If you invest in US stocks, receive dividends from American companies, or provide services to US clients, you may have come across the W-8BEN form. It’s an important tax form for non-US residents, including Indians. Submitting it ensures you get the correct tax treatment under US law and any DTAA (Double Taxation Avoidance Agreement) between India and the US. Let’s break down what it is, why it matters, and how to renew it.

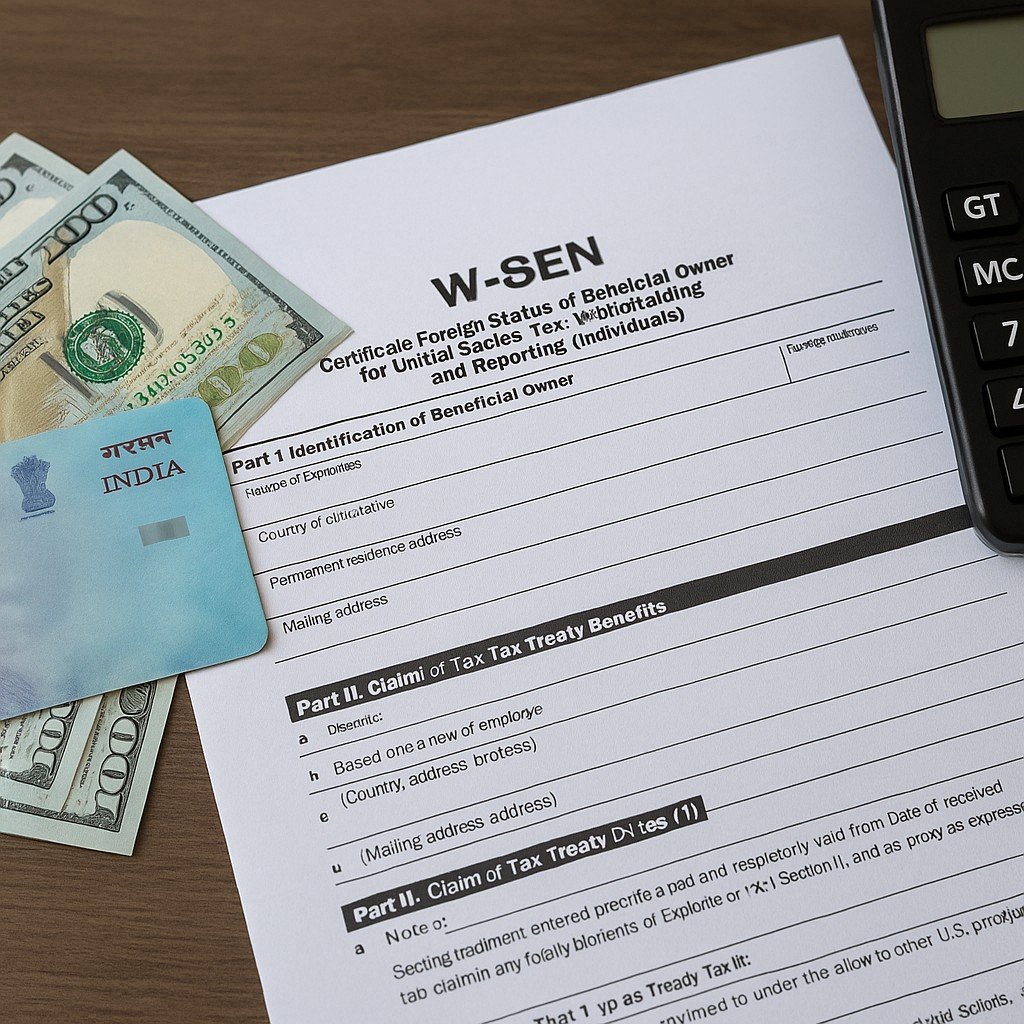

What is the W-8BEN Form?

- Full name: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals).

- It tells the US tax authorities (IRS) that you are a non-resident.

- Without this form, brokers or companies may deduct 30% withholding tax on income like dividends or royalties.

- With a valid W-8BEN, Indian residents can claim a reduced tax rate (usually 25% on US dividends) as per the India-US DTAA.

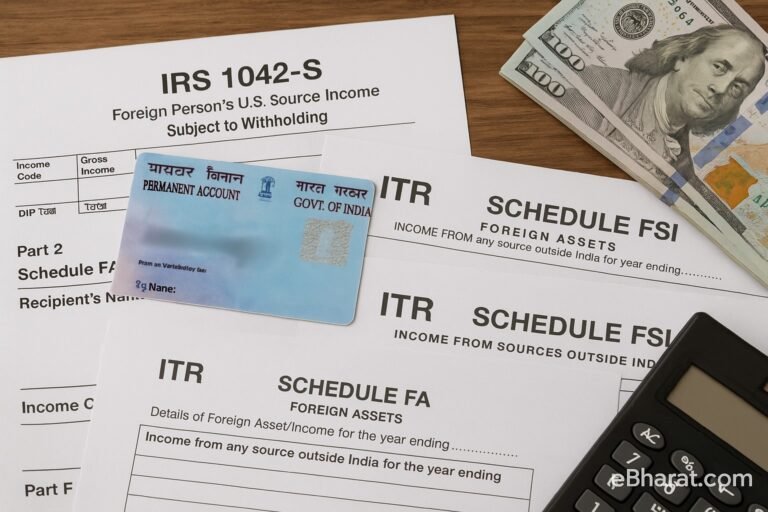

Who Needs to File W-8BEN?

- Indian investors in US stocks or ETFs through platforms like Groww, INDmoney, or Vested.

- Freelancers or consultants earning from US clients (via platforms like Upwork).

- Anyone receiving dividends, interest, or royalties from US sources.

How Long is W-8BEN Valid?

- Once submitted, the W-8BEN form is generally valid for the year of submission plus the next three calendar years.

Example: If filed in July 2025, it stays valid until December 31, 2028. - After that, you must renew it to continue enjoying lower withholding tax rates.

Renewal of W-8BEN

- Renewal is usually handled through your broker, platform, or US withholding agent.

- Investors often get reminders from their trading platforms.

- If not renewed on time, withholding tax automatically goes back up to 30%, and reclaiming the excess is a long process.

Example: Indian Investor in US Stocks

- You invest $10,000 in US stocks and earn $500 in dividends in a year.

- Without W-8BEN: Broker deducts 30% = $150. You receive $350.

- With W-8BEN: Tax reduced to 25% = $125. You receive $375.

- Savings: $25 each year — and much more if your portfolio grows.

The W-8BEN form helps Indian investors and freelancers reduce US withholding tax and avoid double taxation. Always ensure your form is submitted and renewed on time to maximize returns and stay compliant.

Keeping your W-8BEN form updated ensures smoother investing, lower tax deductions, and full compliance with US-India tax rules — helping you keep more of what you earn.