“Two cups of tea a year — that’s what these government-backed schemes cost. But are they truly enough to protect your family?”

Millions Enrolled, But Very Few Know What They Actually Signed Up For

In cities and villages across India, bank staff routinely sign up account holders for two government-backed insurance schemes — PMSBY (₹12) and PMJJBY (₹330). Most people agree without a second thought.

After all, ₹12 and ₹330 a year seems like loose change, right?

But what do these micro-insurance plans actually cover? And in 2025, are they still worth it — or just another unchecked debit from your account?

Let’s break it down.

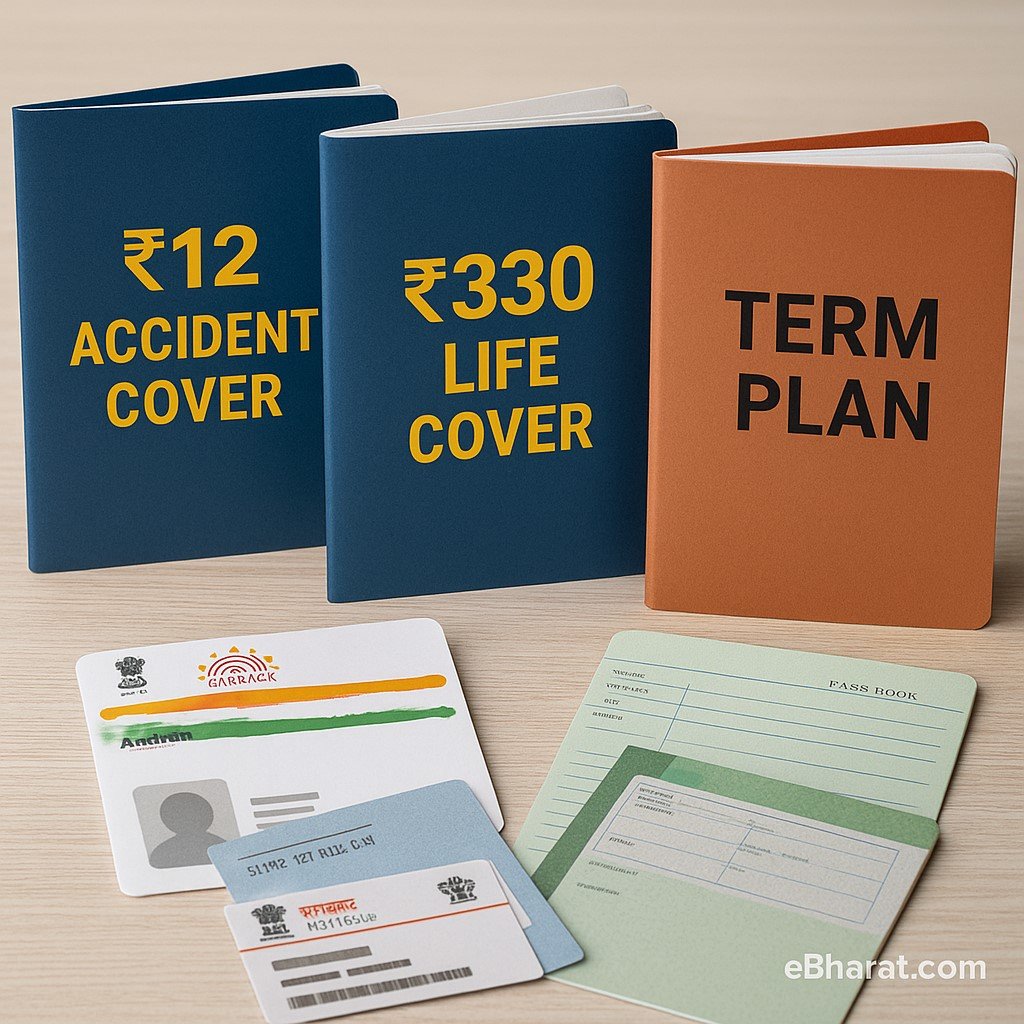

What Are These ₹12 and ₹330 Schemes?

| Scheme Name | Premium | Coverage | Who It’s For |

|---|---|---|---|

| PMSBY (Pradhan Mantri Suraksha Bima Yojana) | ₹12/year | ₹2 lakh in case of accidental death or permanent disability | Anyone aged 18–70 |

| PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana) | ₹330/year | ₹2 lakh in case of death by any cause | Age 18–50 (cover ends at 55) |

Both plans are auto-renewed every year through your bank — unless you opt out. They’re primarily meant for financially vulnerable households, especially those holding Jan Dhan accounts.

What PMSBY Actually Covers (₹12 Plan)

- Covers only accidental death or permanent disability

- No coverage for natural causes, diseases, illness, or old age-related death

- Partial disability (like loss of one limb or eye): payout limited to ₹1 lakh

- Exclusions include: death/injury while drunk, suicide, or adventure sports

So yes, it’s super cheap — but also very narrow in scope.

If someone passes away due to a heart attack or cancer, this plan pays nothing.

What PMJJBY Offers (₹330 Plan)

- Covers death due to any cause — accident, illness, or natural

- Payout of ₹2 lakh to the nominee

- Only available to people aged 18 to 50

- Coverage automatically ends at age 55

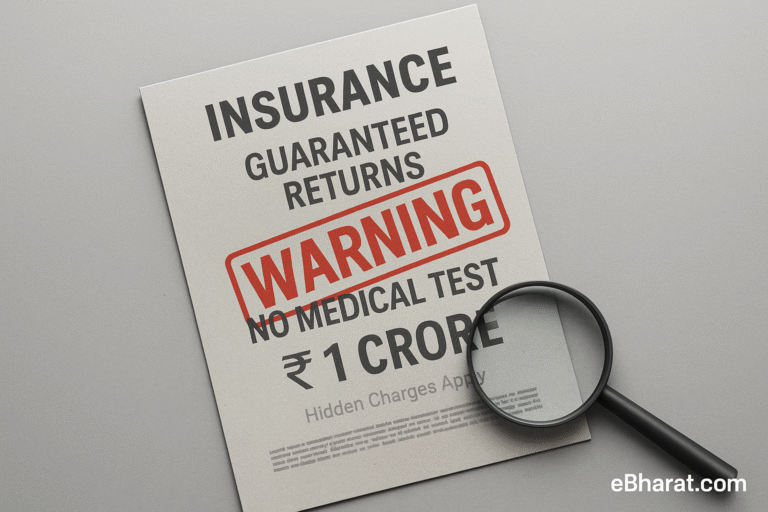

But here’s the hidden catch:

If your Aadhaar isn’t linked, or your bank account becomes inactive, your policy lapses silently — with no alert or refund.

And if you die during a “lapsed” year, your nominee may get nothing.

Why Claims Are Low — And Awareness Even Lower

According to recent IRDAI disclosures, the claim settlement ratio of both PMJJBY and PMSBY remains significantly lower than regular life insurance plans.

- Many users don’t know they’re enrolled

- Beneficiaries don’t know how or where to file claims

- Documents like death certificates or disability proofs are often missing

- Lapsed or dormant accounts lead to automatic cancellation

For lakhs of families, the insurance existed — but never paid out when needed.

Are These Plans Still Worth It in 2025?

Yes — but only as a basic safety net.

Think of PMJJBY and PMSBY as the first rung in your insurance ladder. They’re incredibly affordable and offer basic protection, but:

- ₹2 lakh is nowhere near enough for a family’s long-term needs

- Rising healthcare costs and inflation make this coverage feel outdated

- Claims depend heavily on documentation, awareness, and timing

A Smarter Way to Use These Schemes

- Keep them active if affordability is a concern — they’re better than having nothing

- Use them alongside other insurance like term plans, accident covers, or health insurance

- Inform your nominee where your policy details are stored

- Check your bank passbook every year around June to see if premiums were debited

- Link Aadhaar and mobile number to your account to receive alerts

Real-Life Scenario: Why ₹2 Lakh May Not Be Enough

Imagine a 45-year-old father with a wife and two children. He has only PMJJBY and PMSBY — ₹2 lakh cover each.

If he passes away from cancer:

- PMSBY: No payout (not an accident)

- PMJJBY: ₹2 lakh paid to the family

In total: ₹2 lakh — barely 4–5 months of expenses in most urban households

Now compare that to a ₹50 lakh term plan, which costs roughly ₹400/month for a healthy 45-year-old. The payout could cover:

- Kids’ education

- Outstanding home loan

- Daily expenses for 5–10 years

If you’re wondering whether to enroll in both or just one of these budget-friendly government schemes, don’t miss our full comparison of PMJJBY vs PMSBY – What’s the Difference and Do You Need Both?. It breaks down the real benefits, overlaps, and whether dual coverage actually makes sense for your needs.

Small Schemes, Big Assumptions

PMJJBY and PMSBY are great entry-level schemes — but they’re not a full solution.

If you’re young and healthy, upgrade to a proper term insurance plan. If you’re a parent or breadwinner, ₹2 lakh just won’t cut it.

Don’t confuse affordability with adequacy.

You deserve real protection — not just a feel-good deduction from your savings account.