SIPs, or Systematic Investment Plans, have become the go-to choice for millions of Indian investors who want to build wealth steadily. Most of us use online SIP calculators to estimate how much our monthly investments can grow over time. But here’s the catch: traditional SIP calculators don’t show the impact of inflation.

That’s where an inflation-adjusted SIP calculator changes the game. It doesn’t just tell you how big your money will look, it tells you how much it will actually be worth when you need it.

What is a SIP Calculator?

A SIP calculator is an online tool that shows you the future value of your monthly investments. You enter three things:

- Your monthly SIP amount

- The expected return rate (for example, 12% per year)

- The investment duration

It then shows your projected wealth — but without adjusting for rising prices.

Why Inflation Can’t Be Ignored

Inflation silently eats into your money’s value.

Example: You aim to build a corpus of ₹1 crore in 20 years. Sounds huge, right? But at 6% inflation, ₹1 crore in the future will only have the buying power of around ₹31 lakh today.

This means you could fall short of your actual financial goals — whether it’s retirement, children’s education, or buying a home.

How an Inflation-Adjusted SIP Calculator Works

Unlike a normal SIP calculator, the inflation-adjusted version:

- Factors in annual price rise (inflation rate)

- Shows the real value of your investments after inflation

- Helps you plan in terms of purchasing power, not just numbers on paper

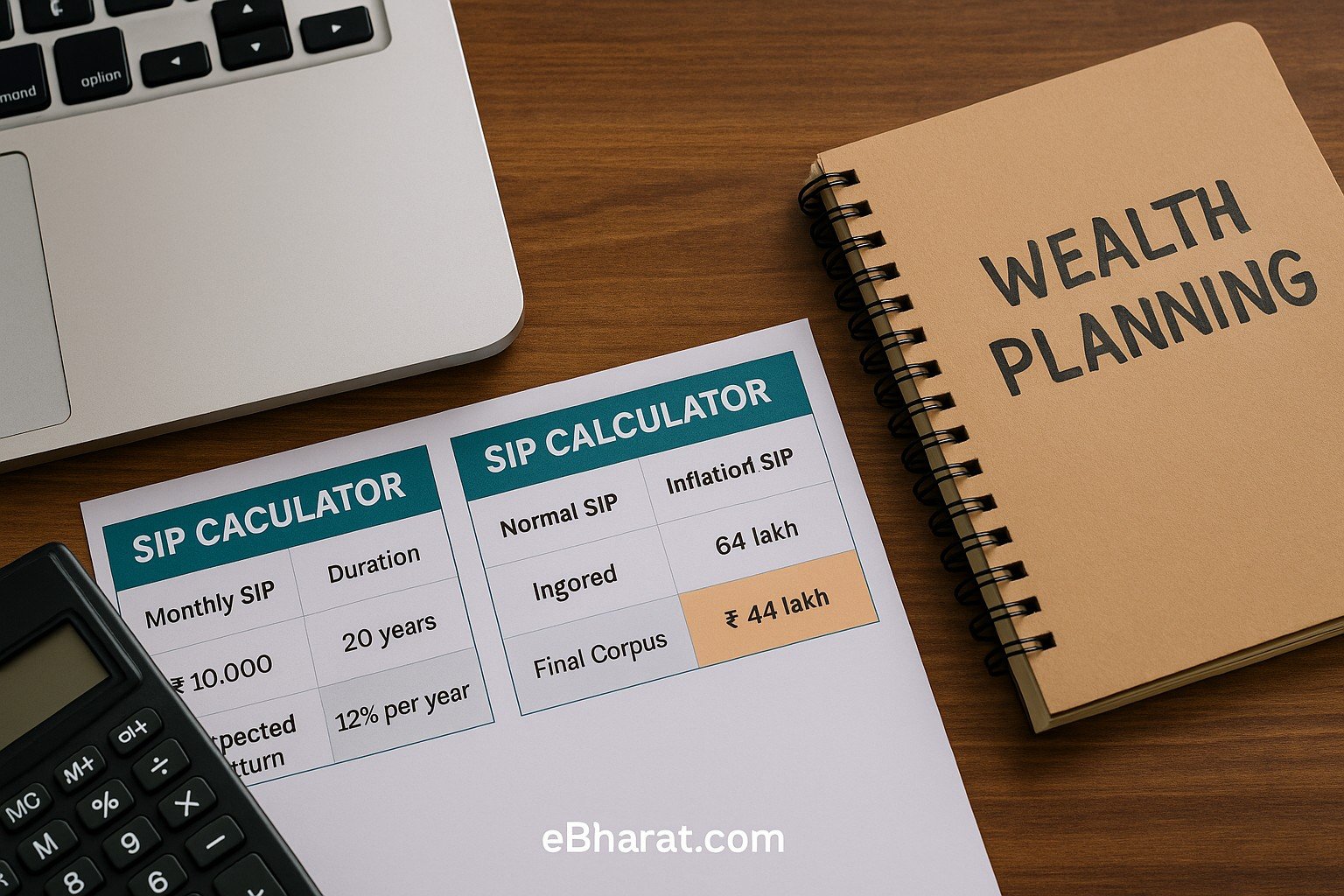

Real-Life Example

| Parameter | Value |

|---|---|

| Monthly SIP | ₹10,000 |

| Duration | 20 years |

| Expected Return | 12% |

| Inflation | 6% |

- Normal SIP Calculator Result: ₹98 lakh corpus

- Inflation-Adjusted Result: ₹44 lakh (real value)

So while your portfolio grows on paper, what you can actually buy with that money is less than half.

Why You Should Use It

- Realistic Planning: Helps you avoid underestimating your needs.

- Goal-Based Investing: Whether it’s retirement or kids’ education, you’ll know the true target.

- Smarter Decisions: You may choose to increase your SIP, extend your duration, or pick step-up SIPs to beat inflation.

Pro Tips for Investors

- Always plan with 5–6% inflation in mind for long-term goals.

- Review your SIP every few years and increase it as your income grows.

- Don’t just chase numbers; focus on the real buying power of your corpus.

A regular SIP calculator tells you how much money you’ll have. But an inflation-adjusted SIP calculator tells you how much your money will be worth. For long-term investors, this difference is crucial. If you want to truly secure your financial future, plan with inflation in mind.