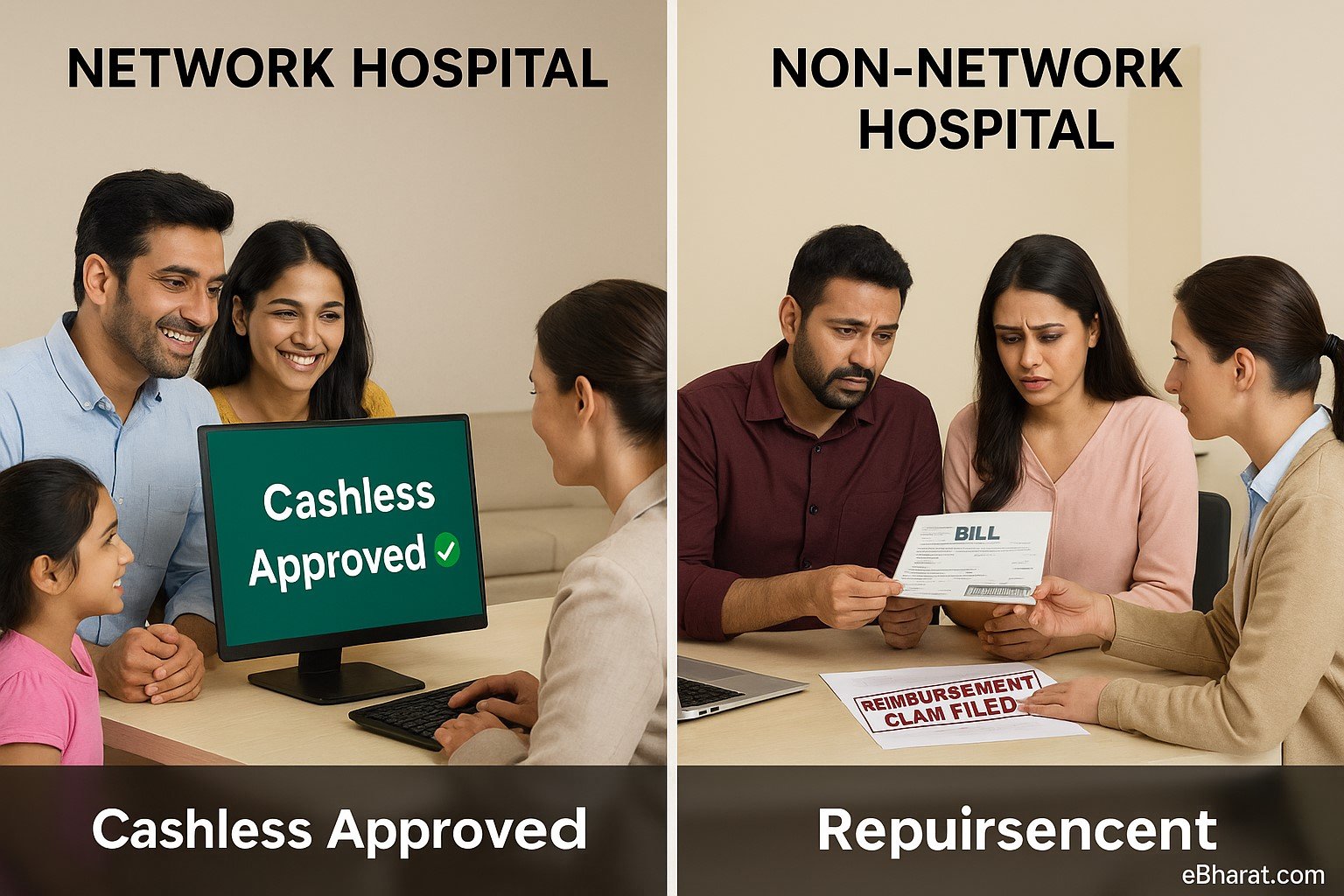

When buying health insurance, most families focus on premium and coverage but ignore an important factor: the hospital network.

In 2025, insurers have tie-ups with thousands of hospitals across India. These hospitals are classified as network hospitals. Treatment outside these facilities is at non-network hospitals—and this choice can decide whether you get cashless treatment or must pay first and claim later.

What Are Network Hospitals?

Network hospitals are healthcare providers that have signed agreements with insurers to offer cashless treatment.

- Bills go directly to the insurer.

- Policyholder pays only non-covered expenses.

- Saves families from arranging large sums during emergencies.

Example: If you are admitted to Apollo Hospital (a listed network hospital), your insurer directly settles ₹3 lakh surgery cost, while you only pay for room upgrades or exclusions.

What Are Non-Network Hospitals?

Non-network hospitals are facilities with no direct tie-up with your insurer.

- You pay the bill upfront.

- Later, you file a reimbursement claim with documents and bills.

- Insurer reimburses eligible costs after verification.

Example: If you are admitted to a small local hospital not in the network, you must pay ₹2 lakh first and then apply for reimbursement.

Quick Comparison: Network vs Non-Network

| Factor | Network Hospitals | Non-Network Hospitals |

|---|---|---|

| Claim Type | Cashless | Reimbursement |

| Payment at Admission | Minimal (non-covered only) | Full bill upfront |

| Ease of Process | Fast, hassle-free | Paper-heavy, time-consuming |

| Emergency Help | Insurer settles directly | Family arranges funds first |

Why Families Should Prefer Network Hospitals

- No Cash Crunch during emergencies.

- Faster Approval—insurer has a pre-agreed rate.

- Transparency—reduced risk of inflated billing.

- Peace of Mind—you focus on treatment, not paperwork.

IRDAI’s Push for Wider Networks in 2025

- Insurers must expand hospital networks in Tier-2 & Tier-3 cities.

- A centralized cashless claim platform is being tested to allow approvals across all insurers.

- By 2025, cashless claims are expected to reach 70% of all health insurance claims.

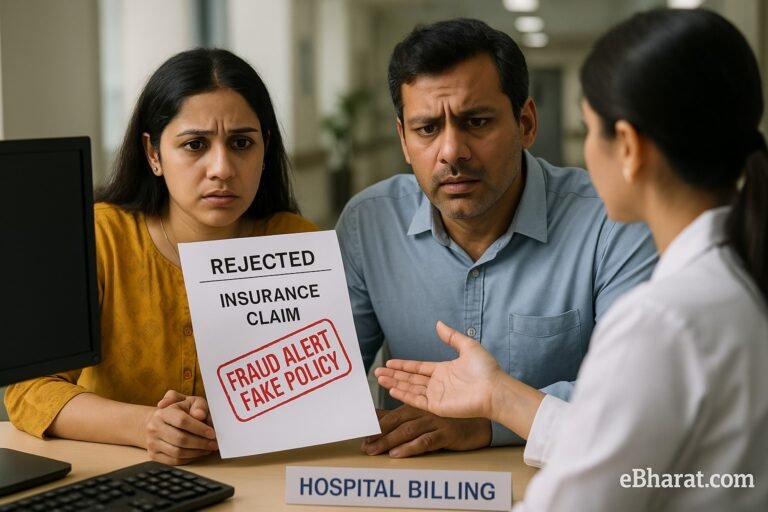

Case Study: Ramesh vs Suresh

- Ramesh was admitted to a network hospital for a gallbladder surgery costing ₹2.5 lakh. His insurer paid directly, and he only spent ₹8,000 on room upgrade.

- Suresh, in a similar situation, went to a non-network hospital. His family paid ₹2.4 lakh upfront, and reimbursement took 45 days.

Lesson: Hospital choice can decide whether your family faces stress or security.

Why This Matters

Network vs non-network hospitals is not just a technical detail—it decides cash flow, speed, and stress during medical emergencies. Always check your insurer’s hospital list before buying or renewing a policy.

Next, read: Top Add-On Covers in Health Insurance (OPD, Day-Care, Maternity)

🏥 Choose the Right Hospital Network

Use Insurance+ to check which hospitals are in your insurer’s network, or join eBharat’s Agent Network to guide families on cashless vs reimbursement claims.

🔍 Check Hospital Network