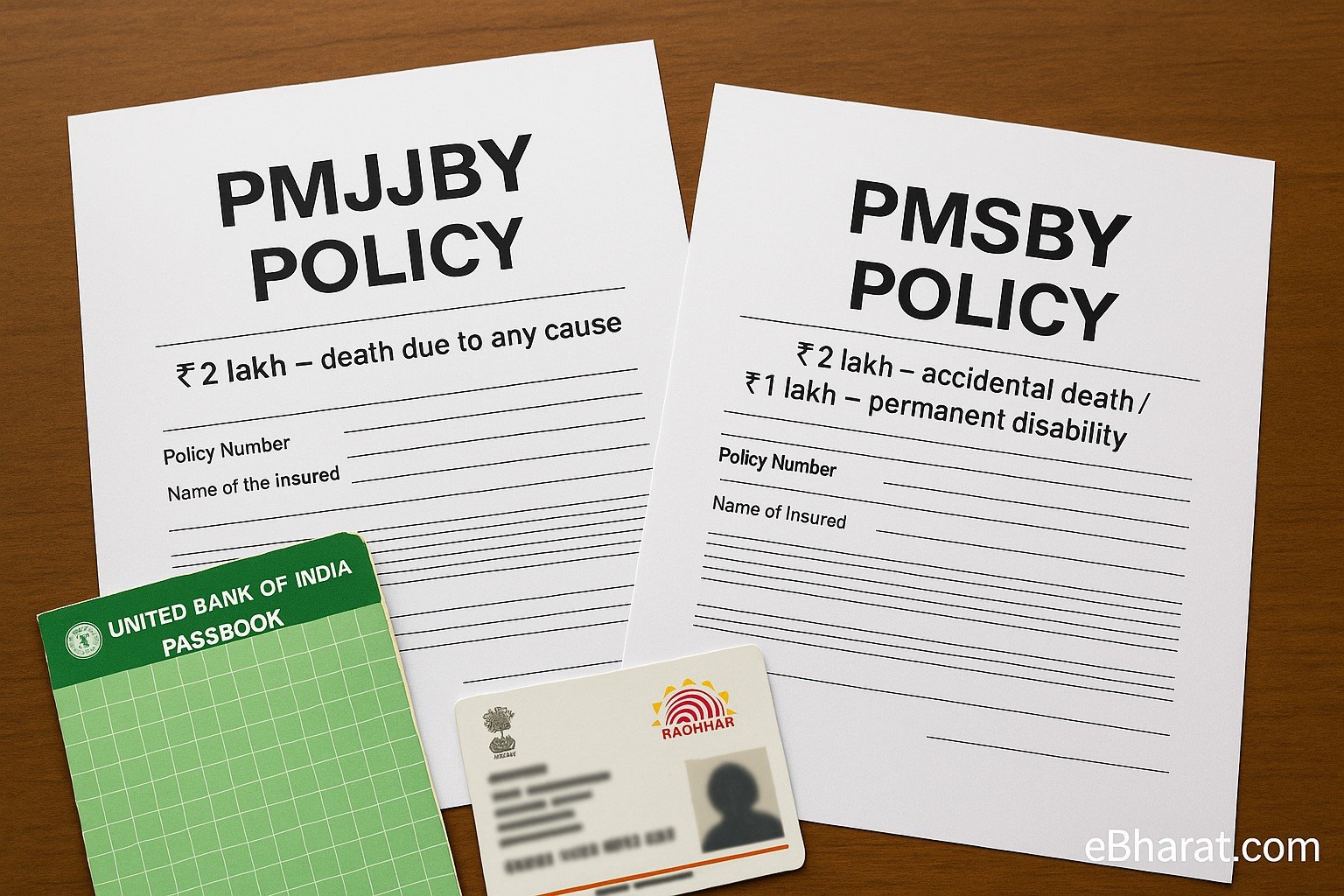

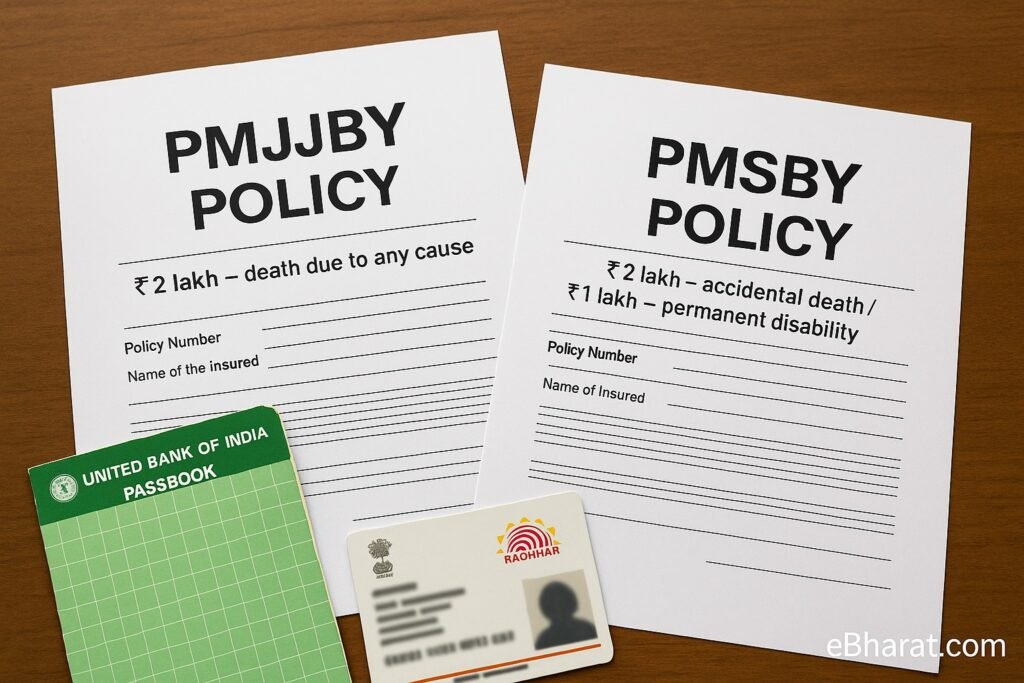

The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY) are among India’s most successful low-cost insurance schemes. Launched in 2015 under the Jan Suraksha initiative, they have provided affordable life and accident insurance to millions of citizens.

In 2025, both schemes continue to offer the same core benefits, but there are updates in enrolment, claim settlements, and awareness levels.

Current Premiums & Coverage (2025)

| Scheme | Annual Premium | Coverage | Age Limit |

|---|---|---|---|

| PMJJBY | ₹436 | ₹2 lakh – death due to any cause | 18–50 years |

| PMSBY | ₹20 | ₹2 lakh – accidental death / ₹1 lakh – permanent disability | 18–70 years |

Claim Settlement Process

PMJJBY:

- Nominee submits death certificate and claim form to the bank.

- Bank verifies details and forwards to insurer.

- Claim is settled in 1–2 weeks in most cases.

PMSBY:

- For accidental death/disability, nominee or insured files claim with FIR, medical records, and form.

- Bank sends claim to insurer.

- Settlement is usually within 2–4 weeks.

2025 Performance Highlights

- Enrolments: Over 35 crore combined PMJJBY + PMSBY active policies.

- Claims Paid: More than ₹15,000 crore disbursed since inception.

- Awareness: Government pushing campaigns in rural and semi-urban areas.

Key Advantages in 2025

- Affordability: ₹456/year for both schemes combined.

- Ease of Enrolment: Auto-debit from savings account.

- Government Backing: Trustworthy and widely accepted.

Limitations

- Low coverage amount — needs to be supplemented with private insurance.

- Premium auto-debit depends on account balance — missed balance means policy lapses.

Case Example

Meera’s family from Sikar received ₹2 lakh from PMJJBY and ₹2 lakh from PMSBY when her husband died in a road accident. The ₹4 lakh payout helped cover immediate expenses and settle debts.

Why It Matters

PMJJBY and PMSBY are among the cheapest ways to secure basic life and accident cover in India. While they shouldn’t replace comprehensive insurance, they’re a must-have safety net for low and middle-income households.

A few hundred rupees a year can mean lakhs for your family in times of need. Share this eBharat.com update so more people enrol and stay protected in 2025.