When a medical emergency strikes, the last thing families want is to struggle with hospital bills. In India, health insurance claims work in two main ways: cashless claims and reimbursement claims. Both protect you financially, but they work differently.

This guide explains the difference between cashless and reimbursement claims, how the process works in 2025, what documents you need, and tips to avoid claim rejection.

What Is a Cashless Claim?

A cashless claim means your insurer settles the hospital bill directly with the hospital. You don’t pay upfront (except non-medical expenses or exclusions).

How It Works (2025 Process)

- Choose a network hospital from your insurer’s list.

- Show your health card / e-card / policy number at the hospital help desk.

- Hospital sends pre-authorization request to insurer/TPA.

- Insurer approves within 2–6 hours (emergencies can be faster).

- Treatment done, hospital bills sent directly to insurer.

- You only pay for non-covered items (food, consumables, etc.).

What Is a Reimbursement Claim?

A reimbursement claim means you pay the hospital bill first and later submit documents to your insurer for repayment.

How It Works (2025 Process)

- Get admitted at any hospital (network or non-network).

- Pay the full bill at discharge.

- Collect all medical records, bills, discharge summary.

- Submit claim form + documents to insurer/TPA.

- Insurer verifies and reimburses to your bank account in 7–15 working days.

Quick Comparison: Cashless vs Reimbursement

| Aspect | Cashless | Reimbursement |

|---|---|---|

| Where Valid | Only at network hospitals | Any hospital in India |

| Payment at Admission | No (except exclusions) | Yes, full bill |

| Approval Time | 2–6 hours | 7–15 working days |

| Ease for Family | High (no upfront burden) | Low (you pay first) |

| Best For | Planned + emergency care at network hospitals | Non-network or urgent admissions |

Documents Required for Reimbursement Claims

- Claim form (signed by insured + hospital)

- Discharge summary

- Itemized hospital bill & payment receipts

- Prescription + diagnostic reports

- Pharmacy bills

- KYC documents (Aadhaar, PAN, bank details)

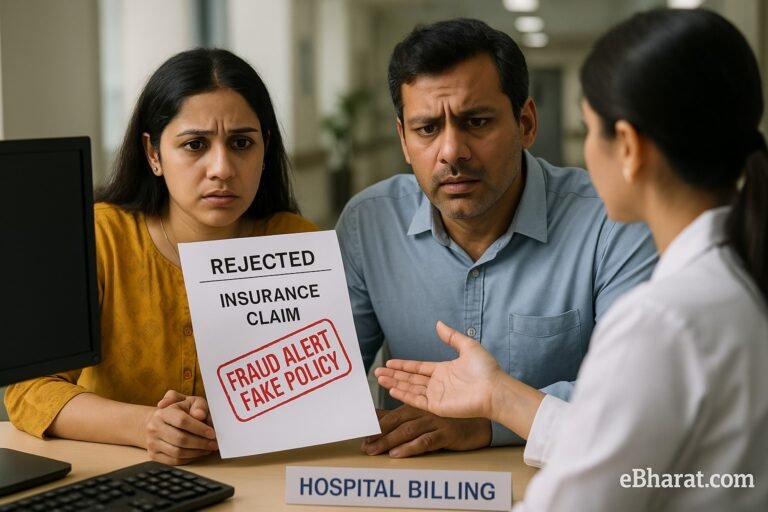

Common Reasons for Claim Rejection

Treatment not covered in policy (e.g., cosmetic, excluded illness).

Hospital not registered/recognized.

Incomplete documentation.

Waiting period not completed for PED (pre-existing disease).

Claim amount exceeding sum insured.

Tip: Always read your policy inclusions/exclusions carefully.

Case Study: Cashless vs Reimbursement in Action

- Cashless Example: Mr. Arora’s ₹3.5 lakh bypass surgery at a network hospital—paid entirely by insurer, out-of-pocket only ₹12,000 (consumables).

- Reimbursement Example: Mrs. Singh’s ₹1.8 lakh fracture treatment at a non-network hospital—she paid first, got reimbursed in 12 days after document submission.

Why This Matters

For families, understanding the difference between cashless and reimbursement can be the difference between financial stress and smooth treatment. In 2025, insurers are pushing cashless across more hospitals, but reimbursement remains vital when outside the network.

Next, read: Critical Illness Insurance: When Should You Buy It?

💳 Understand Health Insurance Claims Better

Use Insurance+ to compare policies with strong cashless networks, or join the eBharat HDFC Life Agent Network to guide families through claims smoothly.

🔍 Compare with Insurance+