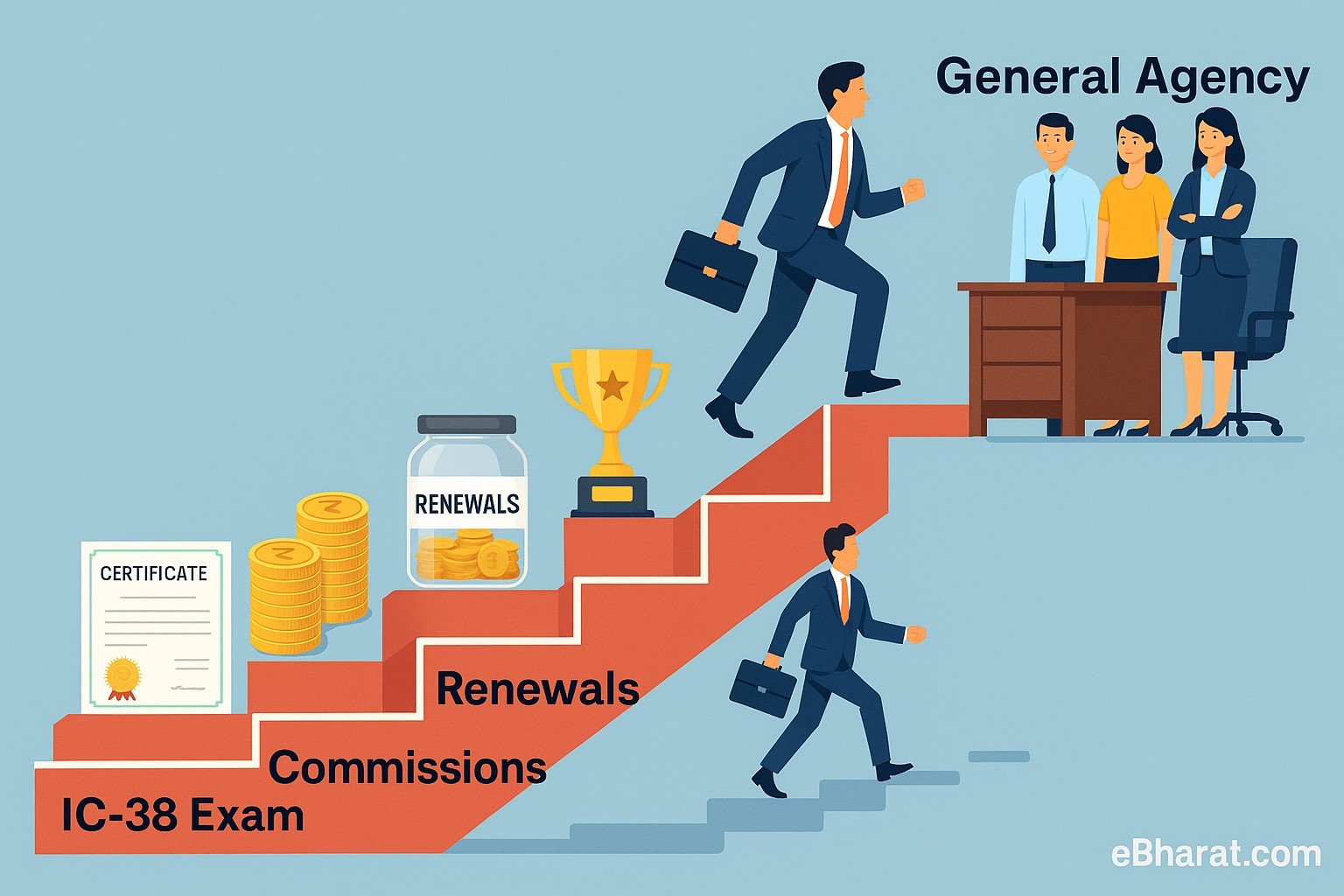

Every successful insurance agent in India begins the same way — by clearing the IC-38 exam. This test, conducted by IRDAI, is the first gate you pass before earning your license. But what happens after that? How do you go from being a freshly licensed advisor to a General Agency (GA) leader earning lakhs every month?

This guide takes you through the step-by-step journey — from exam to first commission, to renewals, to MDRT recognition, and finally to running your own agency. Along the way, we’ll highlight real income examples and practical tips that ordinary Indians have used to build ₹10 lakh+ careers in insurance.

Step 1: Clearing the IC-38 Exam

- What it is: IC-38 is the qualifying exam set by IRDAI (Insurance Regulatory and Development Authority of India).

- Who can take it: Anyone above 18 with a minimum 10th/12th pass qualification.

- Why it matters: Clearing the exam gives you your license to sell policies of the insurer you represent — LIC, HDFC Life, SBI Life, ICICI Prudential, etc.

- Next step: After clearing, you attend onboarding and product training, which prepares you for your first client meetings.

Read more: What Happens After IC-38 Exam? Commission Roadmap Explained

Step 2: Your First Commission

Your first income as an agent comes when you sell your first policy. Commissions vary depending on the product:

| Policy Type | First Year Commission | Renewals (2nd Year Onwards) |

|---|---|---|

| Term Insurance | 25–30% | ~5% |

| Savings / Endowment | 35–40% | ~5–7% |

| ULIPs | 2–7% | ~1–2% |

Deep dive: How Much Passive Income Can Renewals Generate in 10 Years?

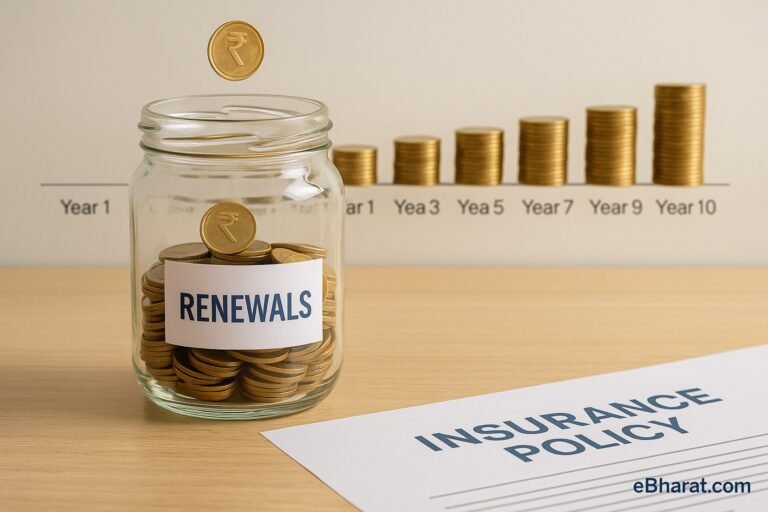

Step 3: Renewal Income — The Silent Wealth Builder

While first-year commissions are exciting, the real wealth lies in renewals:

- Every time your client pays the annual premium, you earn again.

- Even if you stop selling for a few months, renewals give you a cushion.

- Over 10 years, agents can build renewal pools worth ₹7–10 lakh annually.

Renewals are why many advisors call this profession “the only career with compounding income.”

Step 4: Climbing the Recognition Ladder — MDRT

The next milestone is recognition. Among these, MDRT (Million Dollar Round Table) is the most prestigious.

- MDRT at HDFC Life often requires ₹12–15 lakh in First Year Premiums (FYP) or ₹4–5 lakh in eligible commissions.

- Agents qualifying enjoy global recognition, conventions, and client trust.

- MDRT opens doors to COT (Court of the Table) and TOT (Top of the Table) — higher honors with even greater income.

Learn more: How to Qualify for MDRT at HDFC Life — Income Targets & Tip

Step 5: Agent Success Stories

Insurance success doesn’t belong only to MBAs or sales professionals. Ordinary people across India have built extraordinary careers.

- Homemakers: Balanced family duties and built ₹12L+ annual commission.

- Retired Teachers: Sold pension/ULIP policies, hit MDRT post-retirement.

- Young MBAs: Used Instagram/WhatsApp to sell policies online, earning ₹10L+ within 18 months.

Read inspiring stories: Agent Success Stories: How Ordinary Indians Earned ₹10L+ in Insurance

Step 6: Transitioning to General Agency (GA)

At this stage, you move from individual contributor to leader.

- What is GA? A General Agency allows you to recruit, train, and manage a team of agents under you.

- How it works: You earn not only on your sales but also an override commission on your team’s production.

- Why it matters: With a strong team, your monthly income can scale into lakhs.

This is the stage where agents create legacy businesses.

Step 7: Motivation Beyond Commission

While money is important, long-term motivation for agents often comes from:

- Recognition: Awards, badges, foreign trips.

- Flexibility: No fixed hours; you control your schedule.

- Personal Growth: Learning sales, finance, and digital tools.

- Impact: Helping families secure their financial future.

Must read: Motivation for New Agents: Why Commission Is Only Part of the Reward

The 10-Year Outlook

If you stay consistent, here’s what the agent journey looks like in a decade:

- Years 1–2: Learning phase, first commissions.

- Years 3–5: Building renewal pool + recognition.

- Years 6–8: Qualify MDRT, expand client base, referrals.

- Years 9–10: Start GA, scale income via team overrides.

By year 10, many agents have a steady ₹1 crore+ lifetime renewal pool and a leadership business that can run independently.

Why It Matters

The insurance agent journey is unique because it combines earning + impact + freedom. From clearing IC-38 to becoming a General Agency leader, every step builds financial security and personal pride.

For those starting out today, remember: commissions are just the beginning. Renewals, recognition, and leadership are what make this a lifelong wealth-building career.