While motor insurance protects millions of Indian drivers, it has also become a target for fraudsters. From fake policies sold online to staged accidents, fraud cases not only cause financial losses but also increase overall premiums for honest policyholders.

In 2025, IRDAI has introduced stricter rules and digital verification systems, but awareness remains the first line of defense.

Common Motor Insurance Frauds in India

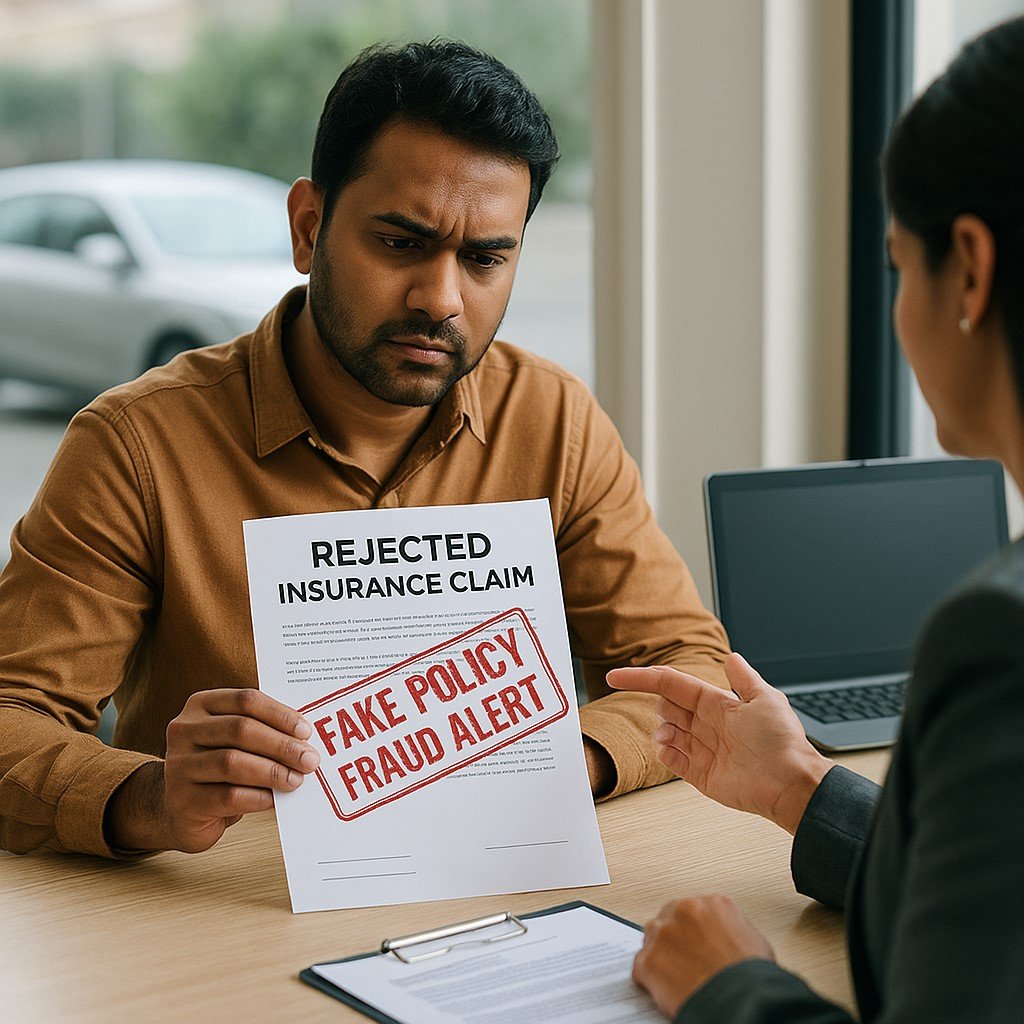

1. Fake Insurance Policies

- Fraudsters sell forged insurance certificates at cheap rates.

- Victims realize only during claims that the policy is invalid.

How to Avoid:

Always buy from IRDAI-approved insurers or verified agents.

Check policy details on the IRDAI / insurer’s website immediately after purchase.

2. Inflated Repair Bills

- Garages sometimes inflate repair costs to claim higher amounts from insurers.

- Policyholders may unknowingly become part of the fraud.

How to Avoid:

Prefer cashless network garages.

Review bills carefully before signing claim forms.

3. Staged Accidents

- Fraudsters deliberately damage vehicles or stage fake accidents.

- Used to claim large sums from insurers.

How to Avoid:

Install a dashboard camera (dashcam) in your car.

Report suspicious incidents to the insurer immediately.

4. Multiple Claims for the Same Damage

- Some fraudsters attempt to file claims with multiple insurers for one accident.

How to Avoid:

IRDAI now mandates policy linking with RC numbers to prevent double claims.

Be honest in all claim submissions.

5. Fake Agents Collecting Premiums

- Fraudsters pose as agents, collect premiums, and disappear without issuing policies.

How to Avoid:

Verify the agent’s IRDAI license.

Use official insurer apps or trusted platforms like eBharat for secure payments.

Case Study: Ramesh’s Fake Policy Loss

Ramesh, a Delhi car owner, bought what he thought was a cheap car insurance policy from an unverified website. Months later, his car was damaged in an accident. When he filed a claim, the insurer informed him that the policy number was fake. Loss: ₹85,000.

Lesson: Always cross-check policy authenticity on the official IRDAI website.

Quick Infobox: IRDAI’s Anti-Fraud Steps in 2025

| Fraud Type | IRDAI Action |

|---|---|

| Fake Policies | Mandatory e-verification QR codes |

| Inflated Bills | AI-based repair cost monitoring |

| Multiple Claims | RC-linked database for policies |

| Fake Agents | Public agent verification portal |

Why This Matters

Fraudulent practices hurt both insurers and genuine policyholders by driving up premiums. By staying alert and using digital verification, Indian vehicle owners can protect themselves in 2025.

Next, read: Engine Protection Add-On: Who Should Buy It?

🚀 Start Your Career as an HDFC Life Agent

Join eBharat’s Agent Network and get training, digital tools, and mentorship to build a successful career in insurance.

👉 Apply Now to Become an Agent