When buying car or bike insurance, most dealers and agents recommend the zero-depreciation add-on, also called “bumper-to-bumper” cover. It promises that in case of an accident, your claim is settled without factoring in depreciation on spare parts.

It sounds like a smart deal—but is it always worth the extra cost in 2025? Let’s explore.

What Is Zero-Depreciation Cover?

Normally, when you make a claim, insurers deduct depreciation on parts like plastic, metal, and fibre.

- Example: If a bumper costs ₹20,000 and depreciation is 50%, you’d get only ₹10,000 from the insurer.

- With zero-depreciation add-on, you’d get the full ₹20,000, paying only nominal charges like consumables.

Why It’s Popular in 2025

- Rising Spare Part Costs – Modern cars and bikes have expensive plastic and fibre components.

- Luxury Cars Trend – Owners of premium cars don’t want to risk high out-of-pocket bills.

- Cashless Claim Ecosystem – Works seamlessly with network garages.

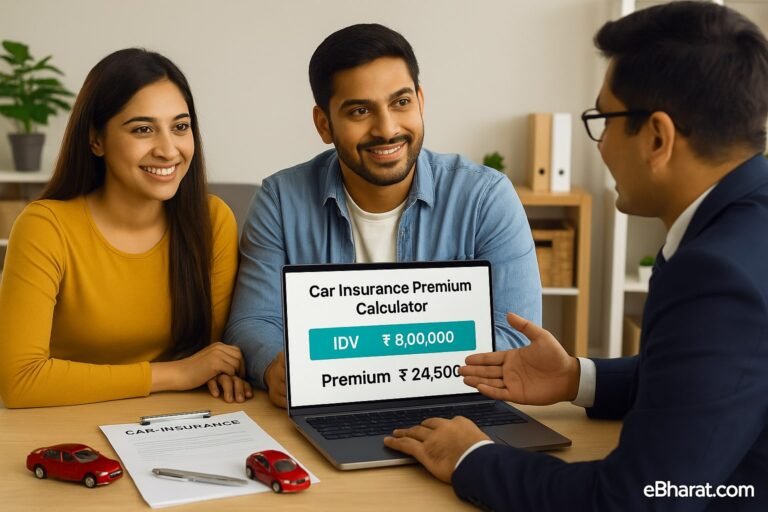

The Real Cost Impact

In 2025, a zero-depreciation add-on increases premium by 15–20%.

Example: Mid-Range Car (IDV ₹7 lakh)

- Comprehensive Premium (No Add-On): ₹12,000

- With Zero-Depreciation: ₹14,500

- Extra Paid: ₹2,500/year

One accident can justify this extra cost in a single year.

When Zero-Dep Cover Is Worth It

- New Vehicles (0–5 years old) – Protects value in early years.

- Metro City Drivers – Higher accident and repair costs.

- Luxury Cars – Expensive spare parts make zero-dep essential.

- First-Time Owners – Reduces financial shocks.

When It’s Not Worth It

- Older Cars (7+ years) – Most insurers don’t offer zero-dep.

- Low Usage Vehicles – If you drive rarely, accident chances are minimal.

- Budget-Conscious Buyers – May prefer lower premiums.

Quick Comparison: Standard vs Zero-Dep

| Factor | Standard Cover | Zero-Dep Cover |

|---|---|---|

| Claim Settlement | Depreciation deducted | Full cost reimbursed |

| Premium | Lower | 15–20% higher |

| Best For | Older cars, low-use vehicles | New cars, luxury vehicles |

Case Study: Priya’s SUV Claim

Priya, a 30-year-old from Mumbai, added zero-dep to her SUV’s insurance in 2024. In 2025, an accident damaged her bumper and headlamp.

- Repair Bill: ₹75,000

- With Zero-Dep: Paid just ₹3,000 (consumables).

- Without Zero-Dep: Would have paid ~₹25,000.

For Priya, the add-on saved almost 10 years’ worth of extra premiums in one claim.

Why This Matters

Zero-depreciation cover is not a must-have for everyone, but for new, high-value, or heavily used cars, it’s a smart financial safety net. For older cars, however, the extra premium may not justify the benefit.

Related: Motor Insurance in India: A Beginner’s Guide (2025)

🚀 Start Your Career as an HDFC Life Agent

Join eBharat’s Agent Network and get training, digital tools, and mentorship to build a successful career in insurance.

👉 Apply Now to Become an Agent