Every vehicle owner in India is legally required to have third-party insurance. But insurance agents and car dealers often recommend a comprehensive policy.

So, which is better for you in 2025? Let’s compare the real cost difference and see what works best for Indian car and bike owners.

What Is Third-Party Insurance?

- Mandatory by law under the Motor Vehicles Act.

- Covers damages or injuries to other people, vehicles, or property.

- Does not cover your own car/bike.

Cost (2025 IRDAI rates – small car example)

- Premium: ₹2,100–₹3,500/year

- Add GST and stamp charges = approx. ₹3,000–₹4,200

Cheapest option, but high financial risk if your own vehicle is damaged.

What Is Comprehensive Insurance?

- Covers both third-party liability and own damage (accidents, fire, theft, natural disasters).

- Can be customized with add-ons like zero-depreciation, roadside assistance, engine protection.

Cost (2025 average – small car example)

- Basic Comprehensive Premium: ₹8,000–₹15,000/year

- With add-ons: ₹12,000–₹20,000/year

Much higher than third-party, but covers almost every major expense.

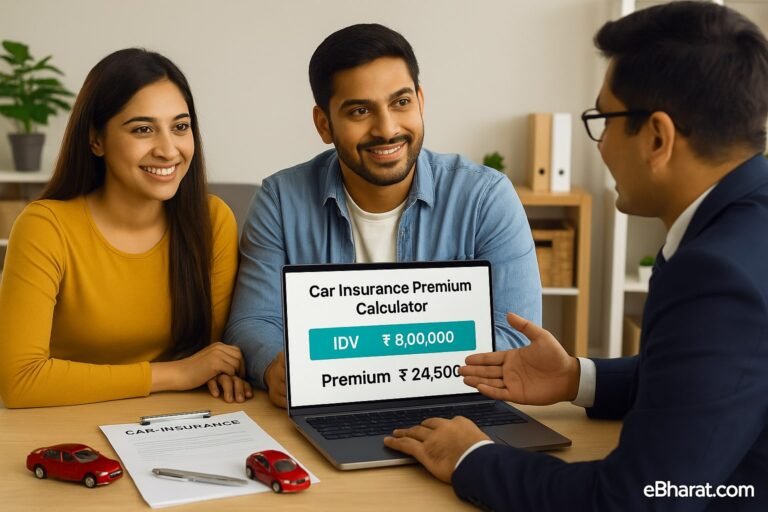

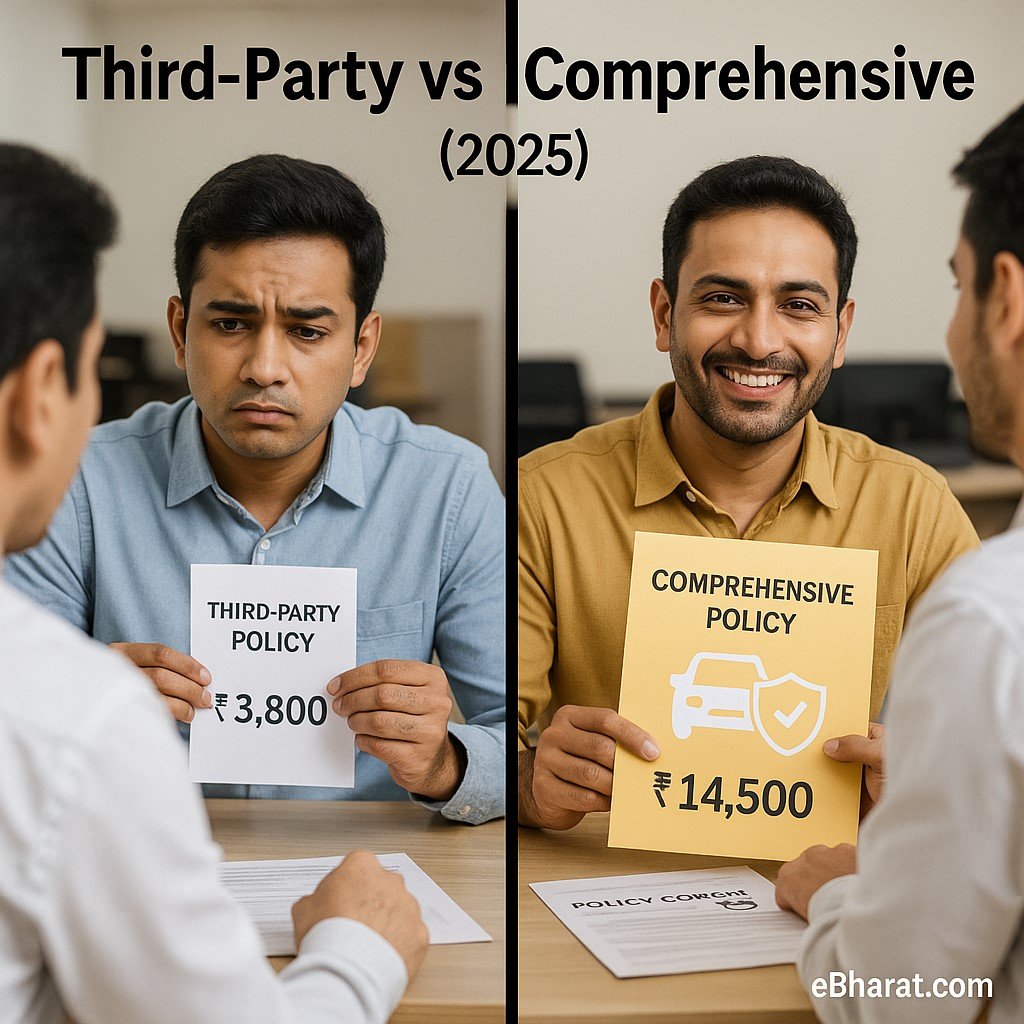

Real Cost Difference Example (2025)

Let’s compare a Hyundai i20 (2022 model, IDV ₹6 lakh):

- Third-Party Insurance: ~₹3,800/year

- Comprehensive Insurance: ~₹14,500/year (with zero-dep + RSA)

Accident Scenario

- Car repair cost: ₹1.5 lakh after an accident.

- Third-Party Policy: Zero payout (you pay full ₹1.5 lakh).

- Comprehensive Policy: Insurance pays ~₹1.35 lakh (after small deductibles).

One accident can cost more than 10 years of saved premium.

Pros & Cons at a Glance

| Factor | Third-Party | Comprehensive |

|---|---|---|

| Legality | Mandatory | Optional |

| Coverage | Others only | Own + others |

| Annual Cost | ₹3k–₹4k | ₹12k–₹20k |

| Best For | Old/low-value vehicles | New cars, frequent users |

When Third-Party Is Enough

- Old cars with market value < ₹1 lakh.

- Two-wheelers that are rarely used.

- If you want the cheapest legal compliance.

When Comprehensive Is Smarter

- New cars or bikes (<5 years old).

- Vehicles driven daily in urban areas.

- Families who cannot afford out-of-pocket repair shocks.

- Anyone buying loans/EMIs (banks usually demand comprehensive cover).

Case Study: Raj’s Dilemma

Raj, 32, from Delhi bought a 2023 Swift. He opted for third-party only to save money. After a collision, repair costs hit ₹1.2 lakh.

Raj had to pay the full amount because his insurance didn’t cover own damage. He later upgraded to comprehensive cover, realizing that the “savings” were false economy.

Why This Matters

In 2025, choosing between third-party and comprehensive is not just about premium—it’s about risk appetite. For most Indians, comprehensive cover offers real protection against today’s high repair and replacement costs.

👉 Next, read: Motor Insurance in India: A Complete Guide (2025)

🚀 Start Your Career as an HDFC Life Agent

Join eBharat’s Agent Network and get training, digital tools, and mentorship to build a successful career in insurance.

👉 Apply Now to Become an Agent