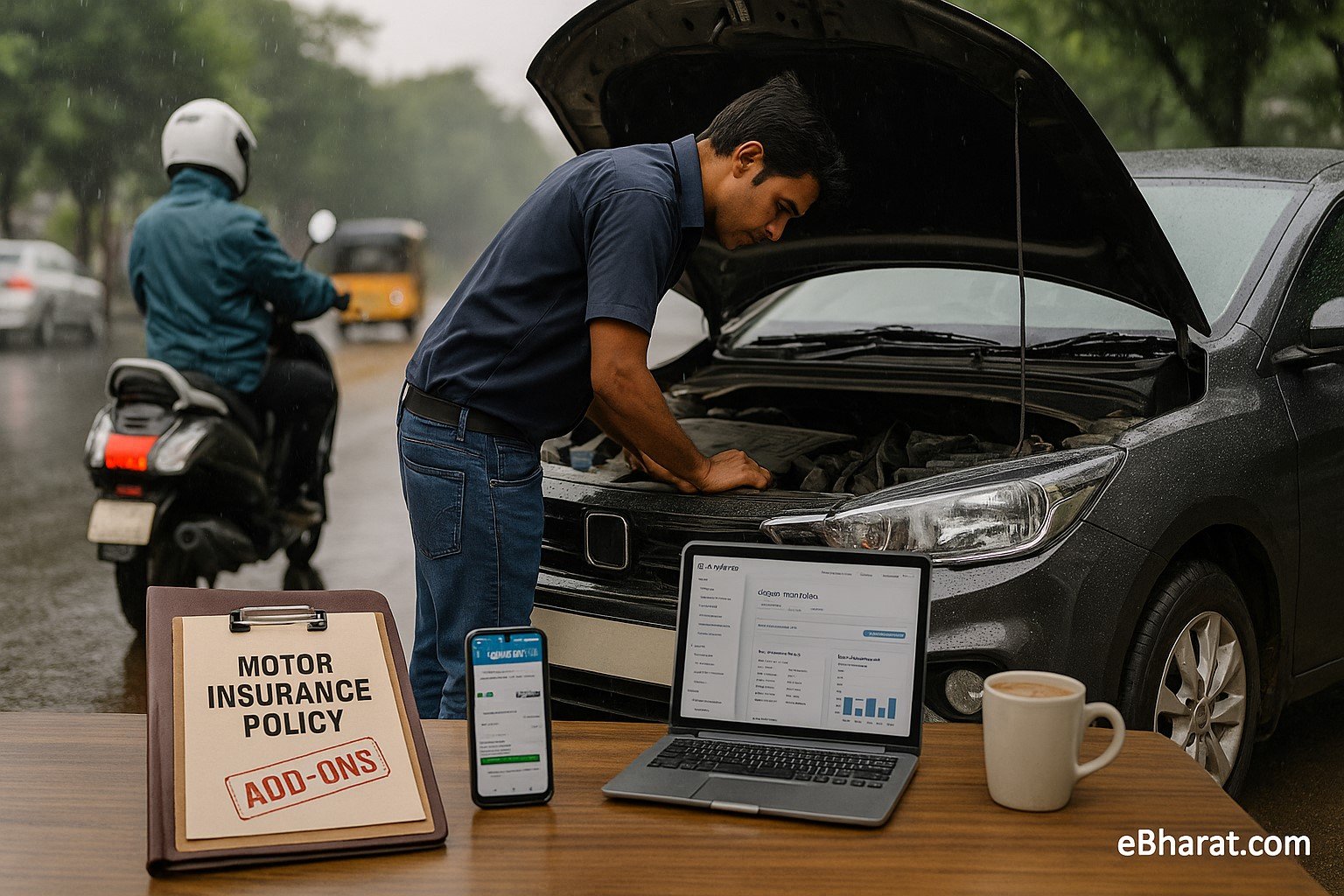

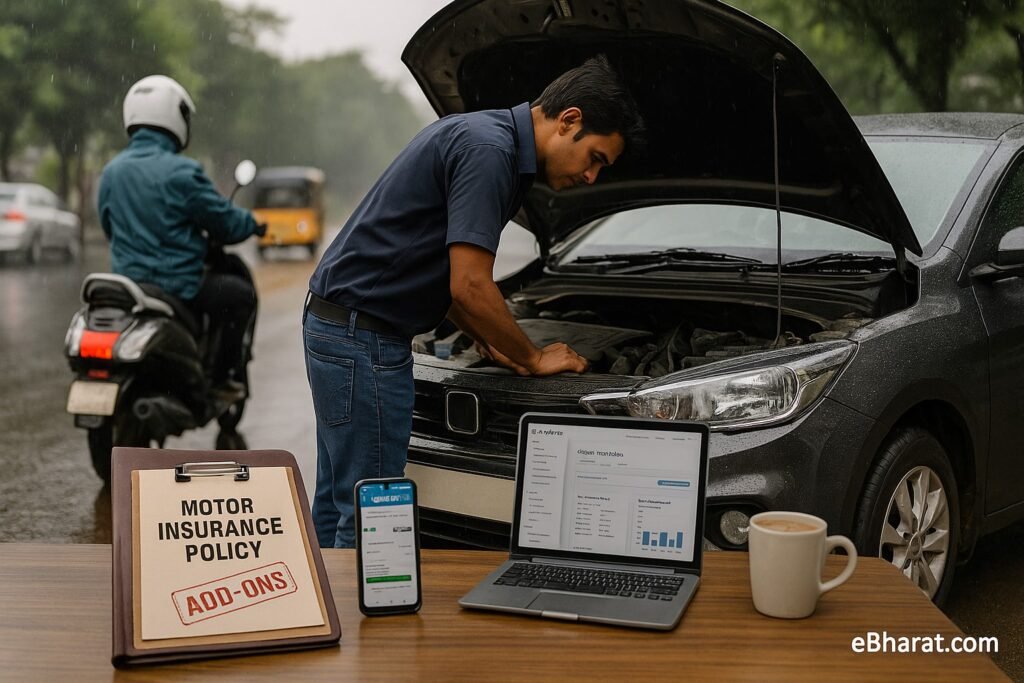

Basic car or bike insurance often leaves gaps. That’s where add-ons like Zero-Dep, NCB Protect, and Engine Protect come in. In 2025, these low-cost covers can save Indian drivers from hefty repair bills, especially during accidents or monsoons. Here’s what to know.

India Snapshot

- Popular Add-Ons (2025): Zero-Dep, NCB Protect, Engine Protect, Roadside Assistance, Consumables Cover, Return-to-Invoice.

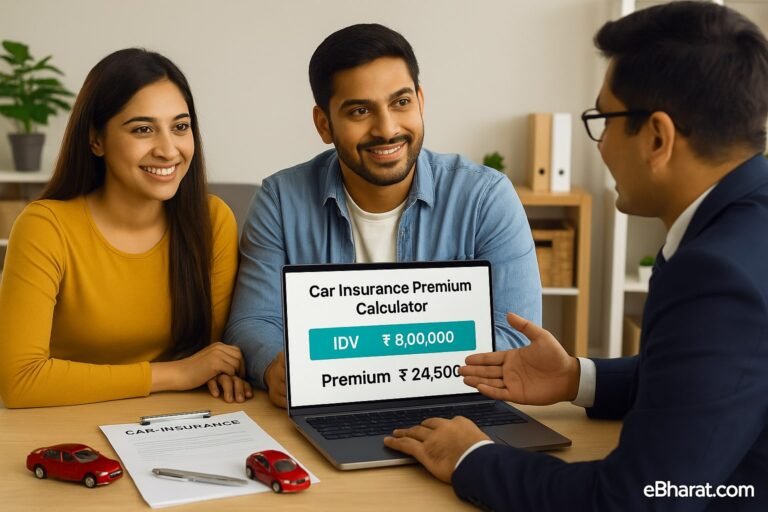

- Cost Range: ₹250 – ₹4,000/year depending on car age, city, and insurer.

- Payments: UPI, NetBanking, Cards, EMI for annual premium.

- GST Invoice: Available across all IRDAI-approved insurers.

- Best Platforms to Buy: PolicyBazaar and Coverfox.

Compare car & bike add-ons instantly:

Check Motor Add-Ons on PolicyBazaar

Explore Add-Ons on Coverfox

1. Zero Depreciation Cover (Zero-Dep)

- Ensures 100% claim for car parts (plastic, metal, fibre).

- No deductions for depreciation during claim settlement.

- Best for: New cars, high-end vehicles, city users.

Premium: ~₹1,500–₹3,000/year.

2. NCB Protection (No Claim Bonus Protect)

- Protects your accumulated No Claim Bonus (20–50% discount) even after a claim.

- Saves money at renewal.

- Best for: Safe drivers with a claim-free record.

Premium: ~₹500–₹1,000/year.

3. Engine Protect Cover

- Covers water ingression, hydrostatic lock, oil leakage.

- Extremely useful during monsoons in Indian cities.

- Best for: Flood-prone areas (Mumbai, Chennai, Kolkata).

Premium: ~₹1,000–₹2,000/year.

Other Add-Ons Worth Considering

- Roadside Assistance (RSA): Towing, breakdown support, fuel delivery. (~₹500/year)

- Consumables Cover: Covers nuts, bolts, lubricants, coolants. (~₹250–₹500/year)

- Return-to-Invoice: Pays full invoice value if car is stolen/total loss. (~₹1,000–₹2,500/year)

Pros and Cons

Pros

- Protects against costly surprises.

- Affordable yearly premiums.

- Customizable per driver’s needs.

Cons

- Adds to total premium cost.

- Some add-ons not available for cars older than 5–7 years.

Quick Checklist for Buyers

- Always add Zero-Dep for new cars.

- Take Engine Protect if you live in flood-prone areas.

- Use NCB Protect if you have 20%+ bonus.

- Add RSA for long-distance/highway drivers.

- Confirm GST invoice for tax benefits.

Protect your vehicle with the right add-ons in 2025:

Compare Car Insurance Add-Ons on PolicyBazaar

Check Bike & Car Add-Ons on Coverfox

In 2025, smart Indian drivers don’t stop at basic motor insurance. Adding Zero-Dep, NCB Protect, and Engine Protect shields you from hidden expenses, especially during monsoons or accidents. With premiums starting as low as ₹250/year, add-ons are affordable peace of mind.