When buying or renewing car insurance in India, many people are confused about how insurers decide the premium amount. Some cars cost ₹10,000 per year to insure, while others cost ₹40,000+.

In 2025, insurers use risk-based pricing models regulated by IRDAI. Understanding these factors helps you make smarter decisions and even save money.

Key Factors That Decide Car Insurance Premium

1. Insured Declared Value (IDV)

- IDV = Market value of your car (after depreciation).

- Higher IDV = higher premium, but better coverage.

2. Car Type & Engine Capacity

- Premiums vary for hatchbacks, sedans, SUVs, and luxury cars.

- Example: SUV with 2000cc engine costs more to insure than a 1200cc hatchback.

3. Location (RTO Zone)

- Cars registered in metro cities like Mumbai/Delhi have higher premiums due to accident & theft risks.

- Rural RTOs usually mean lower premiums.

4. Age of Car

- Older cars = lower IDV → lower premium.

- But higher risk of breakdown may increase repair-based claims.

5. Add-On Covers

- Zero depreciation, engine protection, roadside assistance, NCB protection → each increases premium.

6. Driver Profile

- Age, driving history, claim history all matter.

- Example: A 28-year-old driver with no prior claims pays less than a 22-year-old with accident history.

How Online Premium Calculators Work in 2025

Most insurers and aggregators (like PolicyBazaar, HDFC ERGO, etc.) provide free calculators.

Steps:

- Enter car details (make, model, year, RTO).

- Select coverage type (Third-Party or Comprehensive).

- Choose add-ons (zero dep, roadside assistance, engine cover).

- Calculator shows instant premium quote.

Pro Tip: Compare multiple calculators before finalizing.

IRDAI’s Role in Premium Regulation

- IRDAI fixes Third-Party (TP) rates annually (same across insurers).

- Own Damage (OD) premium varies by insurer → competitive pricing.

- In 2025, IRDAI has pushed for transparent premium disclosures so customers know why they’re paying extra.

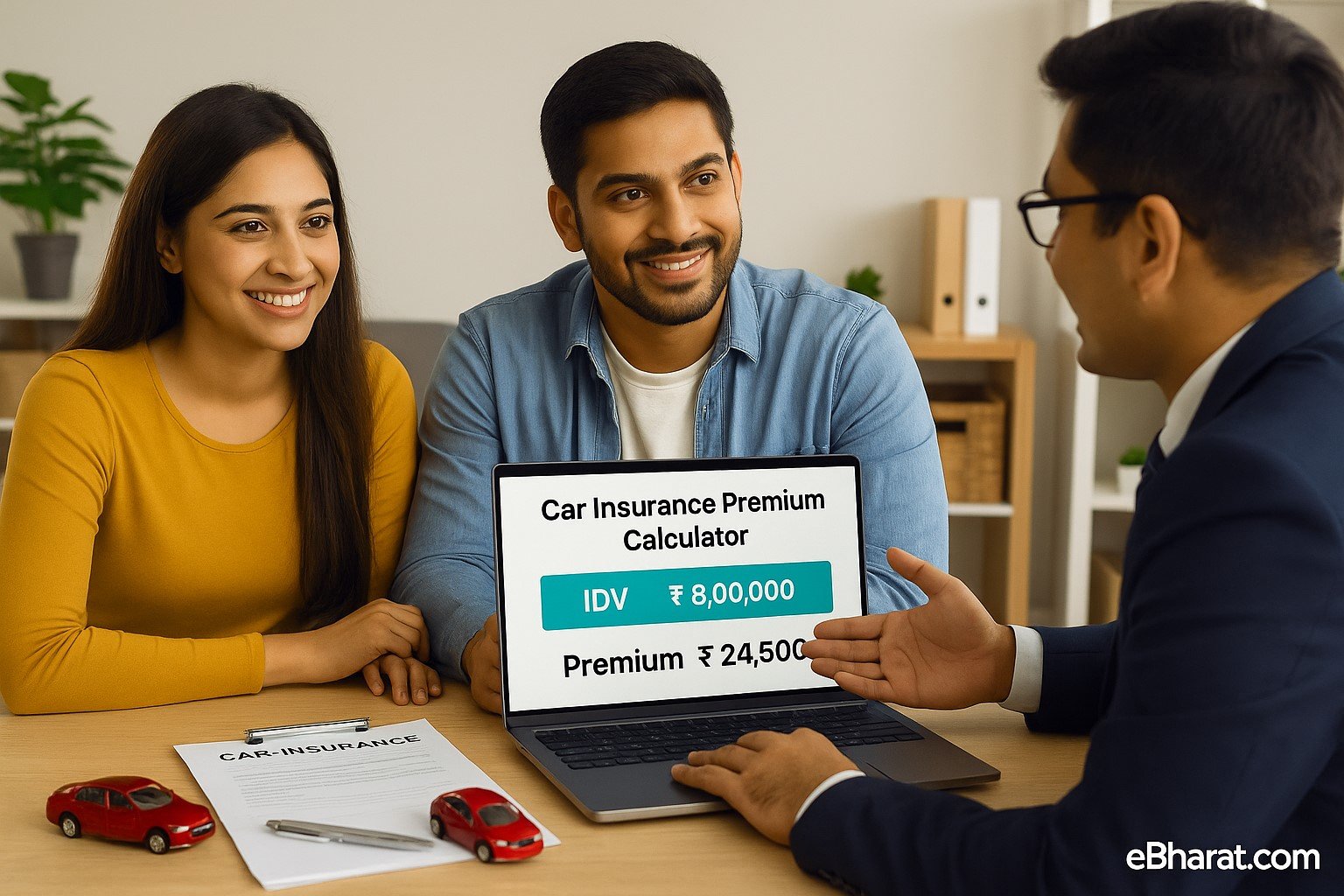

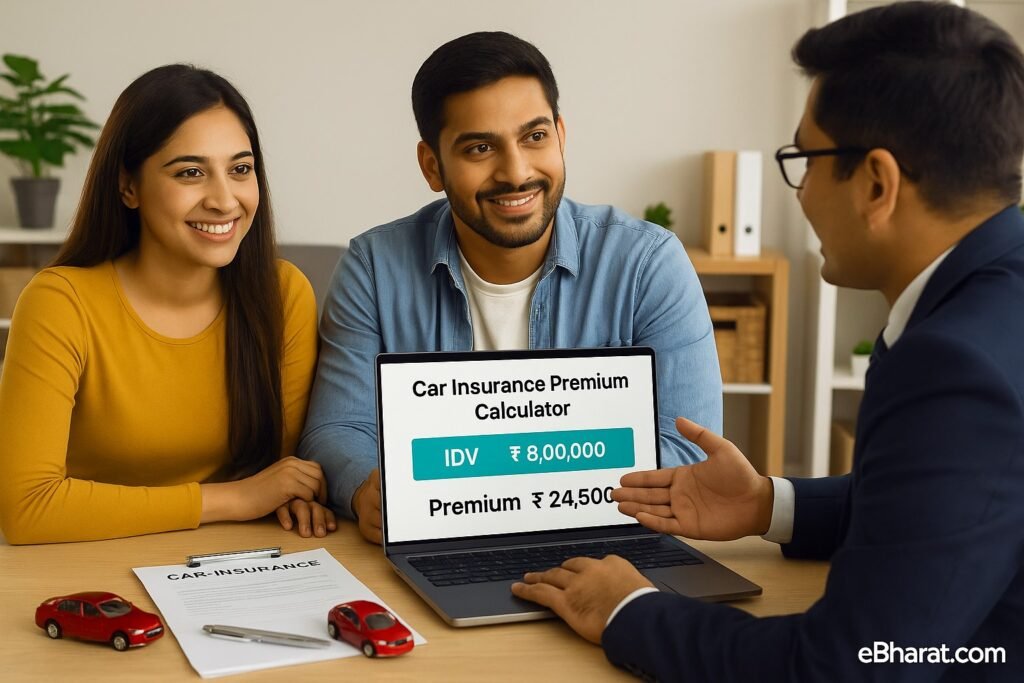

Case Example: Ramesh’s Car Insurance

- Car: 2021 Sedan, IDV = ₹8 lakh.

- Location: Delhi.

- Add-Ons: Zero Depreciation + Roadside Assistance.

- Premium = ₹24,500 annually.

Without add-ons, premium would have been ₹18,000.

Lesson: Add-ons give better protection but raise costs.

Quick Infobox: Car Insurance Premium Components

| Component | Fixed by IRDAI | Varies by Insurer |

|---|---|---|

| Third-Party (TP) Premium | ✅ Yes | ❌ No |

| Own Damage (OD) Premium | ❌ No | ✅ Yes |

| Add-On Covers | ❌ No | ✅ Yes |

| GST (18%) | ✅ Yes | ❌ No |

Why This Matters

Understanding premium calculation helps you:

- Choose the right IDV.

- Avoid unnecessary add-ons.

- Compare quotes to save money.

Next, read: Why Car Insurance is Mandatory in India: Legal & Financial Logic

🚀 Start Your Career as an HDFC Life Agent

Join eBharat’s Agent Network and get training, digital tools, and mentorship to build a successful career in insurance.

👉 Apply Now to Become an Agent