What Happened

Chris Wood, Global Head of Equity Strategy at Jefferies, has made a notable shift in his India long-only portfolio:

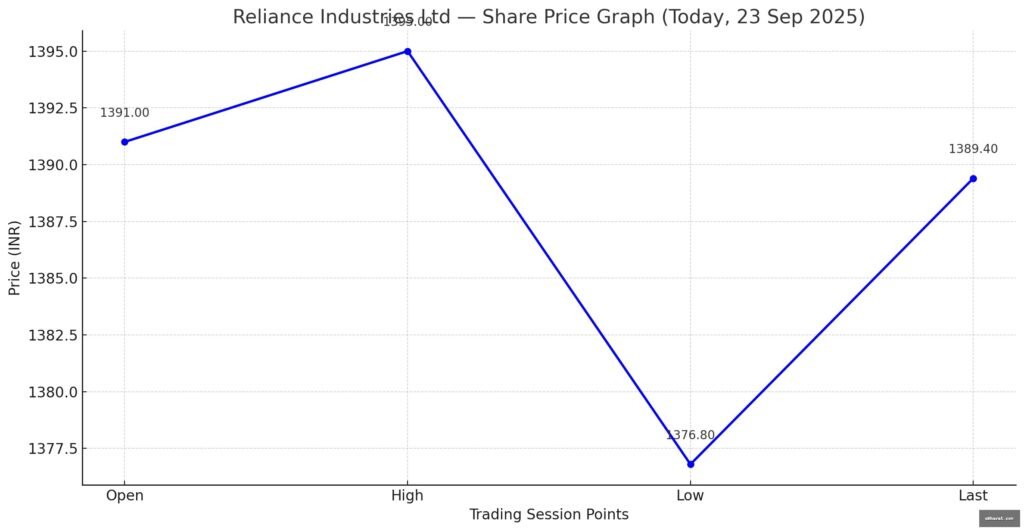

- He sold shares of Reliance Industries, which had already gained about 15% so far in 2025, according to recent reports.

- Proceeds from this move are being redirected into Adani Group-owned Ambuja Cement as well as other stocks like Ixigo (Le Travenues Technology) and Lemon Tree Hotels.

- Other reductions were made in select financial names including Axis Bank; partial trimming of stake in ICICI Bank, REC, and JSW Energy were also noted.

Why This Matters

This kind of large institutional reallocation signals several things about market expectations and sentiment:

- Shift in Growth & Risk Perception

Selling out of Reliance suggests that Jefferies sees the risk-reward profile as having changed. Reliance has already delivered strong gains, and further upside may be viewed as more limited vs other opportunities. Meanwhile, Adani / Ambuja Cement perhaps provide better growth potential (or at least better recent catalysts) in the current interest/earnings environment. - Focus on Hard Assets, Infra & Commodity Plays

Adani’s businesses are strong in infrastructure, cement, renewables, power etc., areas that are viewed as less volatile under certain macro conditions, especially with India’s push for infrastructure, renewable energy, and regulatory clarity. The shift away from some financial names also suggests a preference for real-asset or heavy-asset exposure. - Regulatory & Sentiment Tailwinds for Adani Group

Adani stocks recently benefited from SEBI dismissing some allegations from Hindenburg Research. That regulatory clarity has eased a sentiment overhang and boosted institutional confidence. - Diversification within Portfolio

By reducing stake in Reliance and increasing weight in Ambuja Cement and others, Jefferies is also diversifying exposure—less concentration in one mega-cap, more weight in other growth or cyclical plays.

Impacts & Reactions

- Market Reaction: Adani / Ambuja Cement have seen buying interest in recent sessions, possibly in part due to such institutional flows. Reliance has held up reasonably well but may underperform near-term vs more actively favored names.

- Valuations: Adani / Ambuja may see valuation multiples expand if investor demand remains strong. But they also carry their own risks—execution, regulatory scrutiny, raw material costs, etc.

- Investor Behavior: Most retail & smaller institutional players track the moves of large money managers. This shift may encourage others to re-balance their portfolios similarly, increasing volume & liquidity in Adani & related stocks.

Risks & Caveats

- Overexposure Risk: Moving heavily into one group (Adani) could backfire if there are negative regulatory, policy, or governance surprises.

- Profit Booking Risk: Stocks that rally on sentiment (especially after regulatory relief) are prone to sharp corrections if expectations are not met.

- Macro & Policy Uncertainty: Inflation, interest rates, global headwinds, or changes in trade and energy policy could impact the hard asset sectors differently than tech or services.

- Valuation Stretch: Some Adani / related names may be trading at high forward valuations; growth needs to be sustained to justify current prices.

What to Watch Going Forward

- Results / earnings of Ambuja Cement & Adani Group companies, especially in the context of cement demand, cost pass-through, renewables performance.

- Regulatory updates, especially any new investigations or rulings that could affect Adani group.

- Broader macroeconomic cues: interest rate actions, inflation data, input cost inflation for cement/power, global commodity prices.

- Portfolio moves by other large institutions—if others follow Jefferies, that amplifies impact.

Conclusion

Jefferies’ decision to shift from Reliance to Adani / Ambuja Cement signals a broader rethinking of risk and return in Indian equities. Institutional money is favoring hard assets, cyclicals, and names with recent regulatory tailwinds. For investors, this is both an opportunity and a warning: gains are possible, but so are sharp reversals. Watching execution, policy, and valuations will be key.