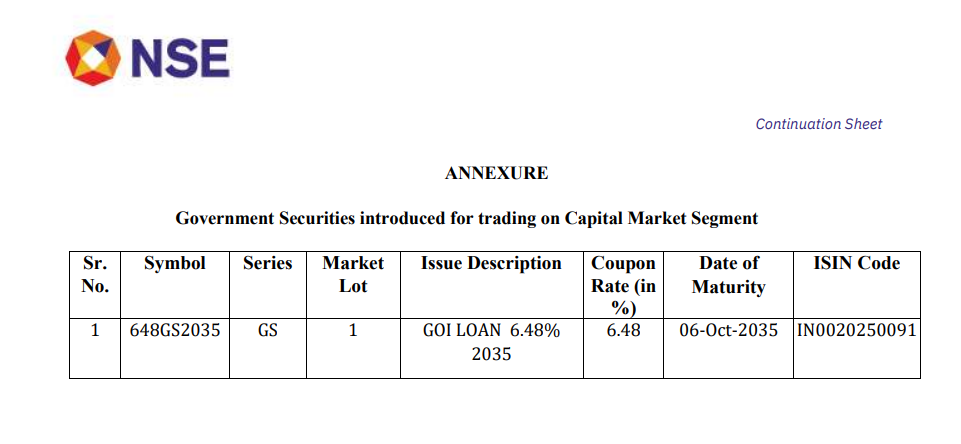

Mumbai | 8-Oct-2025, 10:30 IST — Filed via NSE Circular

The 6.48% Government of India (GOI) Bond, 2035 has been formally admitted to dealings on the National Stock Exchange (NSE) Capital Market segment effective today, October 8, 2025. The listing expands the range of long-term sovereign debt instruments available to investors in the secondary market, offering opportunities for both institutional and retail participants seeking exposure to government securities.

Bond Snapshot

- Bond Name: 6.48% GOI 2035

- Coupon Rate: 6.48% annually

- Maturity: 2035 (10-year tenure from issue)

- Issuer: Government of India

- Segment: NSE Capital Market (from Oct 8, 2025)

The bond will be available for trading in dematerialised form through NSE’s capital market platform, providing investors with an additional avenue to diversify portfolios into safe sovereign-backed instruments.

Why It Matters

The inclusion of the 6.48% GOI 2035 bond on NSE capital market is important for several reasons:

- Access to Retail Investors: By admitting G-Secs on exchange platforms, retail participants can invest in government bonds just like equities, without requiring gilt accounts with banks.

- Liquidity Enhancement: Exchange-traded bonds improve secondary market liquidity, making it easier for investors to buy and sell.

- Portfolio Diversification: A long-dated sovereign bond adds stability to portfolios, especially in times of equity market volatility.

- Rate Visibility: With a fixed coupon of 6.48%, the bond provides predictable income until maturity in 2035.

Market Context

India’s bond market has been witnessing rising participation from both domestic and foreign investors amid expectations of further monetary easing by the Reserve Bank of India in late 2025. Government securities (G-Secs) continue to remain the most secure form of investment, backed by sovereign credit.

Analysts note that the admission of this 2035 bond comes at a time when demand for long-term debt is increasing, driven by pension funds, insurers, and retail investors seeking steady yields.

The move also aligns with policy efforts to deepen India’s debt market and enhance transparency through exchange-based platforms.

Risks & Considerations

- Interest Rate Risk: If RBI cuts rates further, existing G-Secs may gain in value, but reinvestment yields could drop.

- Liquidity Variance: Although admitted to NSE, actual trading volumes will determine how liquid the instrument becomes for retail buyers.

- Tenure Commitment: With a 10-year horizon, investors must consider whether they can hold long-term or rely on the secondary market for exits.

Outlook

The listing of the 6.48% GOI 2035 bond on NSE is a step forward in making sovereign bonds more accessible. Retail investors now have a transparent and convenient avenue to invest, alongside institutional players.

As India’s bond market continues to evolve, exchange-traded government securities are expected to become a mainstream investment option for those seeking stable, long-term returns.