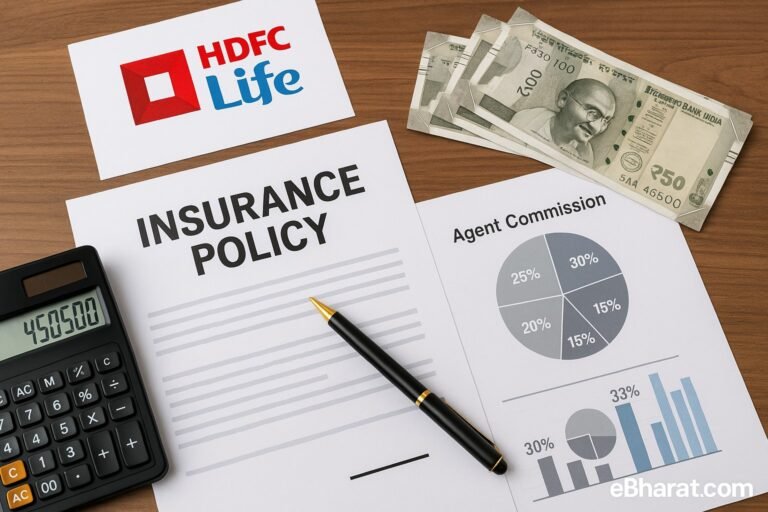

Looking for a guaranteed savings plan that’s safer than mutual funds but better than a fixed deposit? The Sanchay Plus plan by HDFC Life offers assured benefits, no market risks, and predictable returns. But is it worth it in 2025?

Let’s break it down with real numbers.

Sanchay Plus Key Features at a Glance

| Feature | Details (2025) |

|---|---|

| Plan Type | Non-linked, non-participating savings plan |

| Return Type | Guaranteed maturity and death benefit |

| Minimum Premium | ₹30,000 per year |

| Entry Age | 30 days to 60 years |

| Policy Term | 10 to 20 years (varies by option) |

| Returns | ~5.5%–6.5% IRR (varies) |

| Tax Benefits | 80C & 10(10D) |

What Is Sanchay Plus?

Sanchay Plus is a guaranteed return life insurance plan from HDFC Life that helps you build a fixed maturity corpus while staying insured. It is not market-linked like ULIPs, so your returns are fixed and known upfront.

It’s designed for risk-averse savers who want predictability — often used as a retirement or legacy fund.

Explore: Guaranteed Return Plans – Are They Really Safe?

Key Features of Sanchay Plus

1. Guaranteed Maturity Benefit

You get a lump sum at the end of the term — no market fluctuation.

2. Multiple Payout Options

Choose from:

- Lump Sum on maturity

- Guaranteed Income for fixed years

- Life-Long Income till age 99

3. Long-Term Flexibility

- Policy terms from 10 to 20 years

- Premium payment terms can be 5/6/10/12 years

4. Optional Riders

- Critical illness

- Accidental death benefit

- Waiver of premium on disability

Pros and Cons

Pros:

- 100% guaranteed returns, not market-linked

- Fixed income option even post-retirement

- Suitable for long-term family financial planning

Cons:

- Returns (~5.5%-6.5%) lower than mutual funds or PPF

- No flexibility to withdraw early

- Taxable if annual premium > ₹5 lakh

Premium & Return Example (2025)

Let’s say you’re 35 years old and invest ₹50,000/year for 10 years.

| Criteria | Value |

|---|---|

| Policy Term | 20 years |

| Annual Premium | ₹50,000 |

| Total Investment | ₹5,00,000 |

| Maturity Amount (Fixed) | ₹8,05,000 – ₹8.35 lakh |

Estimated return ~6.3% IRR (tax-free if below ₹5L premium rule).

Claim Process for Sanchay Plus

- Submit maturity/death claim request on HDFC Life’s official website or branch

- Upload PAN, Aadhar, policy docs, nominee ID proof

- Receive claim payout within 7 working days (if all docs are in order)

Claim Help: How to Cancel a Life Insurance Policy Without Losing Money

Common Mistakes to Avoid

- Choosing the wrong payout option (monthly vs lump sum)

- Buying at an older age (reduces maturity benefit)

- Not checking tax impact if your annual premium > ₹5L

Expert Insight

According to IRDAI’s 2024 report, non-linked guaranteed plans are seeing high adoption among middle-class families in Tier 2 & Tier 3 towns — due to their simplicity and predictable returns.

Tools to Help You Choose

👉 Use eBharat’s Plan Matcher Tool

👉 Try the [Savings Plan Calculator – Returns Estimator]

👉 Use the [Rider Selector Quiz – For Family Needs]

Final Word

Sanchay Plus is a reliable, no-surprise plan for savers who prefer safety over higher returns. It works well if you’re looking for predictable retirement income or guaranteed maturity benefits.