Mumbai | Oct 9, 2025, 11:00 IST

The much-anticipated initial public offering (IPO) of LG Electronics India is shaping up to be one of the standout listings of the year. With strong demand across investor categories and chatter about a possible green-shoe option, the South Korean major’s Indian arm is firmly in the spotlight.

About LG Electronics India Ltd.

LG Electronics India Ltd., incorporated in 1997, is a leading manufacturer and distributor of home appliances and consumer electronics (excluding mobiles). Operating through segments in Home Appliances, Air Solutions, and Home Entertainment, it serves both B2C and B2B markets with installation, repair, and maintenance services. The company runs two manufacturing units in Noida and Pune, supported by 25 warehouses, 23 RDCs, 51 branch offices, and 30,847 sub-dealers. Its after-sales network includes 1,006 service centers and 13,368 engineers. Backed by the global LG brand, it enjoys #1 market share in key categories with strong innovation, efficiency, and growth.

IPO Structure & Price Band

LG Electronics India’s IPO is a pure Offer for Sale (OFS) of 10.18 crore shares, aiming to raise nearly ₹11,607 crore. The company has fixed the price band at ₹1,080–₹1,140 per share, putting the potential valuation above ₹1 lakh crore at the upper end.

Since this is a complete OFS, proceeds will flow to the selling shareholders, including the parent company, and not to LG India itself. That makes the IPO primarily a valuation and liquidity event, not a capital-raising exercise for expansion.

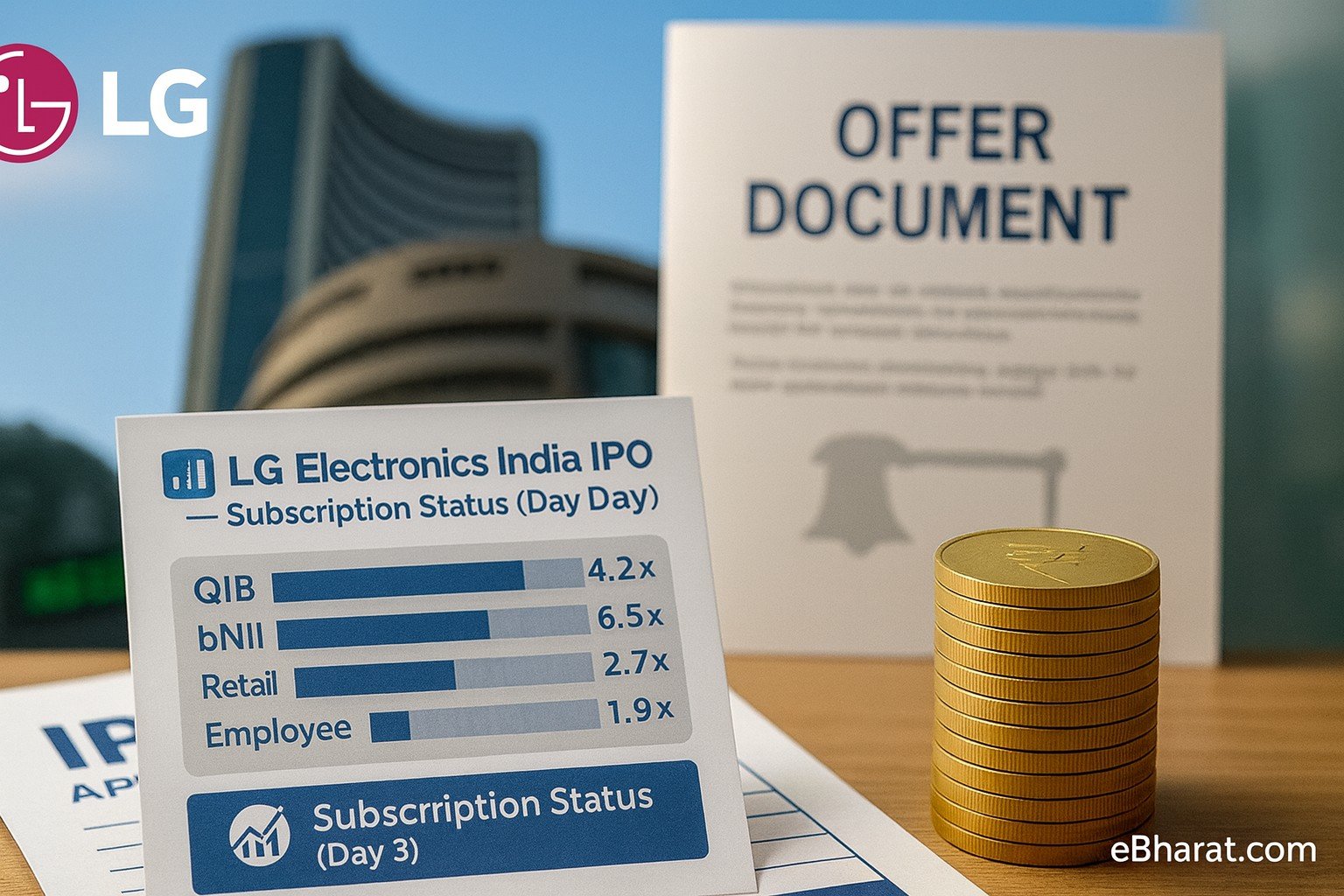

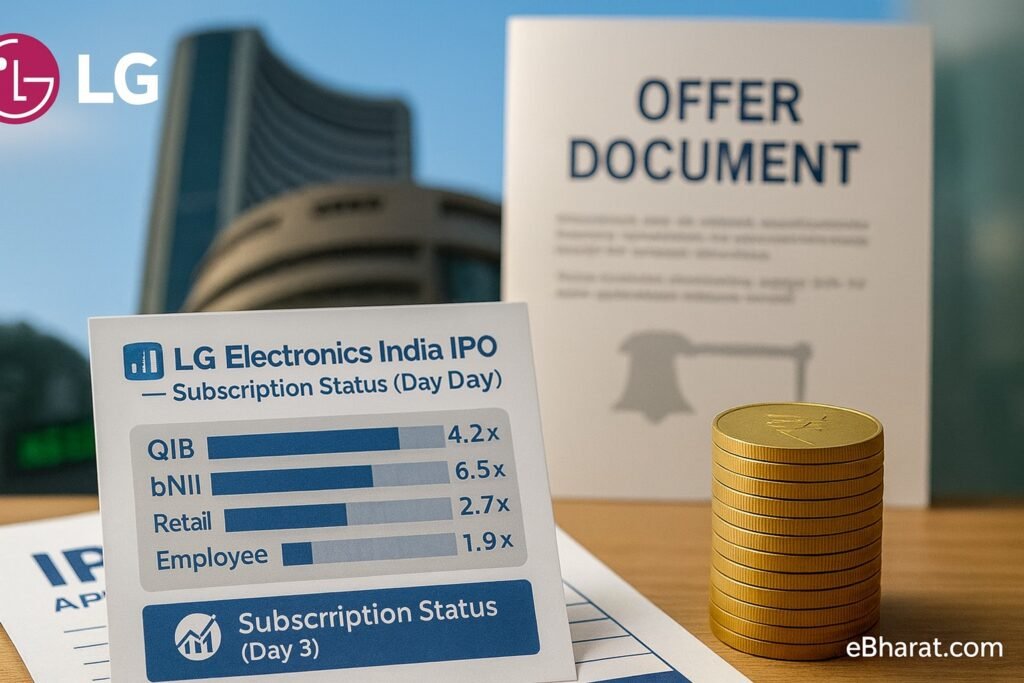

Subscription Surge

The IPO has seen remarkable interest since its launch. According to exchange data, the issue was fully subscribed within hours on Day 1. By the end of Day 2, total bids had reached 3.33× the shares offered, underscoring confidence in the brand and its India growth story.

The strong response across categories highlights broad-based enthusiasm, especially among high-net-worth and institutional investors.

Anchor Investor Confidence

Ahead of the IPO, LG India raised ₹3,475 crore from anchor investors at the upper band of ₹1,140 per share. This tranche drew interest from Abu Dhabi Investment Authority (ADIA), Goldman Sachs, BlackRock, and sovereign wealth funds from Singapore and Norway.

Such heavy anchor participation not only boosts credibility but also acts as a stabilizer for large IPOs, providing early confidence before retail and institutional bidding picks up.

Green-Shoe Option Buzz

With the IPO already oversubscribed and grey market premiums (GMP) suggesting healthy listing gains, speculation has emerged about a green-shoe option. This mechanism, if activated, would allow underwriters to allocate additional shares beyond the original size, helping manage excess demand and smooth post-listing volatility.

Reports indicate the GMP is hovering around ₹298, implying a ~26% potential premium over the upper price band. Analysts suggest that if such demand sustains, activating a green-shoe could ensure orderly price discovery at listing.

Strengths & Risks

Why investors are excited:

- LG enjoys strong brand recognition in India’s consumer durables market, spanning TVs, refrigerators, ACs, washing machines, and kitchen appliances.

- It has built robust local manufacturing capabilities and a wide distribution network.

- Relative valuations appear reasonable compared to listed consumer peers.

What to watch:

- As a pure OFS, no fresh capital flows into LG India; growth must come from retained earnings or parent support.

- Profitability remains vulnerable to raw material costs, forex swings, and intense competition in consumer electronics.

- Post-listing volatility may emerge if speculative GMP-driven buying unwinds.

Outlook

The IPO closes on October 9, with allotment likely on October 10 and a listing expected on October 14, 2025. Market experts believe that given robust subscription levels and anchor backing, LG India could see a strong debut, potentially supported by a green-shoe if activated.

The LG Electronics India IPO, already among the largest this year, is turning into a litmus test for investor appetite in India’s booming consumer market. Robust demand and green-shoe buzz suggest a blockbuster listing may be on the horizon.