Starting as an HDFC Life agent can be exciting—you get the chance to help families secure their future while building a solid income stream. But many new agents stumble early in their journey, not because they lack potential, but because they repeat the same avoidable mistakes.

In this guide, we’ll highlight the 5 most common mistakes new agents make and provide clear strategies on how to avoid them—so you can build a successful career right from day one.

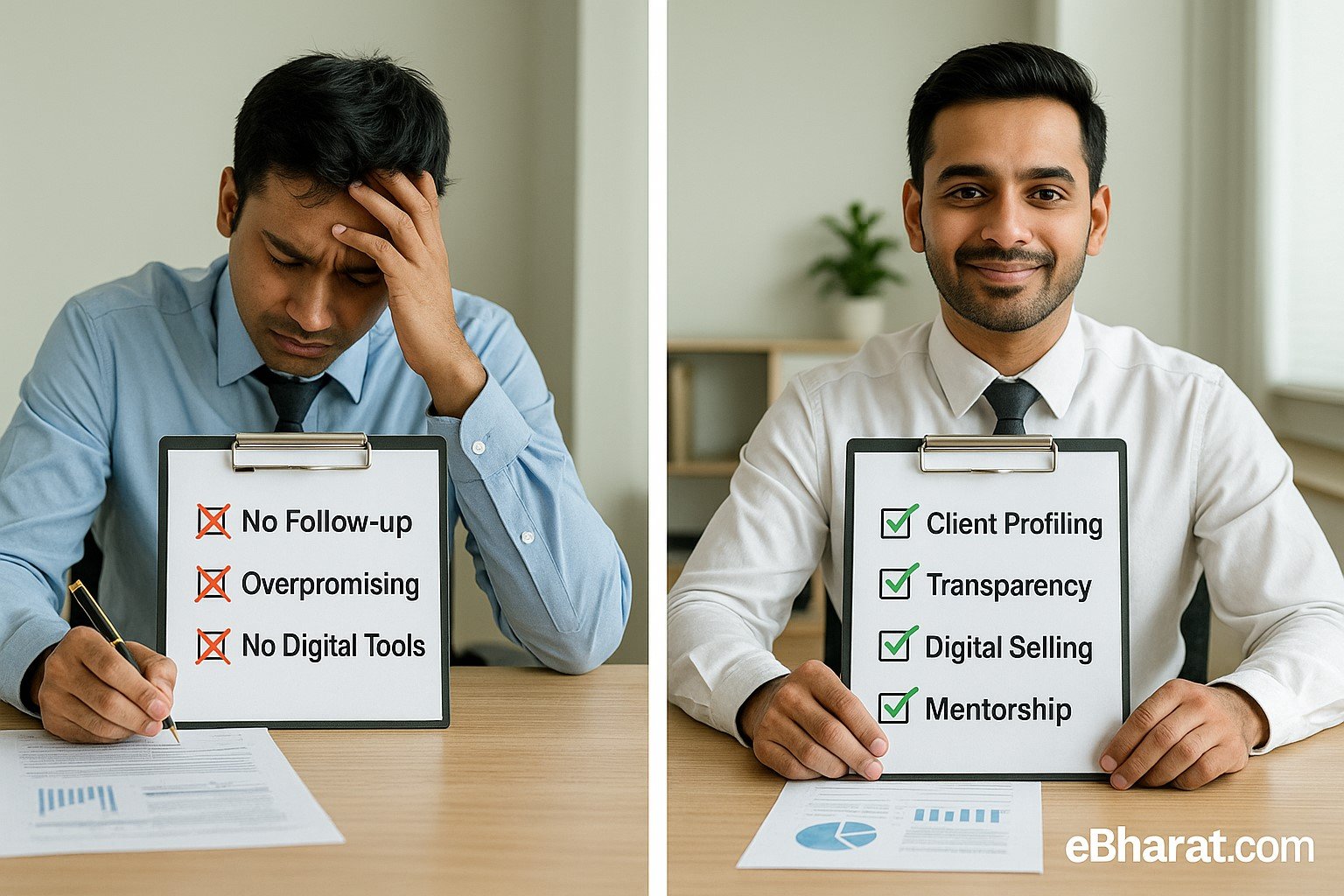

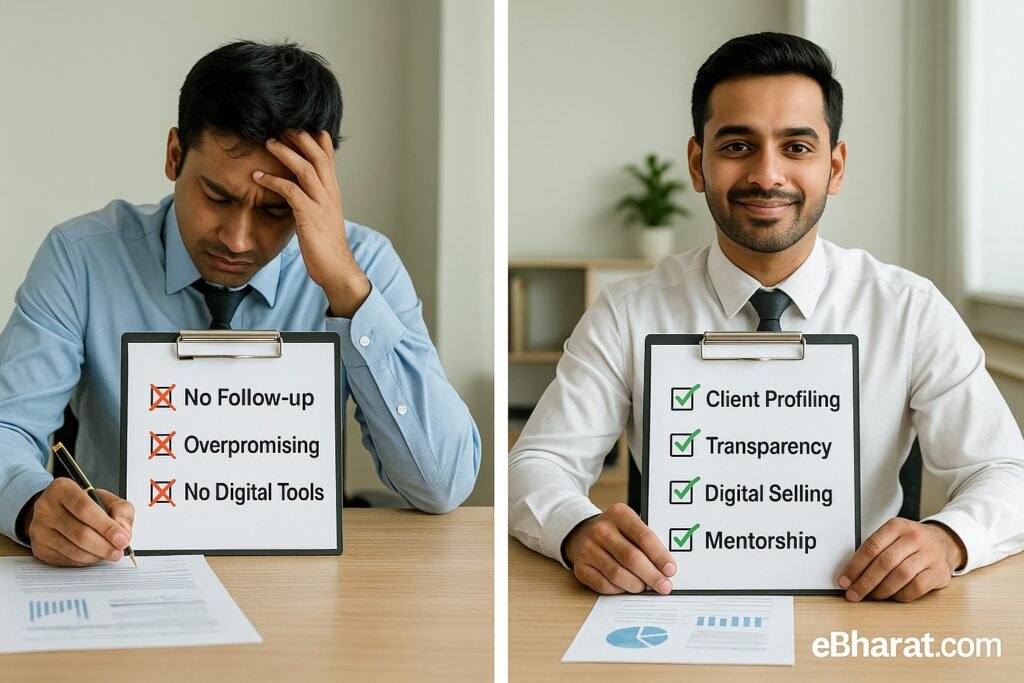

Mistake 1: Selling Without Understanding the Customer’s Needs

Many new agents rush to sell policies without analyzing the client’s financial situation. This creates mistrust and can lead to policy cancellations.

How to Avoid It:

- Start every meeting with a needs analysis (income, dependents, goals).

- Use digital tools like PlanMatch to recommend the best-fit plan.

Mistake 2: Overpromising and Mis-Selling

Some agents exaggerate returns or hide exclusions to close deals quickly. This backfires when clients feel cheated.

How to Avoid It:

- Be transparent about what the policy does and doesn’t cover.

- Always follow IRDAI’s code of ethics.

- Remember: honest advice builds long-term clients and referrals.

Mistake 3: Ignoring Digital Platforms

In 2025, most customers are online. New agents who avoid digital tools miss out on 80% of potential leads.

How to Avoid It:

- Learn to use WhatsApp, Facebook, Instagram, and LinkedIn for lead generation.

- Use HDFC Life’s mSmart App and eBharat’s digital CRM for onboarding and tracking.

Mistake 4: Not Following Up

Many beginners think if a client says “No” once, the opportunity is lost. In reality, 80% of sales happen after the 3rd follow-up.

How to Avoid It:

- Schedule reminders with CRM tools.

- Call or message clients on birthdays, renewals, or festivals—it keeps the relationship alive.

Mistake 5: Working Alone Without Guidance

Agents who join directly often lack mentorship. Without scripts, roleplays, or a support group, they lose motivation quickly.

How to Avoid It:

- Join under a mentorship-driven agency like eBharat.

- Learn from experienced agents.

- Stay active in support groups that provide daily tips and leads.

Quick Recap Table

| Mistake | Consequence | Solution |

|---|---|---|

| Selling without needs analysis | Mistrust, cancellations | Start with financial profiling |

| Overpromising returns | Client dissatisfaction | Be transparent, follow IRDAI rules |

| Ignoring digital platforms | Lost leads | Use apps, CRM, social media |

| No follow-up | Missed sales | Automate reminders, reconnect |

| Working alone | Demotivation, failure | Join mentorship network |

Case Example

Ravi, a 26-year-old agent, made only 2 sales in 3 months because he didn’t follow up and avoided social media. After joining eBharat’s mentorship, he learned digital marketing and scripts. Within 4 months, his client base grew to 20 policies sold.

Why This Matters

The difference between struggling agents and successful ones isn’t talent—it’s avoiding these simple mistakes. If you start right, with proper training and digital tools, you can grow into a top-performing HDFC Life advisor in less than a year.

Interlinking Suggestion

👉 Next, read: Why eBharat Agents Close More Deals than Others

CTA

🚀 Want mentorship that helps you avoid mistakes and grow faster?

Apply Now to Join Our Agent Network