Every year, crores of Indians sign up for government insurance schemes like PMJJBY and PMSBY through their bank accounts — often with just a signature and little understanding of what they’re really getting.

The appeal is obvious: ₹2 lakh cover for just ₹330 or ₹12 a year? Sounds like a great deal.

But when life throws a crisis your way — is this really enough?

Let’s break it down simply — what PMJJBY and PMSBY actually offer, and how they compare to a proper term life insurance policy.

What Are PMJJBY and PMSBY?

| Scheme | Coverage Offered | Annual Premium | Eligibility |

|---|---|---|---|

| PMJJBY (Life Cover) | ₹2 lakh (Death by any cause) | ₹330 | Age 18–50 |

| PMSBY (Accident Cover) | ₹2 lakh (Accidental death/full disability) ₹1 lakh (Partial disability) | ₹12 | Age 18–70 |

These are government-backed micro-insurance plans, meant for financial inclusion — not comprehensive coverage.

Why They’re Not Enough on Their Own

PMJJBY and PMSBY are better than having no insurance at all. But they come with strict limitations:

- Low coverage amounts — ₹2 lakh won’t go far for a family facing a major crisis.

- No maturity benefit — These are pure risk covers. You get nothing back if you survive.

- Annual auto-renewal — If your bank account doesn’t have enough funds, your policy might lapse silently.

- Strict definitions — Especially in PMSBY, claims are approved only for specific types of “accidental death” or disability.

And most importantly — they only last one year at a time.

How Term Insurance Is Different — and Better

| Plan Type | Coverage Amount | Tenure | Annual Premium (Avg) | Extras Possible |

|---|---|---|---|---|

| Term Insurance | ₹50 lakh – ₹1 crore+ | 10 to 40 years | ₹4,000 – ₹12,000 (depending on age/health) | Riders like critical illness, accidental death, waiver of premium |

What makes term insurance superior:

- Long-term coverage: Peace of mind for decades — not just 12 months.

- Guaranteed payouts: As long as premiums are paid, the sum assured is locked.

- Customizable: Add riders for health risks, income replacement, etc.

- Claim process backed by IRDAI norms — which makes it more transparent and trackable.

It’s not just about death cover — it’s about financial protection for your spouse, children, or ageing parents.

Real-Life Comparison: Same Age, Different Outcomes

Let’s take two 38-year-old men living in Ranchi:

- Ramesh has only PMJJBY + PMSBY (₹342/year)

- Suresh pays ₹5,200/year for a ₹75 lakh term insurance policy with a critical illness rider

If both unfortunately pass away suddenly:

- Ramesh’s family gets ₹2 lakh (if policy was active and death qualifies)

- Suresh’s family gets ₹75 lakh — guaranteed — plus possible critical illness benefit if diagnosed earlier

Who’s better protected?

That ₹5,000 difference could change a family’s future forever.

Common Misconceptions You Should Avoid

“Government plans are enough.”

Not true. These are starter covers, not full-scale family protection.

“Term insurance is too expensive.”

Actually, if you’re under 40 and healthy, you can get ₹1 crore cover for as little as ₹500/month — the cost of 2 movie tickets.

“I’ll get my PMJJBY auto-debited yearly.”

Only if your bank account has the funds and is linked properly. Many policies lapse without notice.

Use PM Schemes and Get a Real Term Plan

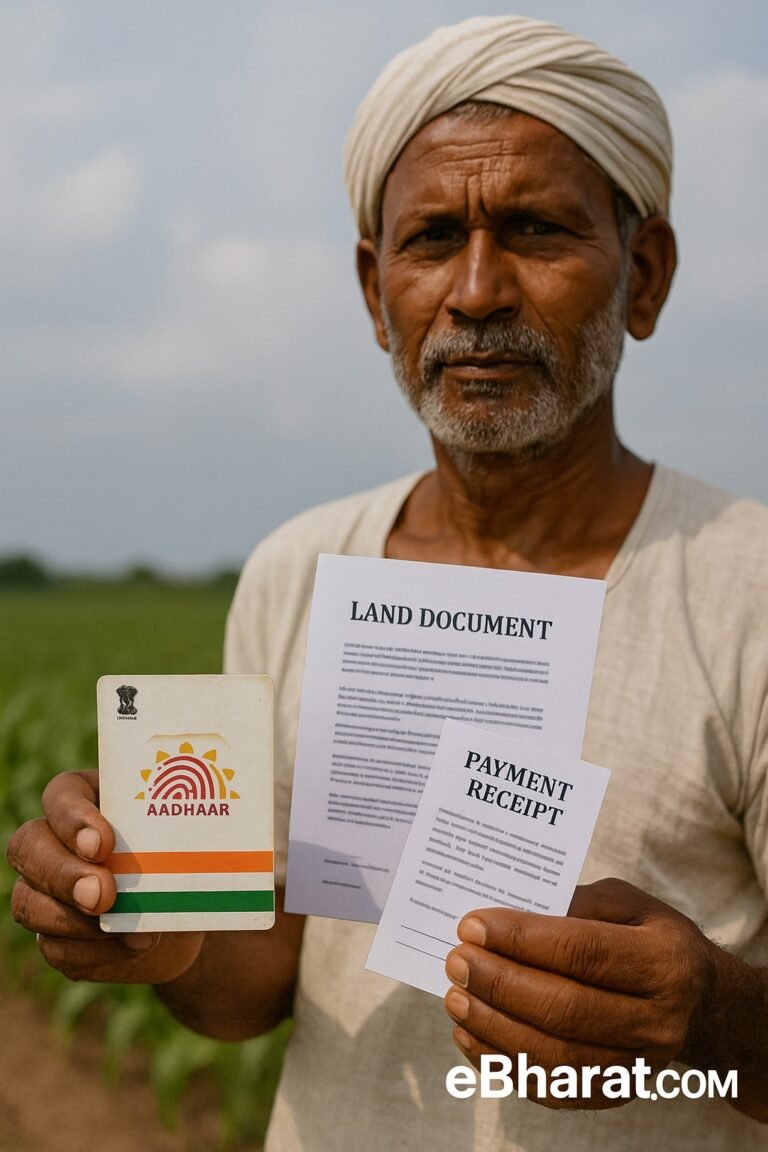

There’s no harm in keeping PMJJBY or PMSBY active — especially for rural, low-income, or informal workers.

But if you’re the main earning member of your family, a proper term plan is non-negotiable.

Your life cover should match your income, dependents, and long-term liabilities.

Don’t rely on ₹2 lakh when your family may need ₹50 lakh or more in your absence.

Already enrolled in PMJJBY but thinking of upgrading? You’re not alone. Many low-income policyholders are now exploring private term plans with better benefits. Here’s how to know if it’s the right time to switch from PMJJBY to a private term insurance plan — and what you need to watch out for.