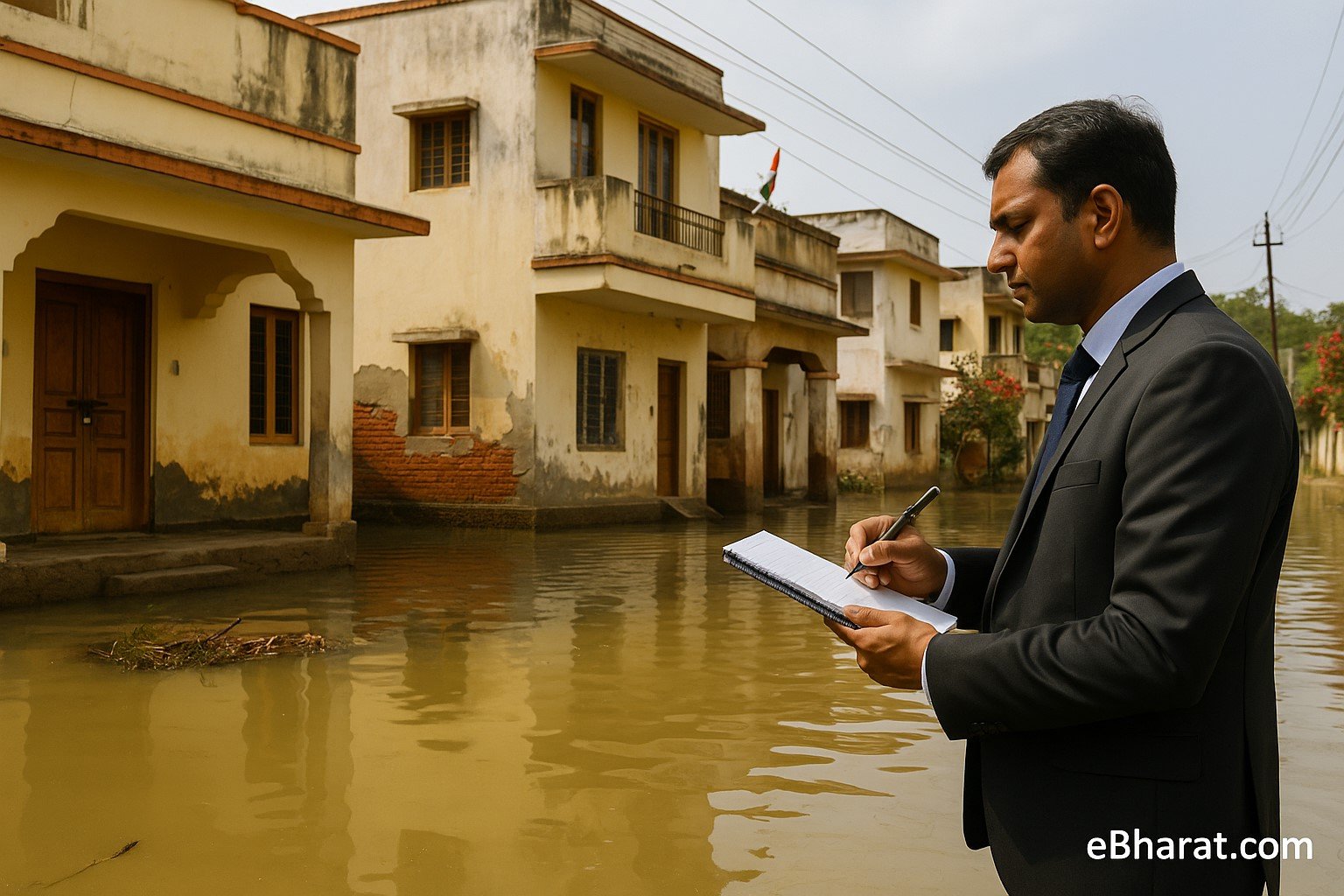

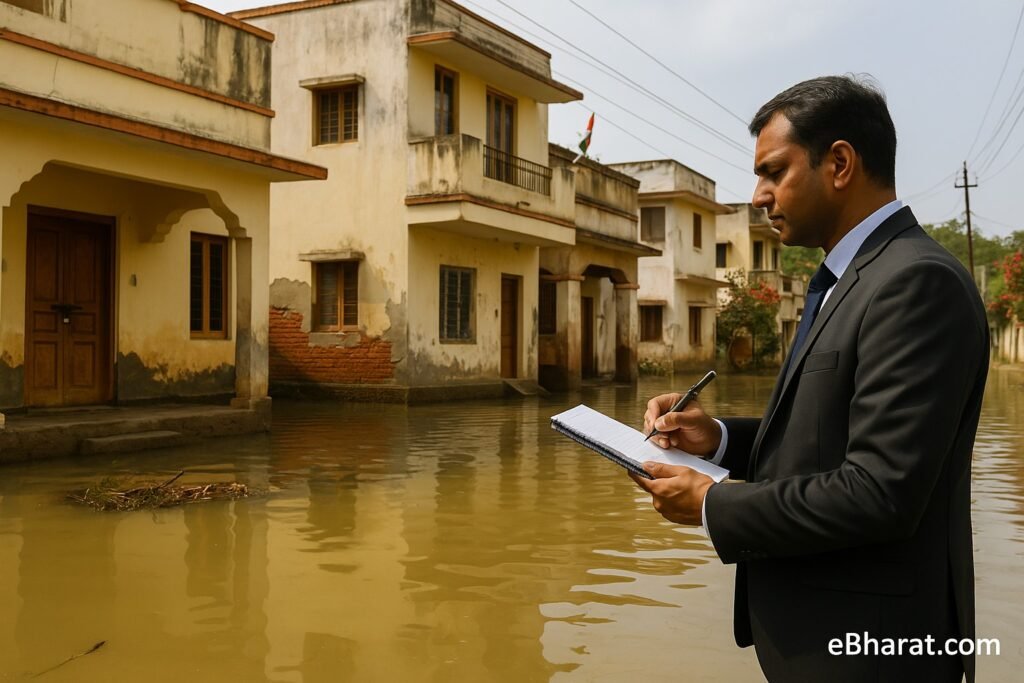

Following recent flood incidents, insurance experts and disaster management officials are advising homeowners and vehicle owners not to start repair work before an insurance surveyor’s inspection. Doing so could jeopardize your insurance claim and make accurate damage assessment more difficult.

| Key Point | Details |

|---|---|

| Situation | Recent floods caused significant damage to homes and vehicles |

| Advice | Do not carry out repairs before surveyor inspection |

| Reason | Claim could be rejected; damage assessment may be compromised |

| Action | Take photos/videos of damage, keep all evidence safe |

| Insurance Guideline | IRDAI rules require surveyor report before claim processing |

Expert Opinions

According to insurance companies, policy terms clearly state that after any natural disaster, an insurance company-appointed surveyor must first assess the loss before the claim process begins. If repairs are made beforehand, it becomes difficult for the surveyor to verify the actual extent of the damage.

Advice for Vehicle and Property Owners

- Take Photographs and Videos: Document every damaged part clearly.

- Preserve All Documents: Keep your policy, receipts, and prior repair bills ready.

- Inform Immediately: Report the incident to your insurer’s claims helpline without delay.

- Emergency Repairs Only: Carry out only urgent repairs (like water removal or preventing a short circuit) and keep bills as proof.

Claim Process and Timelines

As per IRDAI guidelines, insurers must appoint a surveyor within 48 hours of receiving claim intimation. Claim settlement begins only after the surveyor’s report is submitted.

Why This Matters

In times of natural disasters, panic-driven decisions can put your insurance claim at risk. By following the correct process, you not only validate your loss but also increase the chances of a smooth claim settlement.

After floods or any natural disaster, it’s better to wait for the surveyor’s inspection before starting repairs. This ensures your insurance claim remains valid and fully supported by evidence.

💡 Don’t risk your claim after a disaster! Always follow the right process to ensure smooth insurance settlement.

📞 Need claim assistance? Visit our InsurancePlus Tool for step-by-step guidance on filing and tracking your claim.