August 2, 2025 — eBharat.com News Desk

The Uttar Pradesh government has announced a significant extension to the Pradhan Mantri Fasal Bima Yojana (PMFBY) 2025 enrollment deadline. While the original cut-off was July 31, farmers now have more time to register and secure Jharkhand’s flagship crop insurance coverage for their Kharif crops:

- Non-loanee farmers: New deadline is August 14

- Loanee farmers: Extended till August 30

Why This Extension Matters

PMFBY is India’s largest crop insurance scheme, offering financial protection against crop loss due to floods, droughts, pest attacks, unseasonal rains, and more. Typically, farmers only pay a nominal 2% premium for Kharif crops, while the rest is subsidized by the central and state governments.

This extension was granted after requests from UP’s Agriculture Minister Surya Pratap Shahi, who urged the Union government to ensure broader access—especially for small and marginal farmers still finalizing their sowing and documentation.

How to Register Before the New Deadlines

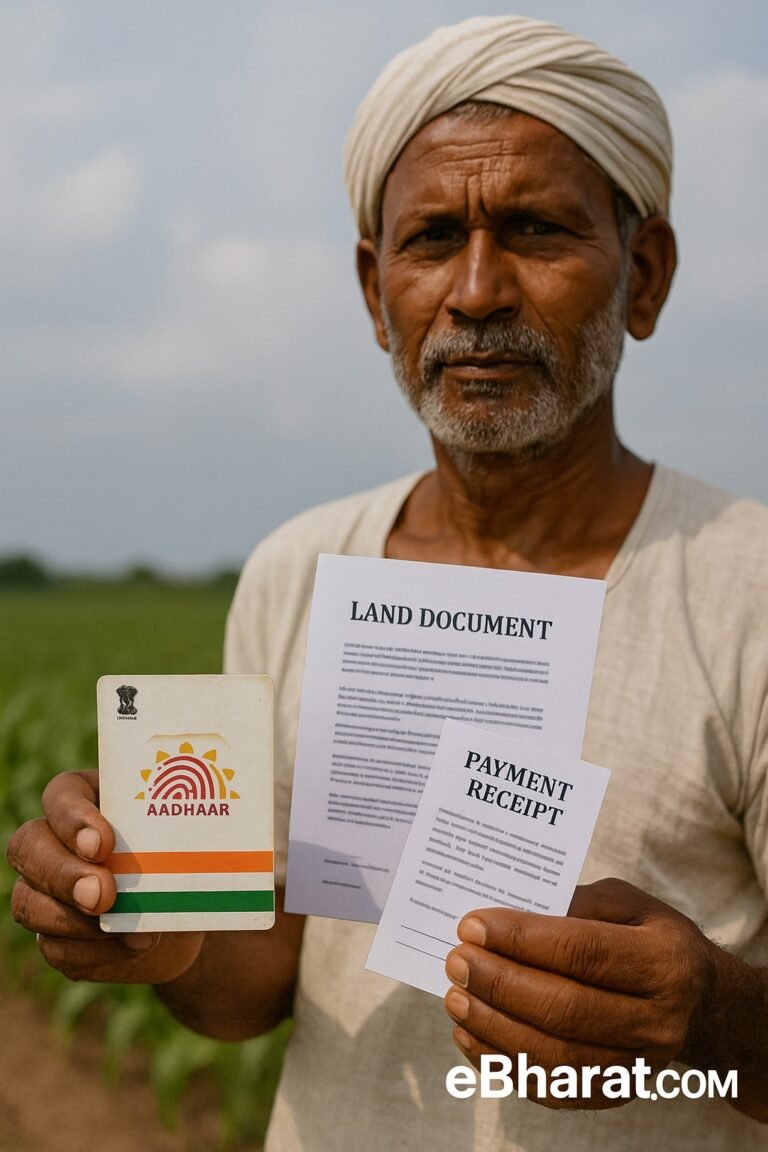

To enroll before the extended dates, farmers must provide:

- Aadhaar card

- Land ownership record (Khatauni)

- Bank passbook

- Crop and field details

Registration methods include:

| Mode | How To Enroll |

|---|---|

| Online | Visit pmfby.gov.in |

| Banks or CSC Centres | Use in-person service points |

| Common Service Centres | Local assistance for registration forms |

What’s at Stake?

Missing the new deadlines means missing the opportunity to insure Kharif crops, potentially leaving farmers vulnerable to weather highs, pest damage, or crop loss. The PMFBY scheme ensures timely compensation—often within two months of damage assessment—to help stabilize income and avoid financial distress.

Uttar Pradesh’s extension of the PMFBY deadline provides a vital window for farmers who’ve yet to enroll. With extremely low premiums and broad coverage, the PMFBY remains one of the most effective tools for protecting farm income in volatile weather conditions.

Don’t wait! Gather your documents and register by August 14 (non-loanee) or August 30 (loanee) to make the most of this opportunity.

While the PMFBY protects farmers against crop losses, livestock is often left uninsured — especially in rural and tribal belts. That’s why Tripura’s recent move deserves attention: it launched the “Complete Animal Wealth Shield” — a livestock insurance scheme for farmers, offering affordable coverage for cattle, goats, pigs, and poultry. A strong step toward full-spectrum rural protection.