Many people think insurance agents are only motivated by commissions. While it’s true that commissions form the income base, successful HDFC Life agents know that insurance selling is about impact, not just income.

In 2025, customers are smarter, IRDAI regulations are stricter, and competition is tougher. If your focus is only on commissions, you will fail. If you focus on customer trust, financial education, and long-term relationships, your commissions will naturally grow.

Insurance Agents: Protectors, Not Just Sellers

When you sell an insurance plan, you’re not just closing a deal—you’re protecting a family’s future. A term plan may become the lifeline for a widow. A child plan may secure education for a young boy even after his parent’s untimely death.

Commission is the reward. The real product is financial security.

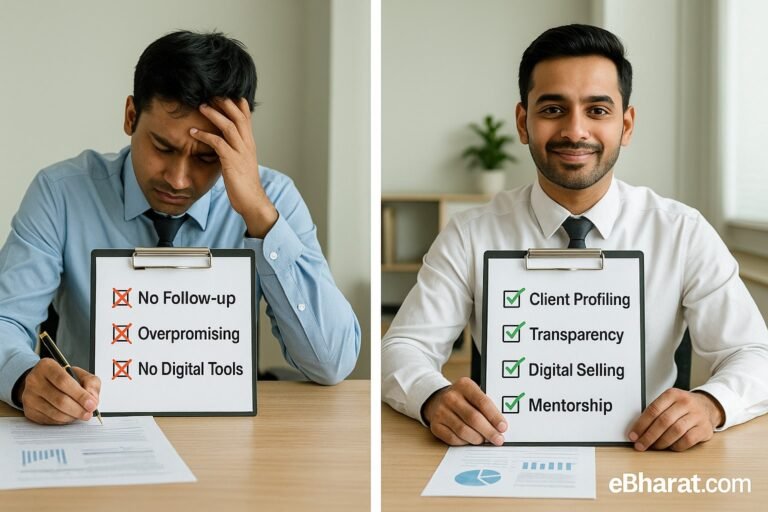

Why Commission Alone Can’t Sustain an Agent

- Customers don’t trust “pushy sellers” chasing commissions.

- Mis-selling may give short-term income, but destroys reputation.

- Agents driven only by money quit early when sales drop.

What Really Builds Success

1. Customer-Centric Selling

- Ask: “What does my client truly need?”

- Sell policies that fit goals, not just pay more commission.

2. Long-Term Relationships

- Policy renewals = recurring income.

- A satisfied client brings 3–5 referrals.

3. Education & Guidance

- Explain insurance in simple language.

- Position yourself as a financial guide, not a salesman.

4. Reputation & Trust

- In today’s digital world, one bad review spreads fast.

- Honest advice builds reputation → more clients → more income.

Case Example

Priya, a new HDFC Life agent, sold her first 5 policies with customer-first conversations instead of commission chasing. Within a year, her referrals doubled, and she earned 2.5x more commission than peers who pushed high-commission policies.

Commission vs Value-Driven Selling

| Focus | Outcome |

|---|---|

| Commission-Only Selling | Short-term income, high dropouts, poor client trust |

| Value-Driven Selling | Customer loyalty, referrals, recurring commissions |

Why This Matters

The insurance industry in India is shifting. IRDAI, digital platforms, and customer awareness are all pushing agents toward ethical, customer-first selling. Agents who embrace this earn more commissions in the long run than those chasing quick sales.

Interlinking Suggestion

👉 Next, read: The Future of Insurance Agents in India: Digital, Trust, and Growth

CTA

🚀 Want to learn how to build a career in insurance beyond commissions?

Apply Now to Join Our Agent Network