Introduction

In India, if you own a car, bike, scooter, or even a tractor, you can’t hit the road without insurance. Motor Insurance is legally compulsory — at least third-party liability cover. Yet many Indians buy the cheapest plan, renew without reading, or don’t even know what is actually covered.

With road accidents rising (over 4.6 lakh accidents reported in 2024), and repair costs shooting up, motor insurance is more than a formality — it’s protection against financial disaster.

This guide explains all about motor insurance in 2025: types, premiums, claim process, IRDAI rules, pain points, and future trends.

What is Motor Insurance?

Motor insurance protects vehicle owners against losses from accidents, theft, fire, natural disasters, and liability towards third parties.

- Third-party Insurance → mandatory by law. Covers damage to others’ vehicle/property and injuries/death.

- Comprehensive Insurance → covers own damage (OD) + third-party.

Example: If your car hits another in Delhi NCR, and damages are ₹80,000, third-party cover pays for the other car. But your own repair bill of ₹70,000 will be covered only if you have a comprehensive plan.

Types of Motor Insurance

- Third-Party Liability Insurance (TP)

- Compulsory under Motor Vehicles Act.

- Cheapest, but offers no protection for your own vehicle.

- Comprehensive Insurance

- Covers third-party + own damage.

- Includes natural disasters (floods, earthquakes), theft, fire.

- Standalone Own Damage (OD) Cover

- For people who already have TP but want extra OD cover.

- Add-ons / Riders

- Zero Depreciation Cover (no deduction for car parts wear & tear).

- Roadside Assistance.

- Engine Protection.

- NCB (No Claim Bonus) Protector.

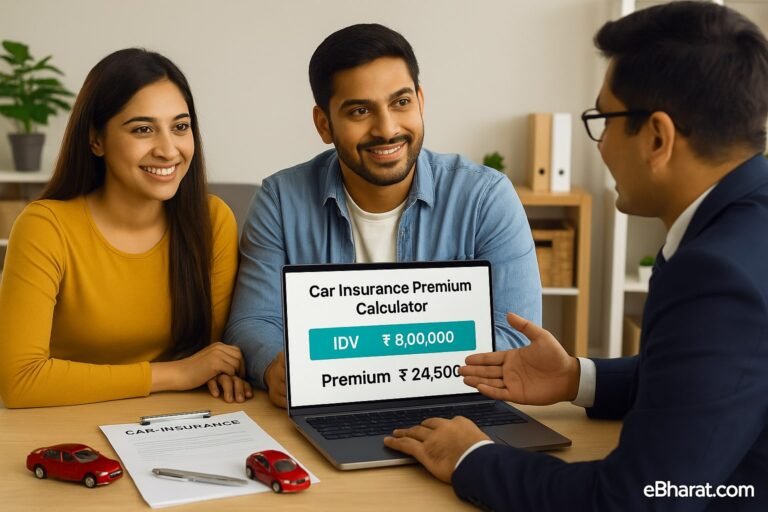

Premium Examples (2025)

| Vehicle Type | IDV (Insured Declared Value) | Annual Premium (Comprehensive) |

|---|---|---|

| Bike (125cc, Delhi) | ₹60,000 | ₹1,200 – ₹1,800 |

| Car (Hatchback, Mumbai) | ₹4 lakh | ₹8,000 – ₹11,000 |

| Car (SUV, Bangalore) | ₹10 lakh | ₹20,000 – ₹25,000 |

| Tractor (Rajasthan) | ₹5 lakh | ₹7,000 – ₹9,000 |

*Premiums are indicative. Source: insurer websites 2025. Vary by city, age of vehicle, and claim history.

Claim Settlement Process

- Inform insurer immediately after accident/theft.

- File FIR (mandatory for theft and major accidents).

- Submit claim form + documents (RC, DL, policy copy).

- Surveyor inspects damage.

- Claim approved → repair/replacement.

Tip: Always use a network garage for cashless repair. Otherwise, you’ll have to pay upfront and claim reimbursement.

IRDAI 2025 Updates

- Online-only renewal allowed → TP policies can now be renewed digitally, no agent needed.

- 15-day claim settlement deadline → insurers must settle OD claims within 15 days.

- Pay-as-you-drive option expanded → premium depends on kms driven.

- EV discounts → up to 15% lower premiums for electric vehicles.

Pain Points Indians Face

- Cheap TP-only policies: People think they’re “insured” but can’t claim for their own damage.

- Claim rejections: Due to expired license, drunk driving, delay in informing insurer.

- NCB confusion: Many lose their bonus while switching insurers.

- High premiums in metro cities: Same car in Jaipur has lower premium than in Mumbai.

Story: Sunita from Jaipur bought a car with TP-only cover. When it was stolen in 2024, she got nothing. If she had paid ₹4,000 extra for OD cover, she could’ve claimed ₹4 lakh.

Motor Insurance vs Health Insurance

| Feature | Motor Insurance | Health Insurance |

|---|---|---|

| What it Covers | Vehicle damage, third-party liability | Medical & hospital expenses |

| Legal Requirement | Yes (third-party mandatory) | No, but essential |

| Policy Period | 1 year (renewable) | 1 year or multi-year |

| Claim Type | Cashless at garages, reimbursement | Cashless at hospitals, reimbursement |

Tax Benefits

- Motor insurance premium: No tax benefit for personal vehicles.

- Business vehicles: Premium can be claimed as business expense.

- EV policies: Some states offer GST rebates.

Future of Motor Insurance in India

- Telematics-based policies (“pay-how-you-drive”).

- AI-driven claim approval → instant decisions.

- EV and hybrid-specific covers.

- More focus on road safety awareness.

Motor Insurance in India (2025): Comprehensive vs Third-Party

Third-Party (Mandatory)

- Covers damage to others’ vehicles/property

- Covers injury/death of third party

- No cover for own vehicle damage

- No protection against theft/natural disasters

- Premium: Lower (₹1,000–2,000 for bikes, ₹3,000–5,000 for cars)

Comprehensive (Recommended)

- Includes third-party cover

- Covers own vehicle damage (accident, fire, natural disasters)

- Covers theft of vehicle

- Add-ons: Zero Dep, Roadside Assist, Engine Protect

- Premium: Higher (₹7,000–12,000 for hatchbacks, ₹20k+ for SUVs)

*Premiums are approximate for 2025. Source: insurer websites.

Infographic © eBharat.com

FAQs

Q. Is third-party insurance enough?

No. It covers only others, not your car/bike.

Q. Can I transfer NCB when changing car?

Yes, NCB is linked to policyholder, not vehicle.

Q. What if I don’t renew on time?

Policy lapses → you lose NCB and risk fines.

Q. Do I need insurance for second-hand car?

Yes, policy must be transferred to your name.

Motor insurance is more than a legal formality. It’s protection against the rising cost of accidents, theft, and natural disasters. In 2025, with IRDAI’s digital reforms and flexible add-ons, Indian vehicle owners have more options than ever. But remember: cheap isn’t always safe. Choose wisely.

This guide is prepared by eBharat.com — verified with IRDAI updates (2025).

Ready to Start Your Journey as an Insurance Agent?

Motor insurance is not just about vehicles — it’s about protecting families from financial shocks. Join eBharat’s HDFC Life Agent Network and learn how to guide people in choosing the right policies while building your own career.

PlanMatch scripts & calculators

Direct from eBharat funnels

Start conversations instantly

Step-by-step training support

Want to explore more? Read our full guide on General Insurance in India (2025) .