Every vehicle in India—whether it’s a scooter, car, or truck—must have compulsory third-party (TP) motor insurance. This cover is mandated by the Motor Vehicles Act, 1988 and regulated by the Insurance Regulatory and Development Authority of India (IRDAI).

In 2025, IRDAI has revised TP premium rates with affordability and safety in mind. Let’s break down what this means for Indian vehicle owners.

What Is Third-Party Insurance?

Third-party insurance protects you against:

- Legal liability if your vehicle causes injury or death to another person.

- Damage to third-party property (like another vehicle, wall, or shop).

Note: It does not cover your own vehicle’s damage. For that, you need comprehensive insurance.

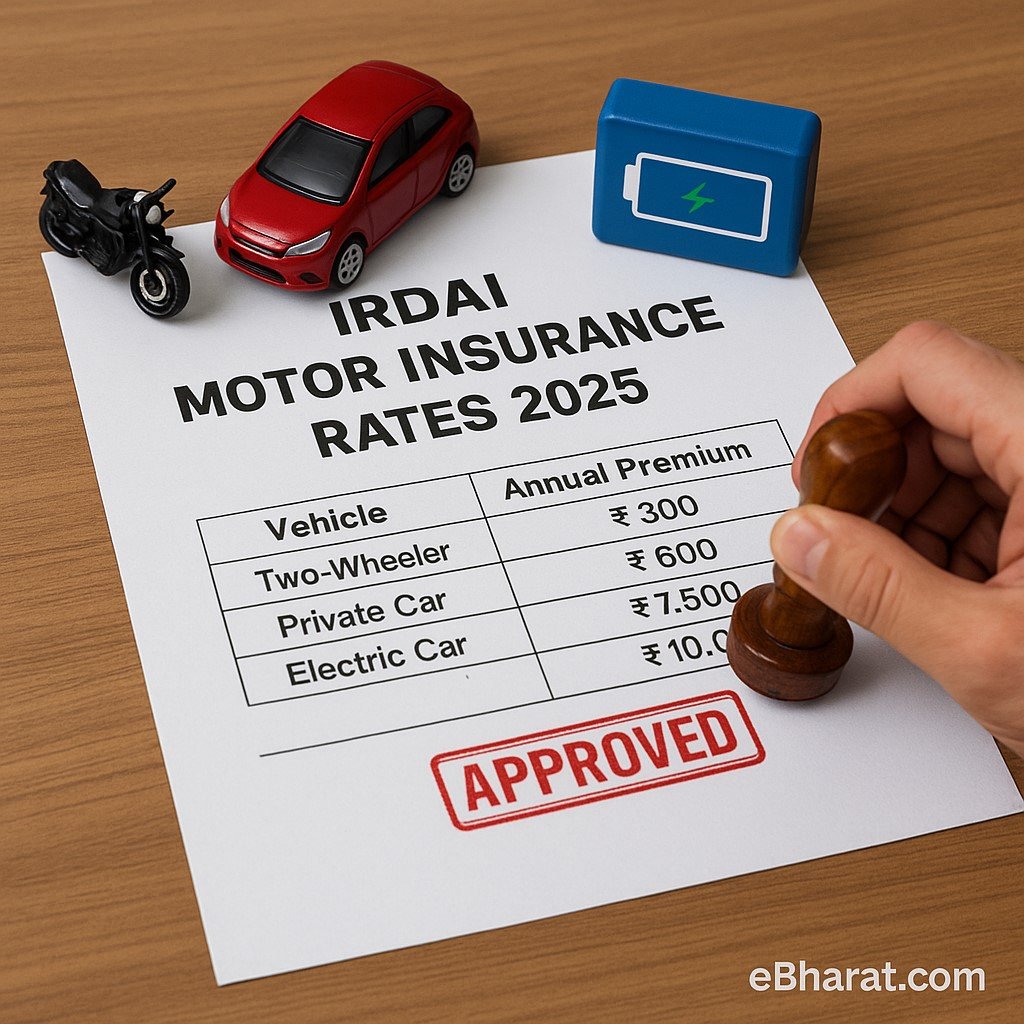

IRDAI Price Bands for 2025

| Vehicle Type | Engine Capacity | TP Premium (2025) |

|---|---|---|

| Two-Wheelers | Up to 75cc | ₹538 |

| Two-Wheelers | 76cc–150cc | ₹714 |

| Cars | Up to 1000cc | ₹2,094 |

| Cars | 1001–1500cc | ₹3,416 |

| Cars | Above 1500cc | ₹7,897 |

Why Rates Differ by Engine Size

- Larger engines = higher accident/loss potential.

- IRDAI uses actuarial data to set fair premiums.

- EVs enjoy discounts on TP premiums to promote green adoption.

Case Study: Amit’s New Hatchback

Amit bought a 1200cc hatchback in 2025. His TP premium was ₹3,416, fixed by IRDAI. When he caused minor damage to another car, the insurer paid ₹45,000 repair costs, saving Amit from a big financial burden.

Lesson: Even basic third-party cover can protect you from huge liabilities.

Why This Matters

Third-party insurance is not optional—it’s the law. With IRDAI’s clear 2025 price bands, customers now have predictable and transparent premium costs.

Next, read: Motor Insurance Claims Process: Step-by-Step in India

🚀 Start Your Career as an HDFC Life Agent

Join eBharat’s Agent Network and get training, digital tools, and mentorship to build a successful career in insurance.

👉 Apply Now to Become an Agent