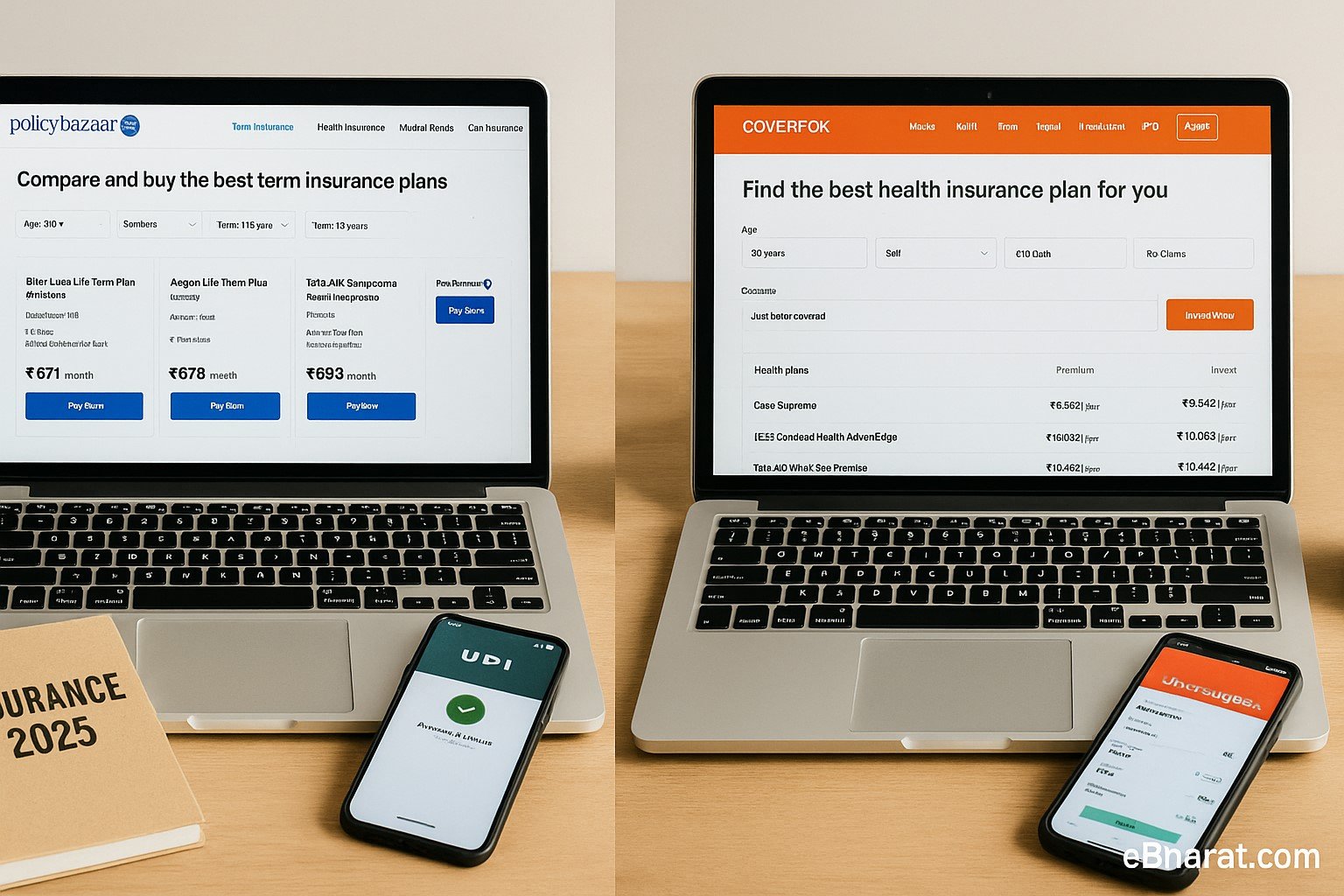

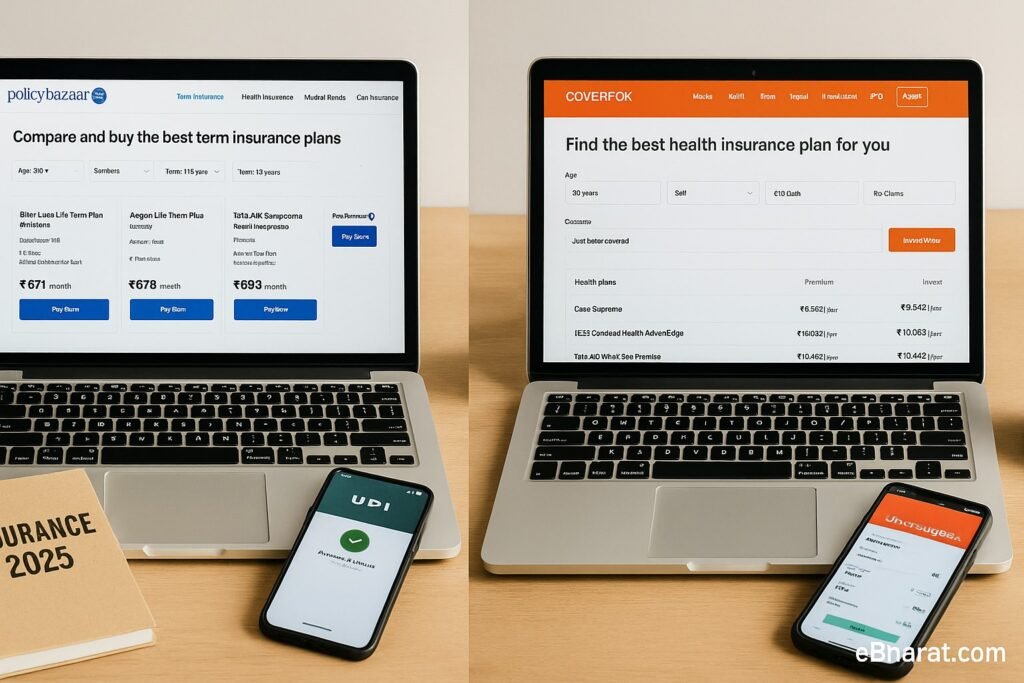

PolicyBazaar and Coverfox are two of India’s most trusted insurance marketplaces. Both help you compare term and health plans, but each has different strengths—PolicyBazaar offers more insurers, while Coverfox focuses on smoother claims support. Here’s how they stack up in 2025.

India Snapshot

| Feature | PolicyBazaar | Coverfox | Notes |

|---|---|---|---|

| Plans Available | 40+ term insurers, 50+ health plans | 20+ term insurers, 30+ health plans | PB wider |

| Pricing | Term: starts ₹400/month; Health: ₹5,000/year | Term: starts ₹450/month; Health: ₹5,500/year | Similar |

| Claim Support | Online claim filing, phone support | Dedicated claim managers | Coverfox better |

| Payments | UPI, NetBanking, EMI, cards | UPI, NetBanking, EMI, cards | Tie |

| GST Invoice | Yes | Yes | Tie |

| Mobile App | Yes (4.3⭐) | Yes (4.1⭐) | Tie |

| Best For | More plan options, brand recall | Simple UI + stronger claim handholding | Depends on need |

Compare India’s top insurance marketplaces today:

Check Term & Health Plans on PolicyBazaar

Explore Coverfox Health & Term Options

PolicyBazaar: The Market Leader

- India’s largest insurance aggregator.

- Wide coverage: LIC, HDFC Life, ICICI Pru, Max Life, Star Health, Niva Bupa, and more.

- Good for comparing low premium term plans (₹400–₹600/month).

- Health insurance covers cashless across 10,000+ hospitals.

- Weakness: Customer service delays during peak seasons.

Best for: Buyers who want the widest range of insurers.

Coverfox: The Challenger

- Simpler interface and easy claim filing.

- Strong focus on health policies + dedicated claim managers.

- Term life options from top insurers like HDFC Life, SBI Life, Tata AIA.

- Faster resolution for health claims, according to SME reviews.

- Weakness: Fewer insurers compared to PolicyBazaar.

Best for: Buyers who value claims support and simpler navigation.

Profitability & Buyer Fit in India

- PolicyBazaar → more choice, cheaper entry premiums, better for first-time term buyers.

- Coverfox → better service in health claims, strong for family health insurance.

Pros and Cons

PolicyBazaar Pros

- Largest aggregator.

- More term + health plan choices.

- Low entry premiums.

PolicyBazaar Cons

- Customer support can feel crowded.

- UI a bit cluttered.

Coverfox Pros

- Clean design, faster navigation.

- Dedicated claim managers.

- Smooth experience for health buyers.

Coverfox Cons

- Fewer insurers.

- Slightly higher average premiums.

Quick Checklist

- If you want widest plan choice → PolicyBazaar.

- If you want better claims help → Coverfox.

- Always compare at least 3 insurers before buying.

- Opt for GST invoices for tax purposes.

- Pay via UPI/NetBanking for faster policy activation.

Ready to buy insurance in 2025? Compare top marketplaces now:

👉 Get Quotes on PolicyBazaar

👉 Check Plans on Coverfox

In 2025, PolicyBazaar remains the best choice for term plans and wide variety, while Coverfox is better for health insurance buyers who want claims support. Both are GST-ready, UPI-friendly, and trusted by millions of Indian users. Your pick depends on whether choice or service matters more.