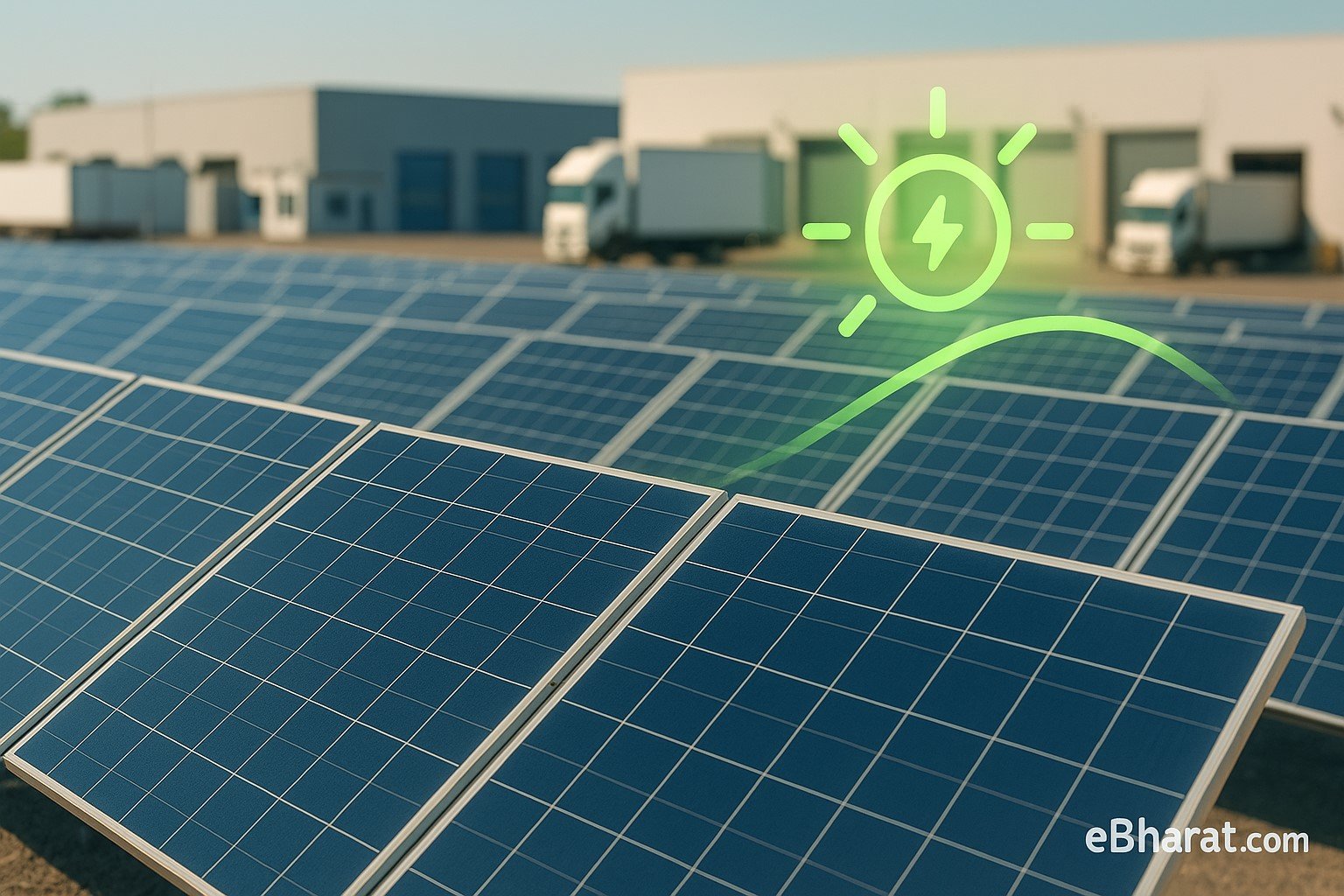

Jaipur | Oct 8, 2025, 16:00 IST — Globe International Carriers Limited (GICL) has approved a new business vertical focused on renewable energy, expanding beyond logistics into solar plants and solar park development. The move aims to diversify GICL’s portfolio and contribute to India’s clean energy goals.

In its 2024–25 Annual Report, GICL disclosed that its subsidiary Intraglobe Green Energy Pvt Ltd (formerly Intraglobe Transport Solutions) is part of the company’s push into renewable energy.

Strategic Shift & Business Rationale

- Diversification: By launching a renewable-energy line, Globe is hedging risks in the logistics/transport business and tapping into long-term, stable returns from power generation assets.

- Subsidiary structure: The annual report mentions Intraglobe Green Energy as GICL’s arm for green energy initiatives, suggesting the infrastructure and corporate link is already in place.

- Synergy & asset utilization: The company expects synergies between its land holdings, transport assets, capital raising ability, and renewable energy development capabilities.

What the Renewable-Energy Line May Entail

Though detailed project plans have yet to be publicly shared, here’s what the new line is likely to include:

- Solar power plants: Utility-scale solar installations (e.g. 50–100+ MW), possibly under long-term power purchase agreements (PPAs).

- Solar parks: Large geographic zones hosting multiple solar installations, with shared transmission infrastructure.

- Land acquisition & development: Converting or leveraging existing land parcels for solar infrastructure.

- Operations & maintenance (O&M): Asset upkeep, performance management, and grid integration functions.

- Green financing & incentives: Tapping government or bank subsidies, renewable energy incentives, carbon credits, and ESG-linked funding.

Market Context & Tailwinds

- Renewables push in India: India aims for 500 GW of non-fossil energy by 2030. Solar is a major pillar of this strategy, driven by favorable policies and declining module costs.

- Growing investor interest: ESG investing, green bonds, and clean energy funds are channeling capital into renewables, making the segment more attractive.

- Energy security & grid demand: As consumption grows, especially in non-metro and rural areas, solar generation offers distributed, lower-cost power.

- Risk mitigation for utility sectors: Diversifying into clean energy helps companies reduce dependency on a single sector (in this case, logistics/transport).

Risks & Challenges

- Capital intensity: Solar parks and plants require significant up-front investment, with payback over many years.

- Regulatory & PPA risk: Changes in PPA terms, tariff regulations, or government incentives could affect revenue stability.

- Land & permitting: Acquiring land, obtaining environmental clearances, and dealing with transmission losses/curtailment are major hurdles.

- Execution risk: Delays in construction, grid interconnection issues, and equipment failures can erode returns.

- Competition: The renewable space already has many established players; Globe must differentiate through scale, cost control, or niche focus.

What to Watch

- Announcements of capacity & locations: The MW targets, states, and solar parks planned will be key in judging ambition.

- PPAs & off-takers: Early tie-ups with distribution companies (DISCOMS), commercial & industrial customers, or government buyers will validate revenue models.

- Financing structure: Whether the projects will be debt-funded, equity-heavy, or use green bonds will impact returns.

- Integration with core business: Whether Globe uses its logistics arm to service or maintain solar parks or use transport assets in project logistics.

- Regulatory environment: Incentives, state policies, project approvals, and renewable purchase obligations (RPOs) will shape success.

Why It Matters: Globe’s shift marks a broader trend of Indian industrial/logistics firms diversifying into clean energy, reflecting that renewables are no longer niche but central to future business strategies.