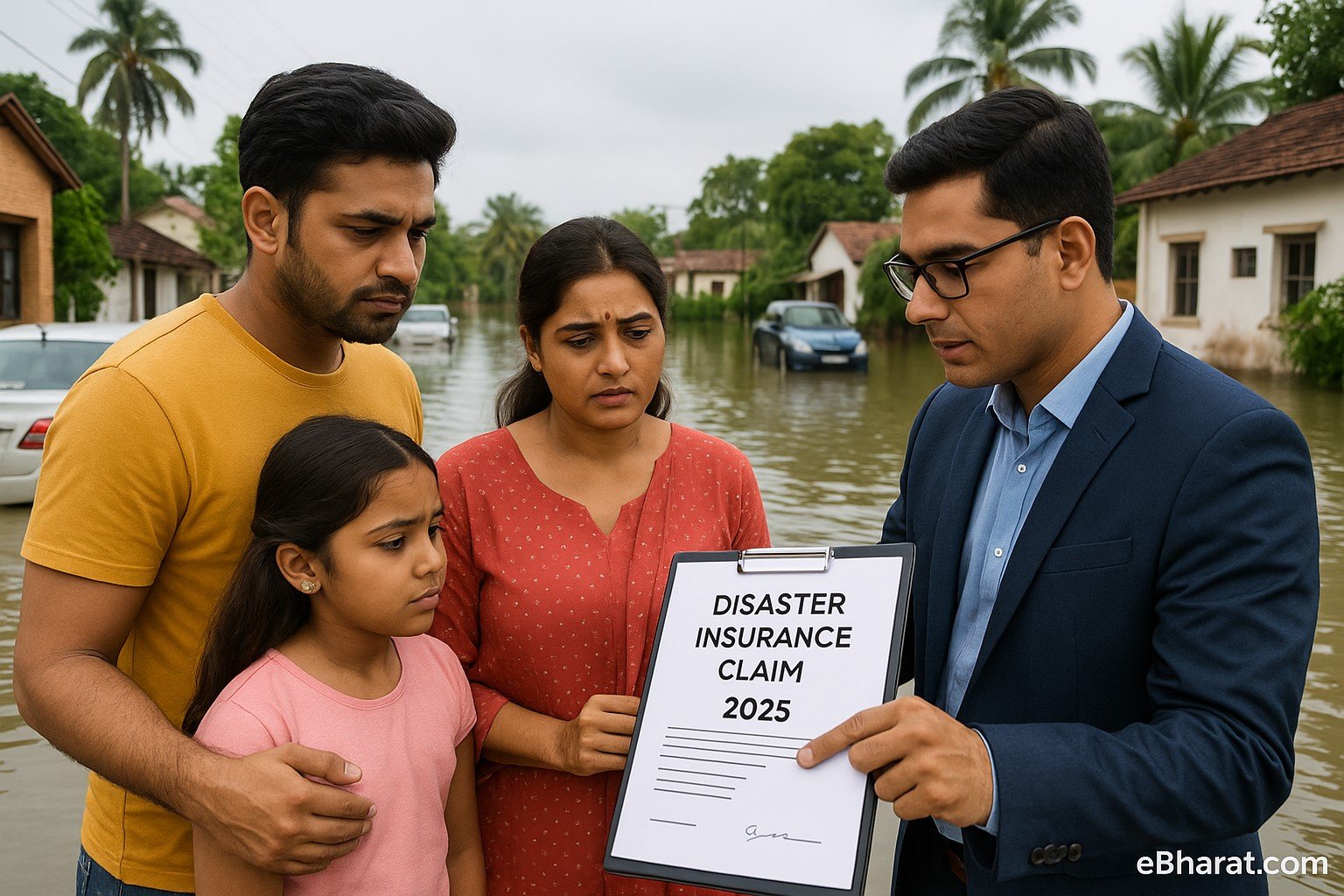

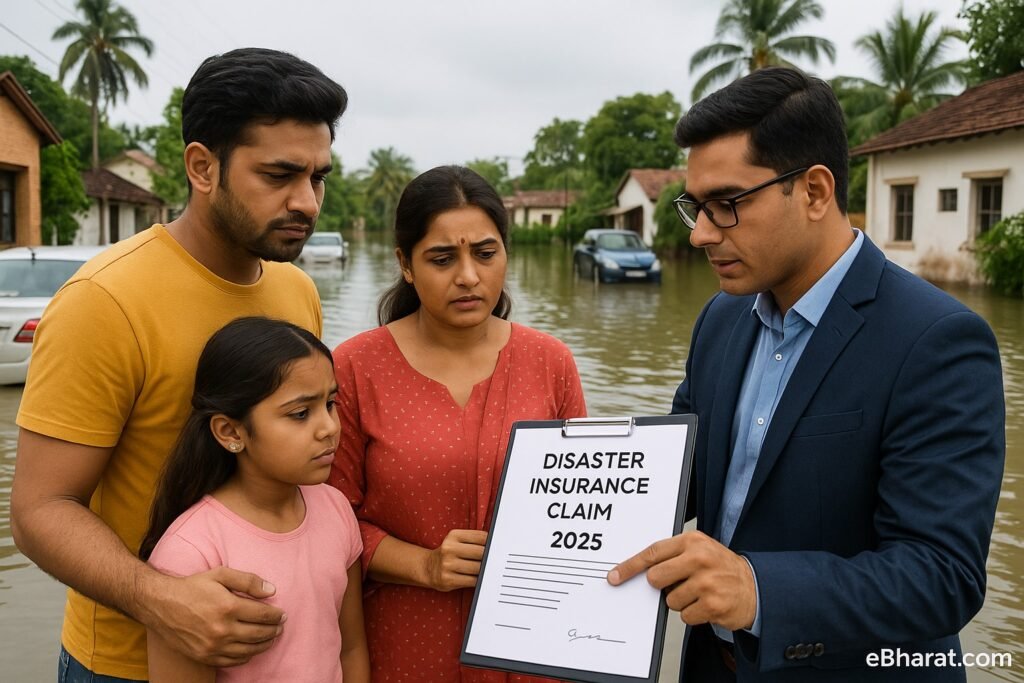

In recent years, India has witnessed a sharp rise in climate-related disasters—from floods in Himachal and Assam to cyclones in Odisha and Gujarat. These disasters don’t just destroy homes and vehicles; they wipe out businesses, farmlands, and livelihoods.

That’s why natural disaster coverage in general insurance policies is becoming essential in 2025. Whether you’re a homeowner, car owner, or SME operator, insurance can be the only financial lifeline during such crises.

What Is Natural Disaster Coverage?

Natural disaster coverage is an add-on or built-in feature of general insurance policies (health, motor, home, fire, crop). It provides compensation for loss or damage caused by acts of nature.

Key Perils Covered:

- Floods and cloudbursts

- Cyclones, storms, and hailstorms

- Earthquakes and landslides

- Fires caused by lightning

- Tsunami damage (if included in policy terms)

Example: A motor insurance policy with natural disaster add-on will cover car repairs if it gets submerged during Mumbai floods.

Types of Policies That Cover Natural Disasters

- Home Insurance

- Covers structure + contents damaged due to floods, storms, earthquakes.

- Ex: Furniture, electronics, and property rebuilding costs.

- Motor Insurance (Comprehensive)

- Covers damages from floods, cyclones, or falling trees.

- Ex: Engine replacement if waterlogged.

- Health Insurance

- Covers hospitalization if injured during disasters.

- Ex: Emergency treatment after earthquake injuries.

- Fire & Property Insurance

- Covers offices, shops, and warehouses against fire, lightning, storms, and floods.

- Crop Insurance (PMFBY)

- Covers farmers against floods, droughts, cyclones.

Common Exclusions

- Gradual damage due to poor maintenance (like seepage).

- Losses without proper documentation (no FIR or claim proof).

- Deliberate negligence or unreported modifications.

- Some policies require add-ons for full disaster coverage.

Real-Life Example: Cyclone Fani (Odisha, 2019)

Thousands of insured homes and shops were rebuilt with insurance payouts, while uninsured families had to rely only on government relief. The difference showed how insurance can fast-track recovery.

Premium Costs (2025 Snapshot)

| Policy Type | Natural Disaster Add-On | Annual Cost (₹) |

|---|---|---|

| Home Insurance | Flood & earthquake cover | 1,000–2,500 |

| Car Insurance | Flood/cyclone protection | 1,500–3,500 |

| SME Shop Insurance | Fire + flood package | 5,000–15,000 |

Affordable premiums compared to potential losses of lakhs or crores.

Why This Matters in 2025

Climate change is making India more disaster-prone. Families and businesses can no longer rely on government relief alone. General insurance with natural disaster coverage is the best shield against unpredictable risks.

Next, read: SME General Insurance Needs: What Every Small Business Should Buy

🚀 Start Your Career as an HDFC Life Agent

Join eBharat’s Agent Network and get training, digital tools, and mentorship to build a successful career in insurance.

👉 Apply Now to Become an Agent