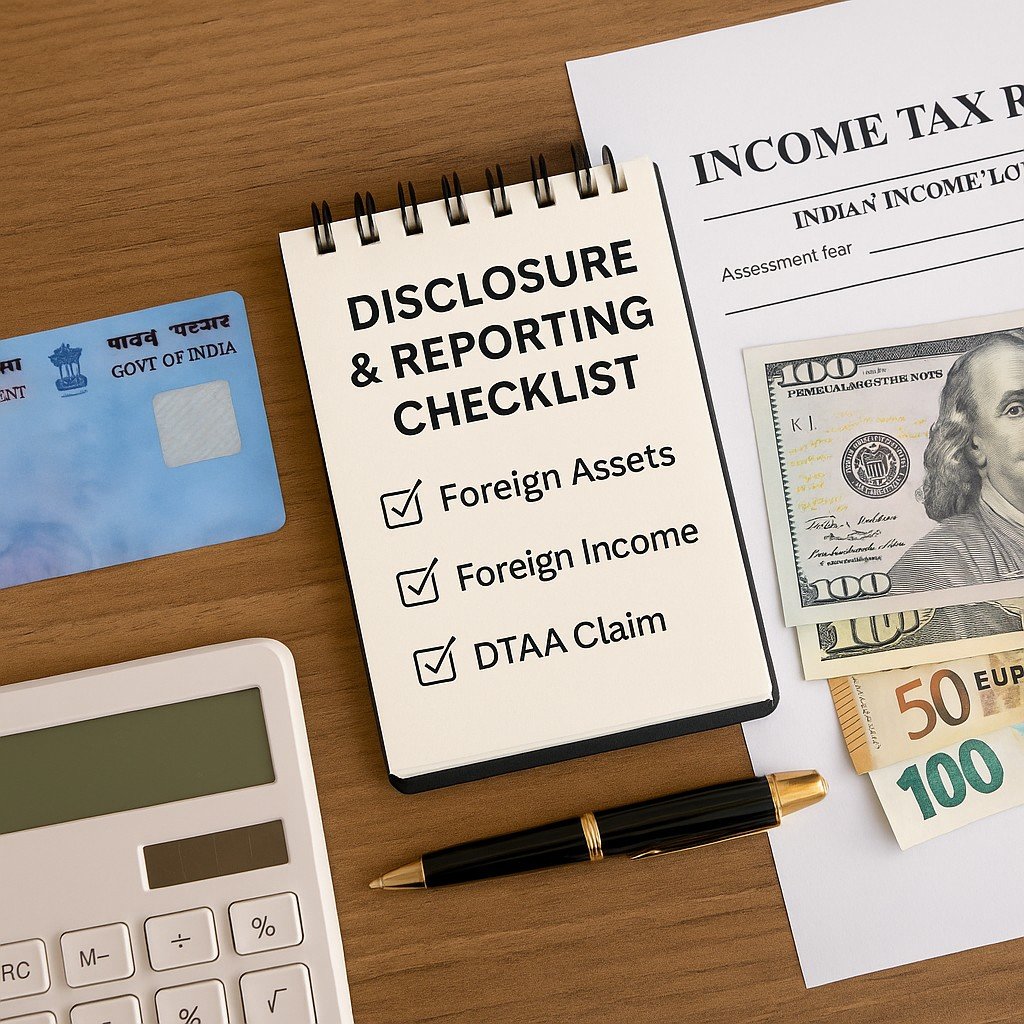

If you invest in foreign stocks, mutual funds, or hold assets abroad, Indian law requires you to disclose and report them while filing your income tax return (ITR). Failing to report can lead to heavy penalties under the Black Money Act. Here’s a simple checklist to make sure you stay compliant.

Why Disclosure Matters:

- Legal compliance: Reporting foreign income and assets is mandatory.

- Avoid penalties: Non-disclosure can result in fines up to ₹10 lakh.

- Transparency: Helps you claim tax credits under DTAA (Double Taxation Avoidance Agreement).

Reporting Checklist

Foreign Assets (Schedule FA in ITR)

You must disclose details of:

- Foreign bank accounts

- Shares and ETFs held abroad

- Mutual funds with overseas investments

- Foreign property (residential or commercial)

- Financial interest in companies, partnerships, or trusts

Foreign Income (Schedule FSI in ITR)

- Salary received abroad

- Dividends from foreign shares

- Rent from foreign property

- Interest from overseas bank accounts

- Business income from foreign sources

DTAA Claim (Schedule TR in ITR)

- Report taxes already paid in foreign countries.

- Claim credit to avoid double taxation.

- Example: If you paid 25% tax in the US and India’s tax rate is 30%, you only pay the 5% difference.

Withholding Tax Certificates

- Collect Form 1042-S or equivalent from US brokers.

- Keep bank statements and TDS certificates for proof.

Common Mistakes to Avoid

- Forgetting to disclose overseas broker accounts.

- Reporting only income but not the asset itself.

- Not renewing W-8BEN, leading to higher US withholding.

- Ignoring small dividends or interest — even ₹100 must be reported.

Indian investors must carefully report all foreign assets and income through the correct ITR schedules (FA, FSI, TR). This ensures legal compliance and allows you to claim DTAA benefits. Transparency is the best safeguard against tax troubles.