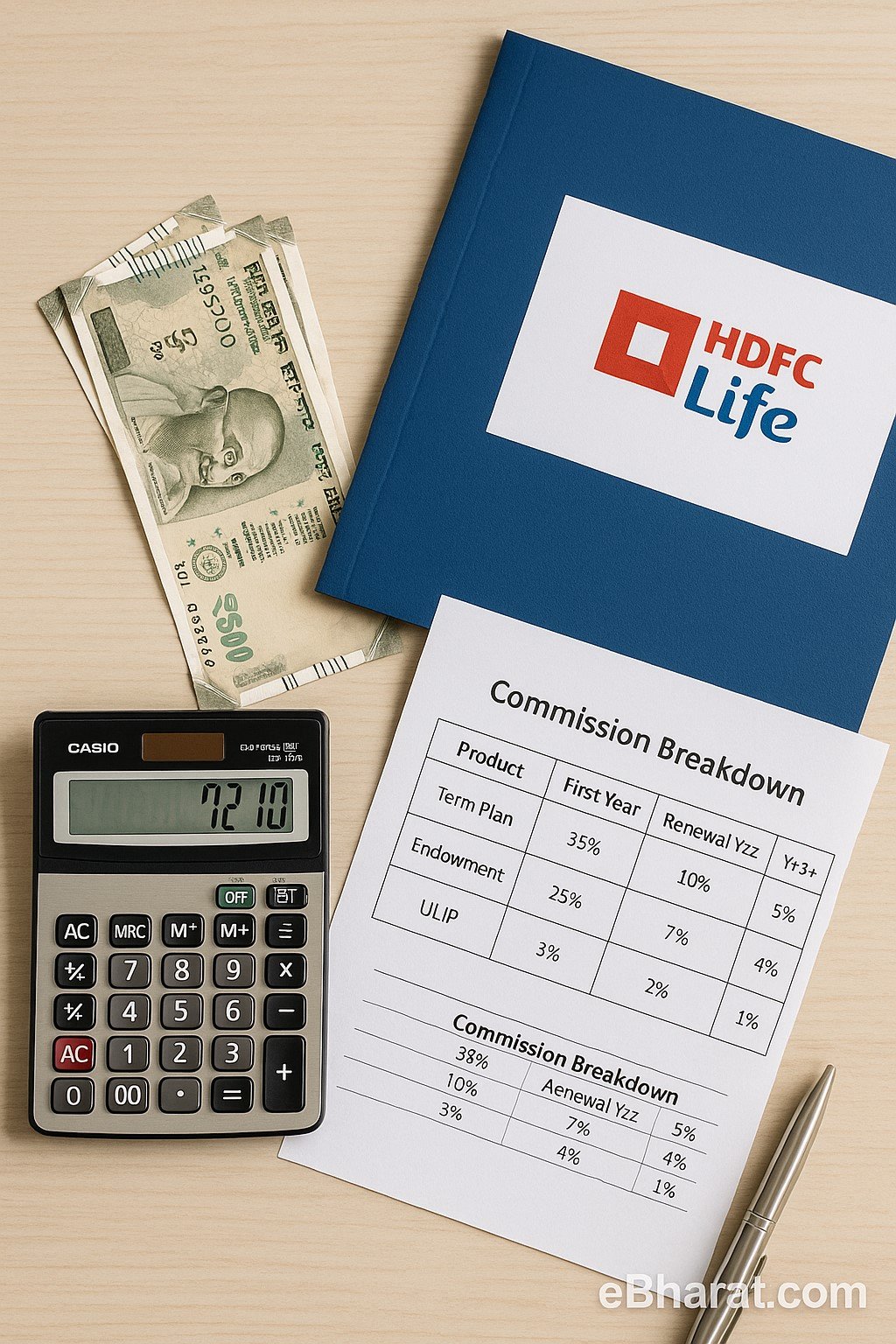

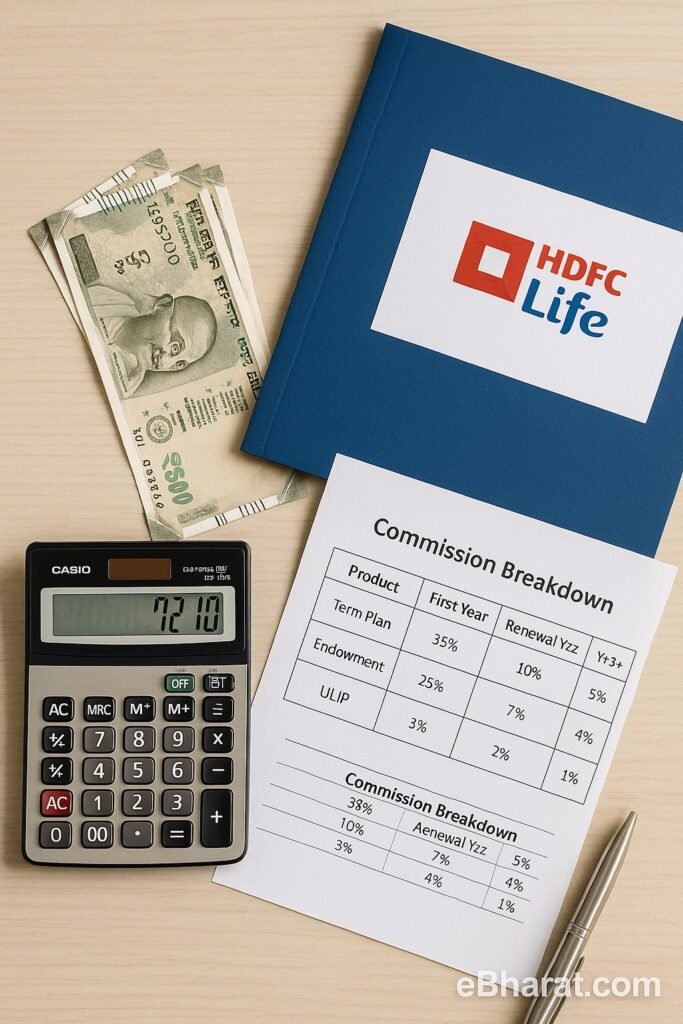

If you’re considering becoming a licensed HDFC Life insurance agent or POSP, one of the first questions you’ll have is:

“How much commission can I earn from selling HDFC Life policies?”

In this 2025 guide, we break down the full commission structure — across term, ULIP, child plans, and endowment — along with examples, renewal payouts, and tips to maximize your earnings.

Sample Income Calculation

Let’s say you sell 5 HDFC Life term plans with ₹15,000 annual premium each:

- Total Premium: ₹75,000

- Avg. Commission (30%): ₹22,500

Sell 10 similar policies = ₹45,000 in one month.

And from year 2, you get renewals on every active policy.

Renewal Income = Passive Growth

Renewals help you build income stability without selling again:

- ₹5,000 renewal from past clients = ₹60,000/year = ₹5,000/month passive layer

This becomes huge in Year 3 onward.

POSP via eBharat vs Traditional Agent

| Feature | Traditional Agent | POSP via eBharat |

|---|---|---|

| Access | Only HDFC Life | Multiple insurers incl. HDFC Life |

| Commission | Similar | Similar or slightly better |

| Tools | Limited | CRM, WhatsApp Kit, PlanMatch |

| Flexibility | Branch-based | Work-from-anywhere |

💼 Want to sell HDFC Life + more? Apply to Join eBharat Agent Network

Tips to Earn More

- Start with term plans – high commission + low cost for clients

- Pitch return of premium (ROP) options for higher premiums

- Bundle term + health + top-up in one sale

- Use eBharat’s WhatsApp scripts to close faster

Final Takeaway

HDFC Life offers one of the best commission structures among private insurers in India — especially for term and endowment plans.

As a POSP under eBharat, you can sell HDFC Life along with other top companies, earn the same or better commissions, and grow faster using digital tools.

🎯 Ready to start? Apply now to join our Agent Network and get started in 3 days.