— eBharat.com Business Desk

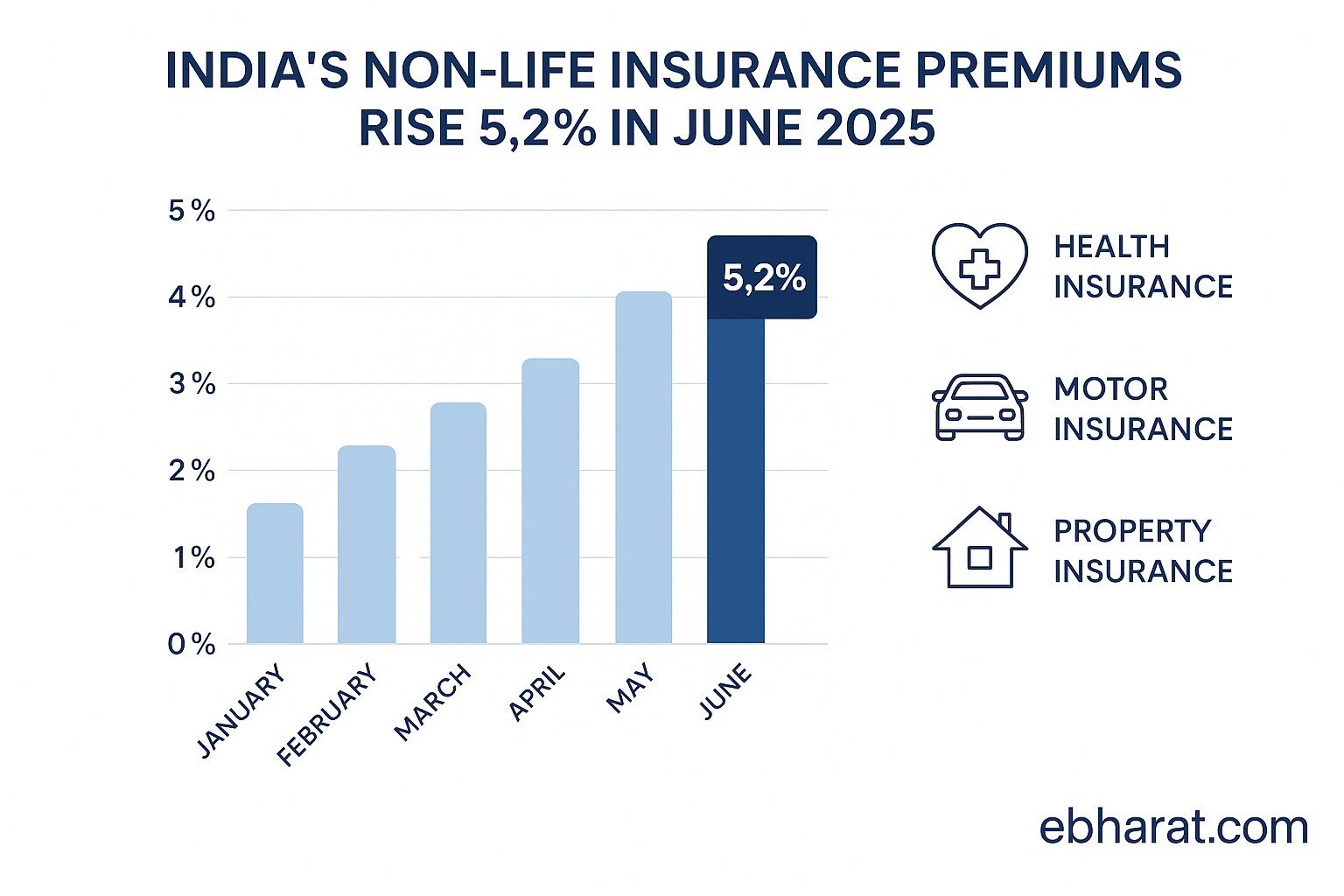

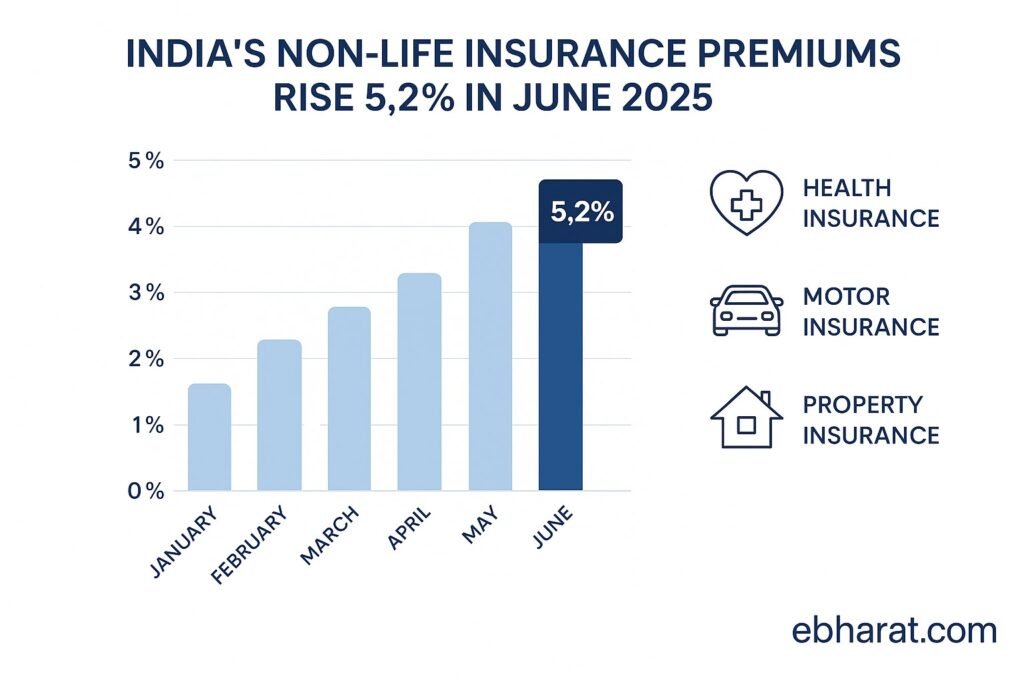

India’s non-life insurance industry recorded a 5.2% year-on-year premium increase in June 2025, with gross direct premiums totaling ₹23,422.5 crore, according to a CareEdge Ratings report. This growth, however, marks a slowdown from the 8.4% expansion seen in June 2024.

What’s Behind the Slowdown?

- A shift to the 1/n co-payment rule in health insurance policies.

- Slowed growth in health insurance, with both retail and group segments seeing single-digit expansion.

- Muting in the passenger vehicle (PV) segment, hampered by sluggish auto sales and pricing pressure.

Despite these pressures, growth in fire and engineering insurance renewals helped stabilize the overall numbers.

Segment Breakdown: What Drove Growth

Excluding health, non-life premiums climbed 6.4% year-to-date, led by robust performances in motor TP, fire, and engineering insurance, which together contributed over 70% of total non-health premiums.

The fire insurance segment grew by 17.1%, while engineering insurance surged by 21.2% in the current fiscal year.

On the other hand, crop insurance premiums dropped sharply—down 50.4%—as business shifted from Agriculture Insurance Co. of India (AIC) to general insurers.

Public vs. Private Insurers

Public sector general insurers significantly outperformed their private peers in Q1 FY26:

- PSU insurers wrote ₹27,787 crore in premiums—up 14.6% year-on-year.

- In contrast, private players recorded an 8.84% overall industry growth, with health insurance growing just 8.12% in Q1

New India Assurance increased its market share from 14.67% to 15.51%, while Oriental and National Insurance also posted double-digit growth.

Among private insurers, Bajaj Allianz grew approximately 9.6%, while ICICI Lombard stagnated with just 0.6% growth, losing market share.

Highlights & Trends

Despite the slowdown in June, non-life premiums surpassed ₹3 lakh crore in FY25, a milestone supported by rising middle-class demand, digital insurance products, and regulatory initiatives like the Bima Trinity push.

Looking ahead, motor insurance growth will closely mirror vehicle sales trends and decisions on third-party premium tariffs. Meanwhile, regulatory changes such as composite insurance licenses could reshape competitive dynamics in the near term.

Premium Snapshot

| Metric | June 2025 |

|---|---|

| Gross Direct Premiums | ₹23,422.5 crore |

| YoY Growth | 5.2% (down from 8.4% in 2024) |

| Non-Health Growth | 6.4% YTD |

| Fastest-Growing Segments | Fire, Engineering, Motor TP |

| Underperforming Segments | Health, Passenger Vehicles, Crop |

June 2025’s premium growth reflects a mixed but resilient non-life insurance sector. Slowed by structural rule changes and headwinds in health and auto insurance, the industry nonetheless held steady thanks to strong commercial line renewals.

As digital adoption rises and new regulations provide support, the non-life sector is expected to accelerate growth once motor and retail health segments regain momentum. Regulatory initiatives like the Bima Trinity will likely play a vital role in sustaining long-term expansion.

Also Read: Despite a 5.2% rise in June non-life premiums, Niva Bupa reported a ₹91.4 crore Q1 loss, showing how individual performance can diverge from industry trends.