Mumbai | 06-Oct-2025, 09:45 IST — Filed via NSE/BSE corporate update

Kalyan Jewellers India Ltd posted a healthy performance in its Q2 FY26 business update, with consolidated revenue climbing about 30% year-on-year. The company cited broad-based growth across India and international operations, underpinned by strong festive and wedding demand.

The bulk of the momentum came from India, where revenue grew about 31% YoY. Same-store sales growth (SSSG) stood at ~16%, reflecting both higher ticket sizes and steady showroom traffic. Management highlighted sustained traction in wedding jewellery demand and noted that early festive purchases also boosted numbers.

Kalyan added 15 new showrooms in India during the quarter, taking its domestic tally to 300 stores. The company said it plans to open another 15 outlets ahead of Diwali, underscoring its aggressive expansion strategy in Tier-2 and Tier-3 markets.

International Operations

Overseas revenue grew around 17% YoY, with the Middle East contributing a ~10% rise, driven purely by same-store growth. International sales now account for ~12% of total revenue, with a footprint of 38 showrooms in the Gulf and 2 in the US.

Despite global headwinds and currency volatility, the company maintained growth momentum abroad, though expansion was more measured compared with India. Two new international stores were opened in Q2.

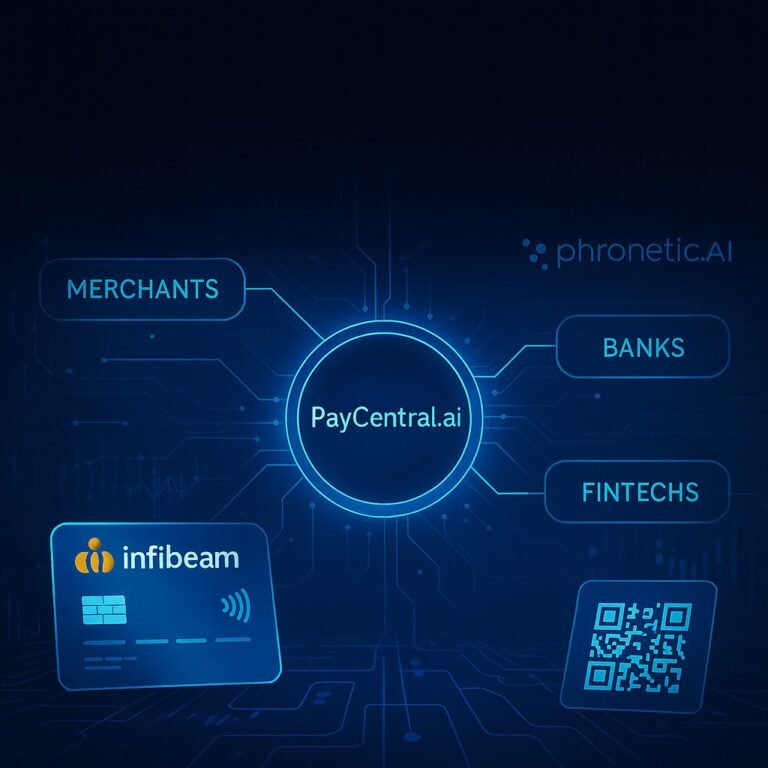

Digital & Omni-Channel

The company’s digital-first brand Candere was the standout performer, recording 127% YoY growth. Footfalls at physical Candere showrooms and higher online conversions contributed to this sharp rise. Kalyan added 15 Candere stores in India during the quarter, signalling confidence in the omni-channel model.

Management continues to position Candere as a growth lever that complements the flagship business, especially as younger urban consumers shift to digital discovery before in-store purchases.

Debt Management and Financial Flexibility

Kalyan disclosed that it has received approval from its lead bank for the release of real estate collateral linked to loans already repaid. This step should improve balance sheet flexibility and aid further debt reduction during FY26. The move is in line with the company’s efforts to deleverage while continuing its showroom expansion program.

| Metric | Figure | Notes |

|---|---|---|

| Consolidated Revenue | ~ +30% YoY | Strong overall growth |

| India Revenue | ~ +31% YoY | Wedding & festive demand |

| India SSSG | ~16% | Across existing stores |

| International Revenue | ~ +17% YoY | Middle East +10% |

| Candere Growth | +127% YoY | Digital-first brand |

| New Stores | 15 India + 2 Intl + 15 Candere | Expansion in Q2 |

| Total Showrooms | 436 | As of 30-Sep-2025 |

Despite solid double-digit growth, this quarter marked one of the more moderate expansions in recent periods, with media commentary noting it was the slowest pace in four quarters. Analysts suggest that while momentum remains intact, incremental growth may now rely more heavily on new showrooms rather than organic same-store expansion.

Going forward, the festive and wedding season pipeline, debt reduction measures, and sustained Candere traction will be key watchpoints. Investors will also track how gold price volatility and currency movements impact margins in the coming quarters.