saves time and ensures error-free forms.

- Clear Explanation of Riders & Exclusions – Avoids surprises at claim time.

- Claim Support – They can guide you or your family during emergencies.

- Periodic Policy Review – Ensures your plan stays relevant as your life changes.

Best for:

- Families with children or dependents

- NRIs buying policies in India

- Pre-retirees or retirees

- Investors in ULIPs, endowment plans, or guaranteed return schemes

Example: If you’re investing ₹15 lakh in a child ULIP, a trained POSP advisor from eBharat can explain charges, bonuses, and maturity benefits in detail.

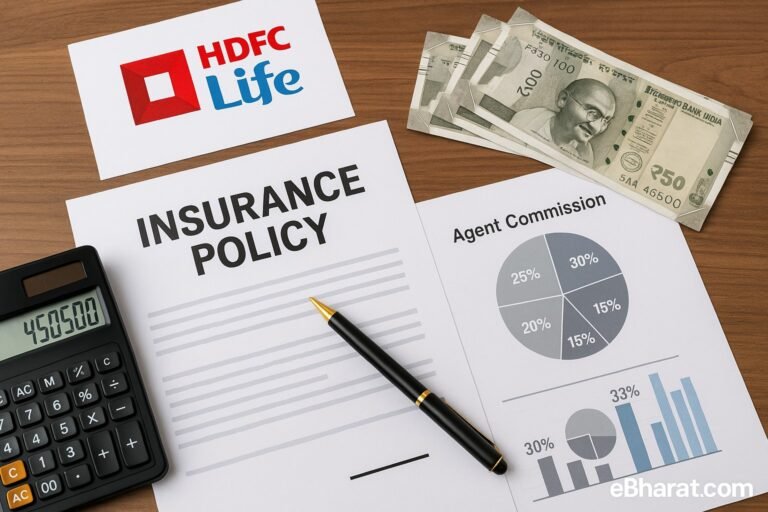

Do Advisors Charge a Fee?

- You don’t pay directly.

- Advisors earn commission from the insurance company.

- Premiums for some traditional or investment-linked plans may be slightly higher, but you also get personal service and ongoing support.

Red Flags to Watch Out For in Some Agents

While many advisors are ethical, some may be sales-focused instead of customer-focused.

Be careful if they:

- Push only high-commission policies

- Refuse to compare plans from other insurers

- Promise “guaranteed 15% returns” (unrealistic)

- Rush you with “last-day discounts”

If you feel pressured — pause, review, and verify before buying.

Best of Both Worlds — Hybrid Model

Today, many platforms (including Insurance+) offer a mix of online convenience + advisor support:

- You research and shortlist plans online

- A licensed advisor explains details and answers questions

- You buy online but still get post-sale service and reminders

This approach works best for buyers who want both clarity and guidance.

- Want to earn as an insurance advisor? Become an Agent

Conclusion

There’s no one-size-fits-all rule.

- If you’re confident, know what you want, and want to save money — buy online.

- If you want personalized guidance, claim support, and help with complex plans — buy through a trusted advisor.

The key is understanding the product, the costs, and how it fits your long-term financial goals.

Whether online or offline, smart insurance buying means informed insurance buying.