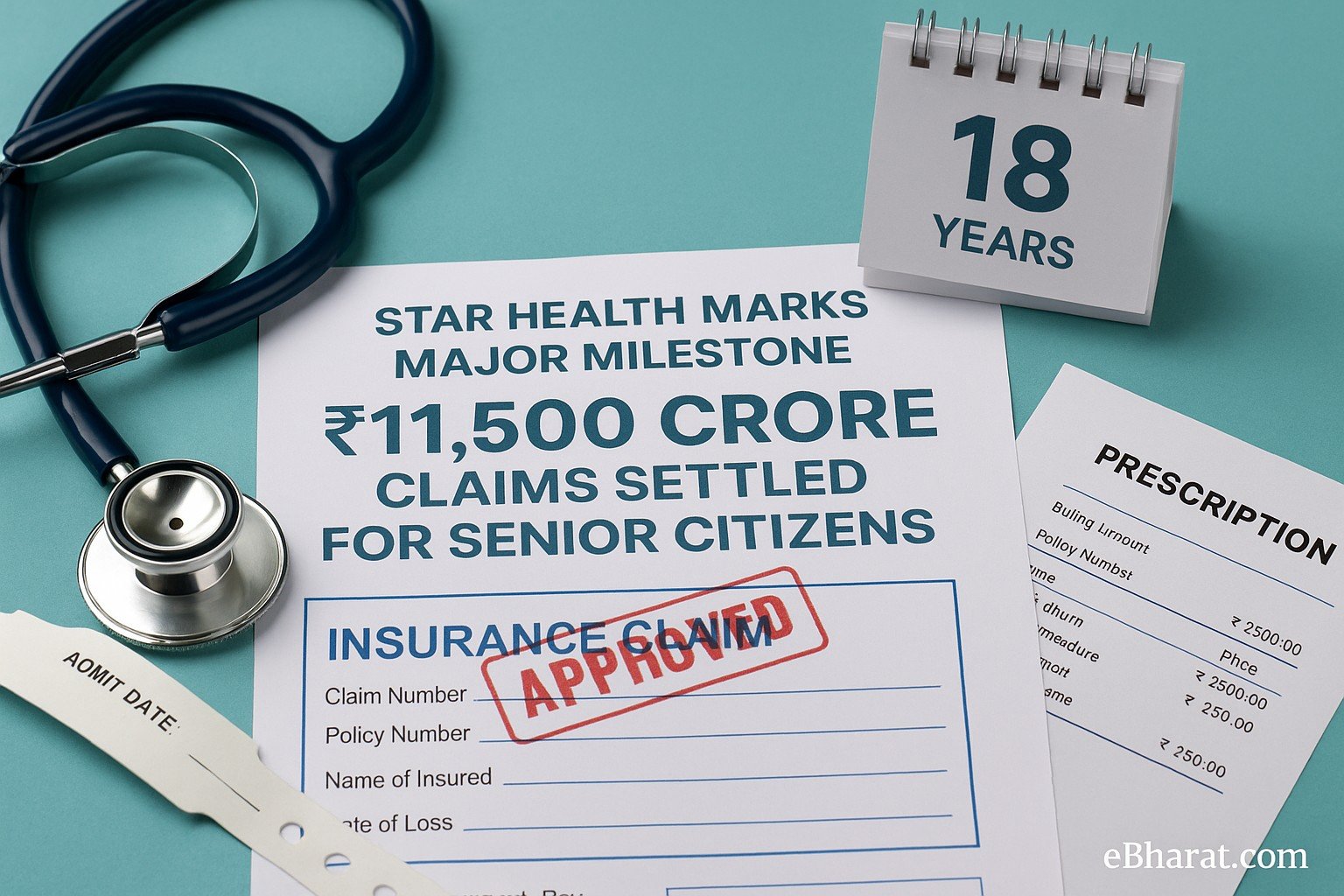

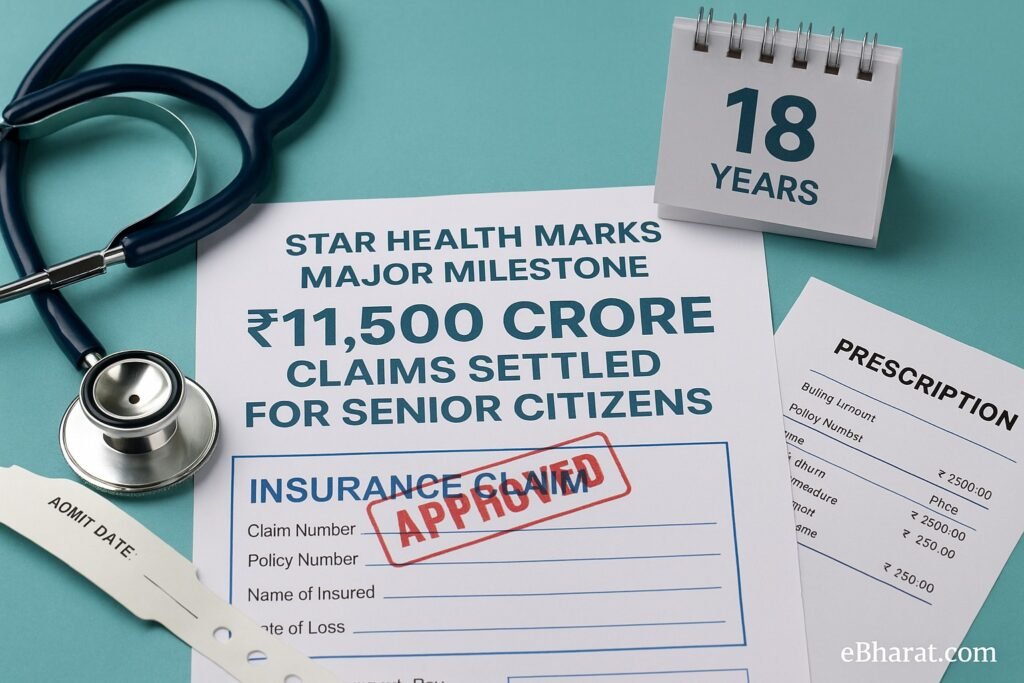

Star Health and Allied Insurance has reached a historic milestone in India’s health insurance sector. Over its 18-year journey, the company has settled claims worth more than ₹11,500 crore for senior citizens, protecting the lives and dignity of nearly 30 lakh elderly policyholders.

This achievement highlights the growing role of health insurance for senior citizens in India, where rising medical costs often make hospital treatment unaffordable without adequate coverage.

Why This Milestone Matters

- Trust & Reliability

For many Indian families, choosing the right health insurer depends on the claim settlement record. Star Health’s ₹11,500 crore payout proves its commitment to timely and hassle-free claim settlement, especially for vulnerable groups like the elderly. - Focus on Senior Citizens

Unlike many insurers who restrict coverage for older age groups, Star Health offers dedicated plans such as Senior Citizens Red Carpet Policy. This inclusivity has made the insurer one of the most preferred choices for retirees and elderly couples. - Rising Medical Costs in India

With hospitalisation expenses increasing at double-digit rates every year, a robust claim settlement ensures that senior citizens don’t have to compromise on quality healthcare.

Health Insurance Trends for Senior Citizens in India

- Growing Demand

With India’s ageing population expected to reach 200 million people above 60 years by 2030, demand for specialized senior citizen health insurance is rising sharply. - High Claim Ratios

Senior citizen policies usually record a higher claim ratio compared to younger groups. Star Health’s milestone proves that the insurer is financially strong enough to handle this responsibility. - Cashless Network Expansion

Star Health has been steadily increasing its cashless hospital network, making it easier for elderly patients to get admission without upfront payments. - Government Push

IRDAI and the Government of India are actively promoting affordable health insurance for the elderly through regulatory reforms, making policies more inclusive.

👉 Looking for the right plan for your parents? Try our Insurance+ tool here to compare health insurance options quickly.

Expert Views

Industry experts believe that milestones like these are not just about numbers—they show the trust that Indian families place in insurance companies. By protecting senior citizens, Star Health is also contributing to India’s broader goal of achieving universal health coverage.

Financial advisors also recommend that every household with ageing parents should secure a dedicated senior citizen health insurance plan, instead of relying solely on family floaters, to avoid claim rejections or inadequate coverage.

⭐ Star Health Milestone (2025)

Claims settled for senior citizens in 18 years

✅ Strong claim settlement ratio

✅ Dedicated senior citizen policies

✅ Wide cashless hospital network

Source: Star Health Insurance (2025)

Why This Matters for You

- If you’re a senior citizen, this milestone is reassurance that your claims are likely to be honored quickly.

- If you’re a policy buyer, it shows that choosing a reputed insurer with a strong track record can make a real difference in times of crisis.

- If you’re considering a career in insurance, this growth in senior citizen health insurance demand opens doors to new opportunities.

Final Word

The settlement of ₹11,500 crore in claims for 30 lakh senior citizens cements Star Health’s reputation as one of India’s most reliable insurers. As more families realize the importance of protecting their elderly members, health insurance for senior citizens is no longer optional—it’s essential.

🌟 Want to build a career in this growing sector? Click here to Become an Insurance Agent and start helping families secure their future while building your own income stream.

Take Your Next Step with eBharat

Looking for the best senior citizen health plans? Compare trusted options instantly with Insurance+. Or, if you want to grow your income, join India’s fastest growing insurance network as an Agent.