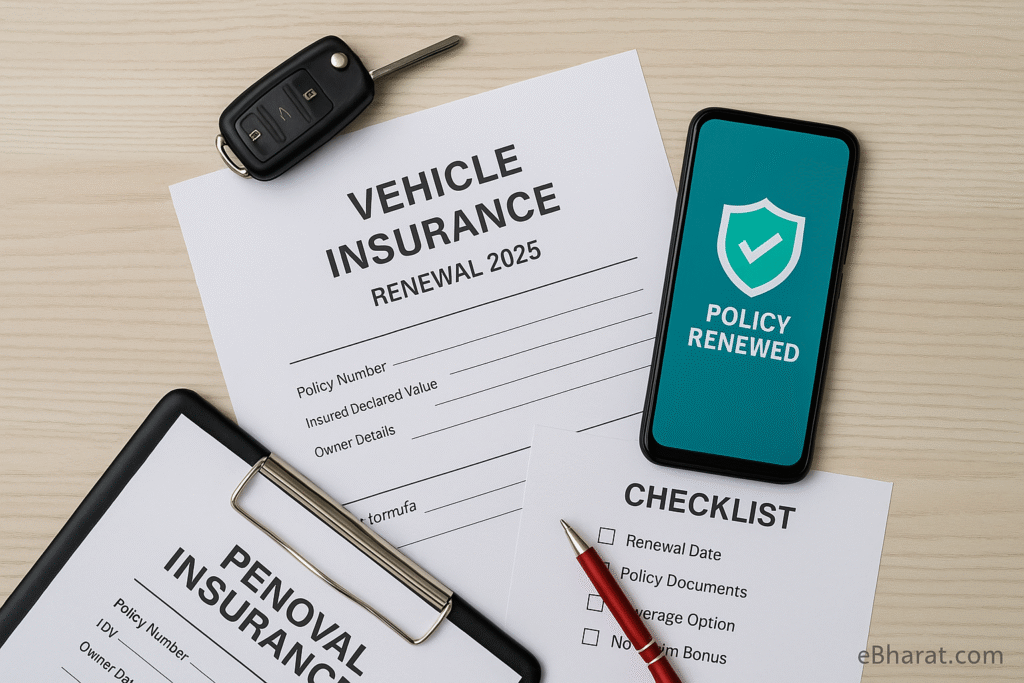

Don’t Just Click and Pay — Read This First

Renewing your vehicle insurance shouldn’t be a “click-and-forget” task — because one small mistake could cost you thousands in rejected claims or legal trouble.

From missing important add-ons to entering incorrect details, oversights at the renewal stage can leave you unprotected when you need help the most.

Here’s your essential 6-point renewal checklist to make sure you stay financially and legally safe.

Renew Early — Avoid Last-Minute Risks

If expired: Don’t drive. Contact your insurer immediately for an offline renewal or schedule a quick vehicle survey.

Why it matters: Waiting until the last day increases the risk of your policy expiring, which means you could be driving uninsured (illegal in India and punishable by fines).

Best practice: Renew at least 7 days before expiry so you have time to correct errors or add missing covers.

Verify Every Policy Detail

Pro Tip: Even a single wrong digit in your RC or chassis number can make your policy useless during a claim.

Renewal forms are often auto-filled from last year’s data — but even a small mistake can delay or deny a claim.

Double-check:

Vehicle registration number

Chassis & engine number

Owner name and ID proof

IDV (Insured Declared Value) — the amount you get if your vehicle is a total loss

Verify Every Policy Detail

Pro Tip: Even a single wrong digit in your RC or chassis number can make your policy useless during a claim.

Renewal forms are often auto-filled from last year’s data — but even a small mistake can delay or deny a claim.

Double-check:

Vehicle registration number

Chassis & engine number

Owner name and ID proof

IDV (Insured Declared Value) — the amount you get if your vehicle is a total loss

Claim Your NCB (No Claim Bonus)

This can save ₹1,000–₹4,000 per year depending on your plan.

If you haven’t filed a claim in the past year, you may get up to 50% off your renewal premium.

But — NCB isn’t applied automatically when you switch insurers.

Steps to secure your NCB:

Ask your old insurer for an NCB Certificate

Share your claim-free history with the new insurer

Upload your previous policy as proof

Compare Quotes Before You Renew

Premiums for the same coverage can vary by ₹500–₹2,000 — so shopping around pays.

Loyalty isn’t always rewarded in insurance — other companies may offer better terms.

Compare 2–3 insurers for:

Higher IDV at the same or lower premium

Lower cost for identical add-ons

Better claim settlement ratio

Final premium post-GST (not just base premium)

Keep Multiple Copies of Your Policy

Why? Because in emergencies or police checks, you need quick access.

After payment, don’t just wait for the email:

Download the PDF policy immediately

Email it to yourself and store it in cloud storage

Keep a hard copy in your glove box or under your bike seat

Take a screenshot of the payment confirmation & transaction ID

5 Minutes Today = Peace of Mind All Year

Renewing vehicle insurance is not just a formality — it’s a safeguard for your finances and legal protection on the road.

A wrong digit, missed add-on, or unclaimed NCB can cause major losses.

Take 5 minutes to follow this checklist, renew smartly, and keep your ride (and wallet) safe.

Next Read: Why Third-Party Motor Insurance Isn’t Enough in 2025

Renew Your Vehicle Insurance the Smart Way

Compare quotes, claim your NCB, and pick the right add-ons — all in one place. Don’t settle for the default renewal price. Save money and get better protection today.

🔍 Browse Insurance+ Motor PlansCompare 50+ motor insurance policies from trusted insurers in India.