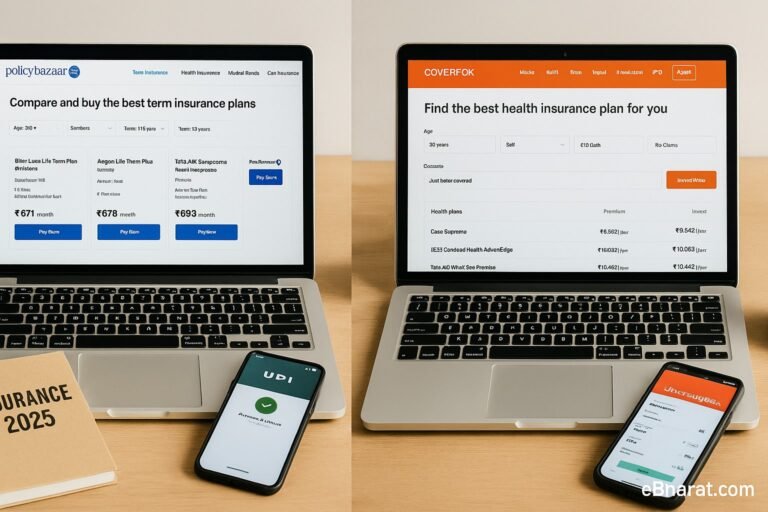

In 2025, buying insurance has never been easier — you can either click a few buttons online or sit down with an agent over tea. Both methods have their own pros and cons, and the right choice depends on your comfort level, product complexity, and budget.

Let’s break down the real differences so you can make the best choice for your needs.

Online vs Agent – Key Differences

| Factor | Online Purchase | Through Agent |

|---|---|---|

| Cost | Lower premium (no agent commission) | Slightly higher premium (includes commission) |

| Convenience | Buy anytime, anywhere | Face-to-face explanation & assistance |

| Understanding Product | Self-research required | Agent explains terms and conditions |

| Claim Assistance | You handle claims yourself or via customer care | Agent helps in claim paperwork and follow-up |

| Product Range | All insurers available in one place | Usually tied to one or few insurers |

When to Buy Online

- You know exactly what policy you want.

- You are comfortable comparing features on aggregator sites.

- You want to save on premium.

When to Buy Through an Agent

- You need help understanding terms and conditions.

- You want personal assistance at claim time.

- You prefer face-to-face interaction.

Case Example

Amit, 32, bought his term plan online after comparing quotes. He saved ₹2,000/year in premium. Meanwhile, his father preferred buying health insurance through an agent for personal guidance and claims help.

Best Strategy in 2025

If you are confident about your research skills, buy online to save money. If you value guidance and assistance, buy through an agent — or use a hybrid approach (research online, buy from a trusted agent).

Why It Matters

The way you buy insurance can affect both your premium cost and your claim experience. Choosing the right method ensures you get maximum value and peace of mind.

Whether you click or connect, the goal is the same — getting the right cover. Share this eBharat.com guide so others can choose wisely in 2025.

Internal Links: