Axis Max Life Insurance has set its sights on outpacing the life insurance industry by 3–5% in FY 2026, riding on robust first-quarter results and a clear growth roadmap. The insurer, currently among the top private players, is aiming to secure the third-largest market position in the segment, banking on distribution strength, product diversification, and digital innovation.

| Detail | Information |

|---|---|

| Growth Target | 3–5% above industry average |

| Industry Rank Goal | Top 3 private life insurer |

| Q1 FY 2026 Performance | Strong double-digit growth in new business premium |

| Key Strategies | Distribution expansion, product innovation, digital transformation |

| Core Products | Term plans, savings & investment products, ULIPs |

Q1 Performance Sets the Tone

Axis Max Life had a strong first quarter, which gave it the confidence to aim for bigger goals this year. The company’s new business premium (NBP) grew by double digits, faster than the overall industry. Company leaders say this growth came mainly from term insurance, savings plans, and ULIPs, which are becoming more popular with customers.

Strategic Growth Drivers for FY 2026

- Banking Channel Leverage – As the life insurance partner for Axis Bank, the company enjoys a vast distribution network, which it plans to deepen in Tier-2 and Tier-3 cities.

- Digital Enablement – Focus on paperless onboarding, AI-driven underwriting, and instant policy issuance to improve customer experience.

- Product Mix Optimization – Balancing protection and savings products to improve margins and persistency ratios.

- Agency Force Expansion – Recruiting and training more insurance advisors to widen market penetration, especially in underinsured segments.

- Customer Retention Programs – Enhancing service quality and post-sale engagement to reduce lapse rates.

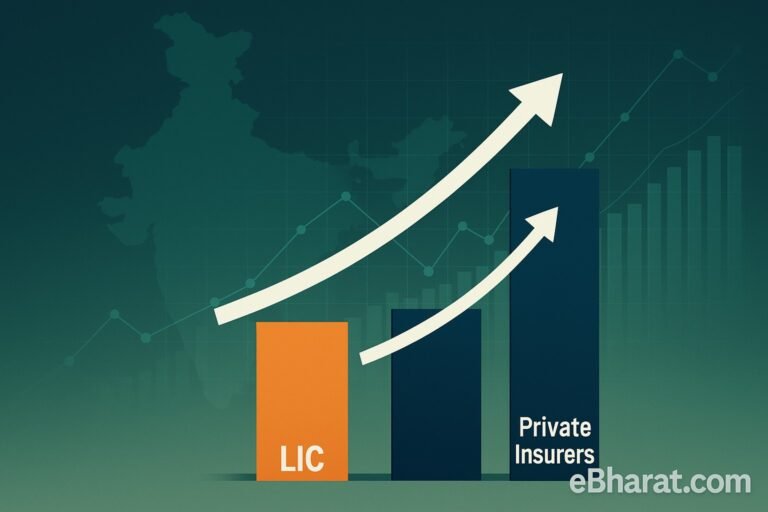

India’s life insurance industry is expected to grow between 12–14% in FY 2026, according to IRDAI estimates. A 3–5% outperformance by Axis Max Life would put its growth in the 15–19% range, potentially propelling it past competitors to the number-three spot in the private segment—currently held by SBI Life and HDFC Life, with ICICI Prudential close behind.

Leadership Commentary

Speaking on the company’s growth outlook, Axis Max Life’s senior management stated:

“Our goal is not just to grow faster than the industry, but to do so sustainably—by deepening customer trust, innovating products, and expanding our reach to underserved markets. FY 2026 will be a defining year for us.”

Impact for Policyholders

For existing and prospective policyholders, Axis Max Life’s expansion means wider access to products, quicker service delivery, and more competitive offerings. With a sharper digital focus, the insurer aims to make policy purchase, claim settlement, and customer support more transparent and efficient.

Why It Matters

In a market dominated by a few large private insurers, Axis Max Life’s aggressive growth push could reshape the competitive landscape. Its strategy aligns with IRDAI’s vision of ‘Insurance for All by 2047’, which calls for deeper penetration in rural and semi-urban areas.

For more updates on life insurance industry growth, follow eBharat.com and connect with us on social media for daily news and insights.