India’s electric vehicle (EV) market is booming, with sales expected to cross 20 lakh units in 2025. While EV buyers enjoy subsidies and lower running costs, one area often overlooked is insurance.

EV insurance is not the same as regular motor insurance. In 2025, IRDAI has introduced special guidelines for EV coverage, and insurers have developed new premium models tailored to EV risks.

Why EV Insurance Is Different

- Battery Costs

- Batteries account for 40–50% of EV value.

- Replacements can cost ₹3–6 lakh, making insurance premiums higher.

- Repair Infrastructure

- EV repair networks are still limited.

- Specialized parts and labour increase claims cost.

- Fire & Safety Risks

- EVs face unique risks like thermal runaway (battery fires).

- Policies include special fire coverage.

- Government Push

- IRDAI offers premium discounts for EVs to encourage adoption.

IRDAI’s EV Insurance Guidelines (2025 Update)

- Discounted Third-Party Premiums: 15% lower than petrol/diesel equivalents.

- Comprehensive EV Policies: Cover battery, charging equipment, and fire risks.

- Pay-As-You-Drive Options: Premiums linked to kilometers driven.

- EV-Specific Add-Ons: Battery protection, roadside charging assistance, depreciation waiver.

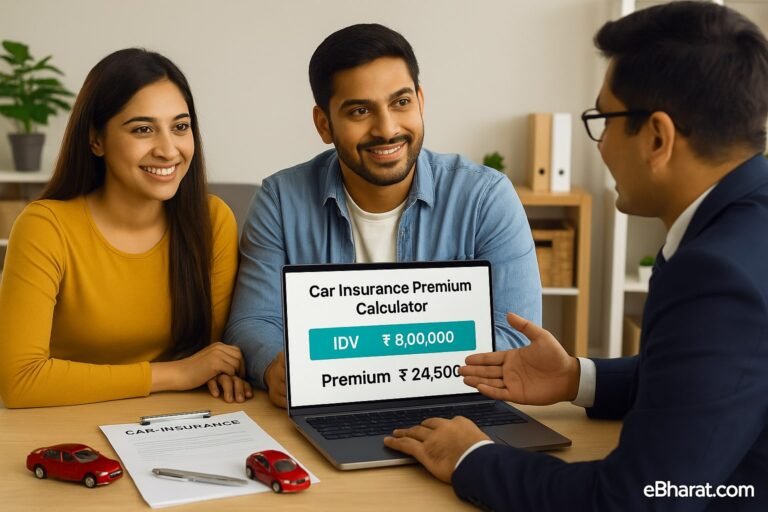

Average Premium Trends for EVs (2025)

| EV Segment | Comprehensive Premium (2024) | Comprehensive Premium (2025) |

|---|---|---|

| Two-Wheelers (Ather, Ola S1) | ₹3,500–₹5,000 | ₹4,200–₹6,000 |

| Cars (Tata Nexon EV, MG ZS EV) | ₹18,000–₹25,000 | ₹20,000–₹28,000 |

| Luxury EVs (BMW iX, Audi e-tron) | ₹75,000–₹1.1 lakh | ₹85,000–₹1.25 lakh |

Add-Ons for EV Insurance in 2025

- Battery Protection Cover – Covers battery repair/replacement.

- Charging Equipment Cover – Protects home chargers and cables.

- Depreciation Waiver – Full settlement on parts, no depreciation deduction.

- Roadside EV Assistance – Mobile charging vans, towing facilities.

Case Study: Sneha’s EV Insurance Experience

Sneha, a 29-year-old from Delhi, bought a Tata Nexon EV in 2023. In 2024, her battery malfunctioned, costing ₹4.5 lakh. Luckily, she had taken the battery protection add-on, and her insurer covered almost the entire amount.

Lesson: Add-ons are critical for EV owners.

Why This Matters

EV adoption is growing, but without proper insurance, owners risk huge repair bills. In 2025, EV-specific policies and add-ons ensure that electric mobility is both affordable and protected.

Next, read: Roadside Assistance Cover: Hidden Benefits Explained

🚀 Start Your Career as an HDFC Life Agent

Join eBharat’s Agent Network and get training, digital tools, and mentorship to build a successful career in insurance.

👉 Apply Now to Become an Agent