With term and life insurance getting more customizable in 2025, riders are becoming a must-know topic for every policyholder. But are they really worth it? Let’s break down what riders are, how they work, and when to say yes or no.

What Are Insurance Riders? (Definition)

Riders are optional add-ons that enhance your basic insurance policy. Think of them as toppings on a pizza — not essential, but can make your cover more powerful depending on your needs.

Riders are most commonly available with term insurance, life insurance, and health insurance plans in India. Some are bundled, while others cost extra.

Types of Riders in India (2025 Update)

Here are the most popular rider options available this year:

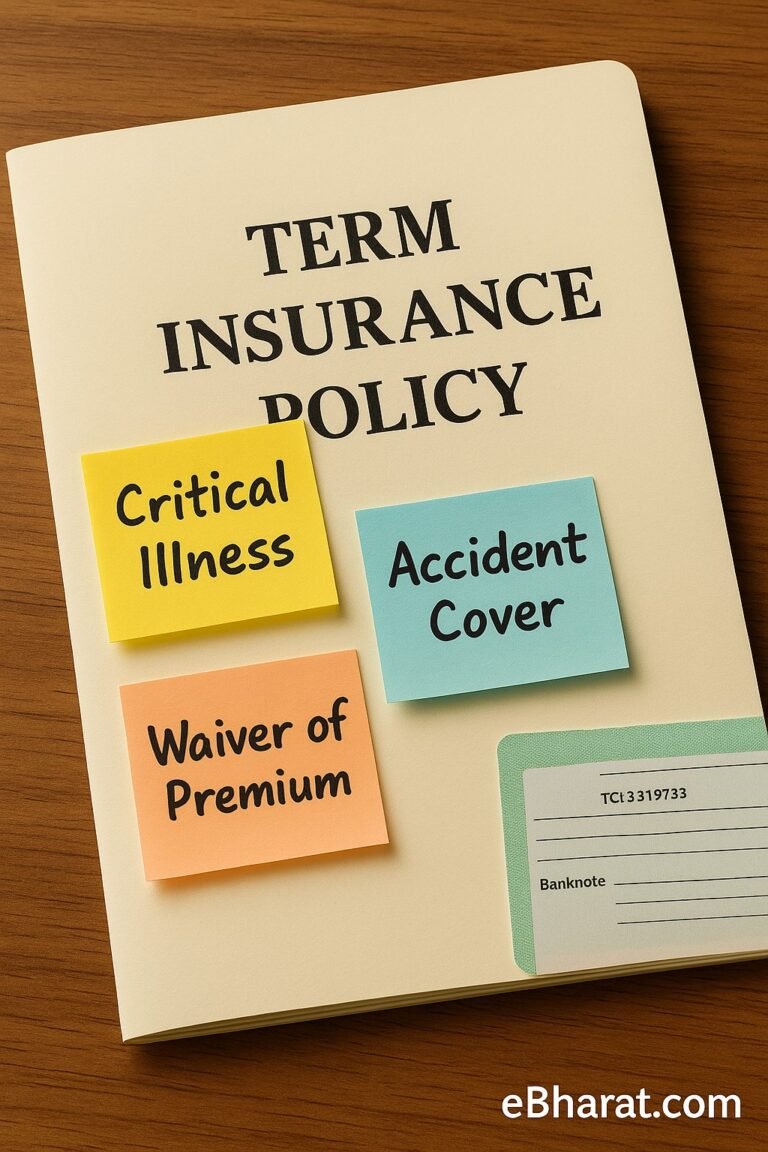

1. Accidental Death Benefit (ADB) Rider

If the policyholder dies in an accident, this rider pays an extra amount over the base sum assured.

2. Permanent Disability Rider

If a serious accident leaves you permanently disabled, this rider pays you a lump sum or regular income, depending on the plan.

3. Critical Illness Rider

Covers major illnesses like cancer, heart attack, stroke, etc. Offers a lump sum payout on diagnosis — can help with treatment and recovery.

4. Waiver of Premium (WOP) Rider

If you become disabled or critically ill, this rider waives all future premiums but keeps the policy active.

5. Income Benefit Rider

Instead of a lump sum, your nominee gets monthly income for a fixed period after your death — ideal if you want your family to get regular support.

Pros and Cons of Adding Riders

Pros:

- Affordable enhancement to your base cover

- Useful in unpredictable scenarios like accident or critical illness

- Keeps policy active even if income stops (WOP rider)

Cons:

- Increases premium slightly

- Some riders may duplicate existing policies (e.g., critical illness plan)

- Claims can be tricky if terms are unclear

How Much Do Riders Cost?

Most riders cost 5% to 15% extra over your base premium. For example, if your base premium is ₹10,000/year, a rider combo might take it up to ₹11,200/year.

| Rider Type | Approx. Annual Cost | Sum Assured |

|---|---|---|

| Accidental Death | ₹500–₹1,000 | ₹10–25 lakh |

| Critical Illness | ₹1,000–₹3,000 | ₹5–10 lakh |

| Waiver of Premium | ₹300–₹800 | N/A |

When Should You Add Riders?

Add a rider if:

- You don’t already have a separate accidental or health cover

- You’re the sole earner in the family

- You want more protection without buying multiple policies

Avoid unnecessary riders if you already have:

- A standalone health insurance or critical illness policy

- Overlapping protection through group covers

Real-Life Example: How Riders Saved a Family’s Policy

A 38-year-old policyholder in Delhi had added the Waiver of Premium + Critical Illness Rider to his term plan. Two years later, he was diagnosed with cancer.

Thanks to the rider, he received ₹10 lakh as lump sum support and all future premiums were waived, while his policy remained active for his family. This reduced financial pressure during treatment.

Related Tools on eBharat.com

- 👉 Compare Rider Add-Ons

- [🧠 Which Rider is Right for You? – Quiz]

- [💸 Premium Calculator with Riders Included]

Final Word

Riders are like safety nets — small in cost, big in benefit.

But don’t add them blindly. Understand your lifestyle, risks, and current covers first. Then choose only what fits your needs.