India’s health insurance industry has grown massively, crossing ₹90,000 crore in premiums by 2025. But with this growth, fraudulent claims and scams have also risen, costing insurers—and honest policyholders—billions.

From fake hospital bills to forged policies, health insurance fraud directly impacts premiums and trust. This guide explains common frauds, IRDAI’s steps, and how you can stay safe.

What Is Health Insurance Fraud?

Fraud occurs when someone intentionally misleads an insurer for financial gain.

Examples:

- Hospitals inflating bills.

- Agents selling fake policies.

- Policyholders hiding pre-existing conditions.

Common Types of Health Insurance Fraud in India (2025)

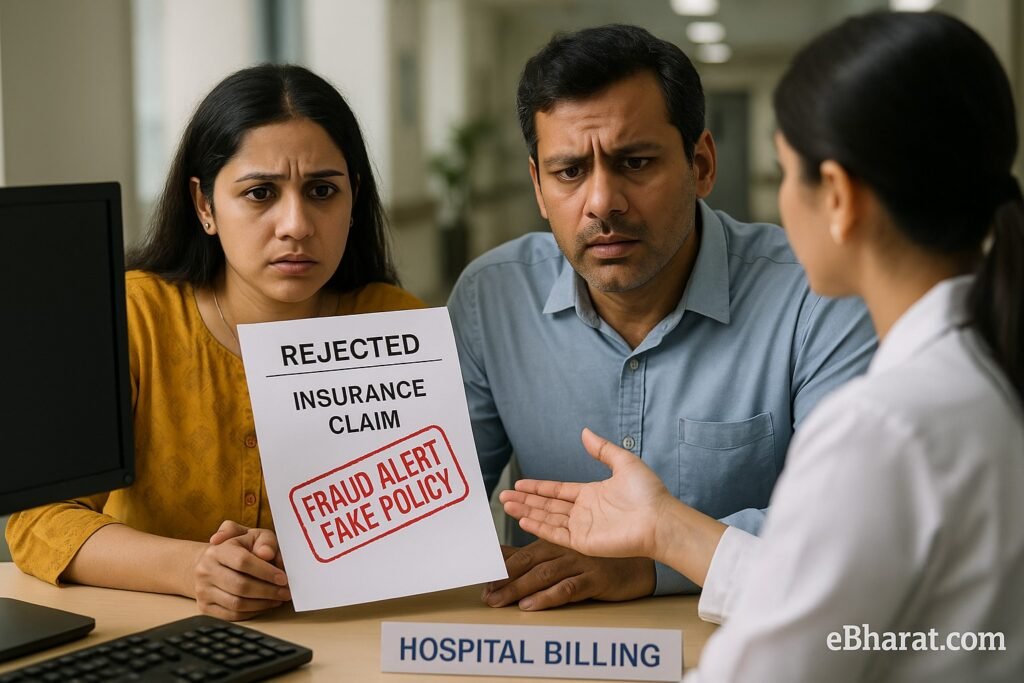

- Fake Policies by Fraud Agents

- Unsuspecting buyers pay premiums to unlicensed agents.

- Later, claims are rejected because the policy never existed.

- Inflated Hospital Bills

- Some hospitals charge for unnecessary tests and procedures.

- Example: ₹1 lakh billed for a ₹60,000 surgery.

- Fabricated Claims

- Policyholders submit fake medical reports for reimbursement.

- Pre-Existing Disease Concealment

- Hiding chronic illnesses like diabetes to get lower premiums.

- Later, claims get rejected → financial loss to family.

- Multiple Claims for Same Treatment

- Fraudsters file claims with multiple insurers for the same hospitalization.

IRDAI’s Safeguards in 2025

- Centralized Health Claim Exchange: Insurers cross-check claims in real time.

- eKYC Mandatory: Digital onboarding prevents fake policies.

- Standard Claim Form: Reduces manipulation of hospital bills.

- Strict Action on Fraud Hospitals: Blacklisting of repeat offenders.

Quick Infobox: Warning Signs of Health Insurance Fraud

| Warning Sign | What It Means |

|---|---|

| Agent avoids receipts | Possible fake policy |

| Hospital pushes “extra tests” | Inflated bill attempt |

| Premium too low to be true | Fraudulent offer |

How to Protect Yourself

- Verify Your Policy

- Always check on the insurer’s official website.

- Use IRDAI’s agent registration lookup.

- Use Cashless Network Hospitals

- Avoid reimbursement claims where bills can be inflated.

- Disclose Honestly

- Mention pre-existing conditions clearly to avoid future claim rejection.

- Check Claim Settlement Ratios

- Pick insurers with high ratios for safer coverage.

- Stay Alert with Agents

- Always demand receipts and policy documents directly from the company.

Case Study: Fake Policy Scam

In 2024, a gang in Delhi issued fake “cashless cards” under the name of a well-known insurer. Hundreds of families lost money. Victims later realized no such policy existed.

IRDAI responded by tightening digital onboarding and awareness campaigns in 2025.

Why This Matters

Fraud not only cheats insurers but also leads to higher premiums for honest policyholders. By staying aware and using digital verification, Indian families can avoid falling prey in 2025.

👉 Next, read: Mental Health Coverage in Insurance: IRDAI 2025 Circular Updates

🛡️ Stay Safe, Stay Insured

Use Insurance+ to compare genuine IRDAI-approved health plans, or join eBharat’s Agent Network to sell only trusted policies.

🔍 Compare Genuine Plans