Bengaluru | Oct 9, 2025, 12:00 IST

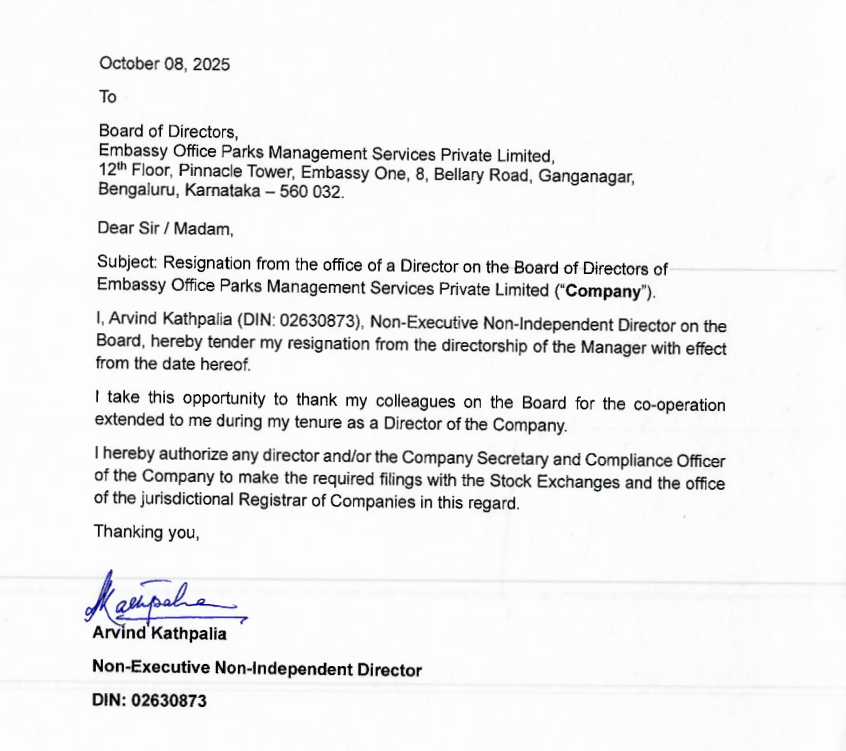

Embassy Office Parks REIT (Embassy REIT) has informed exchanges that Arvind Kathpalia has resigned from the Board of its Manager following a dilution of his stake. The disclosure, made via an NSE and BSE filing, marks a governance-level change at India’s first listed REIT, which oversees one of the country’s largest office portfolios.

Filing Highlights

In its regulatory note, Embassy REIT said that Kathpalia stepped down from the board of Embassy Office Parks Management Services Pvt. Ltd., which acts as the Manager to the REIT. The resignation, effective immediately as per the filing, is linked to a dilution of his shareholding.

The Manager clarified that the change was purely driven by stake adjustments and did not cite operational or compliance-related issues. All statutory requirements under SEBI’s REIT Regulations and LODR norms have either been completed or are underway.

Why the Move Matters

The board composition of a REIT’s Manager plays a central role in guiding strategy, distribution policies, and corporate governance. Directors help shape decisions on:

- Leasing strategies with blue-chip tenants,

- Capital allocation across acquisitions and developments,

- Debt management and refinancing, and

- Distribution payouts to unitholders.

When a director linked to ownership exits due to stake dilution, it usually signals an ownership realignment rather than any red flag on performance. Still, investors track such exits closely, especially when the REIT sector in India is attracting growing institutional and retail participation.

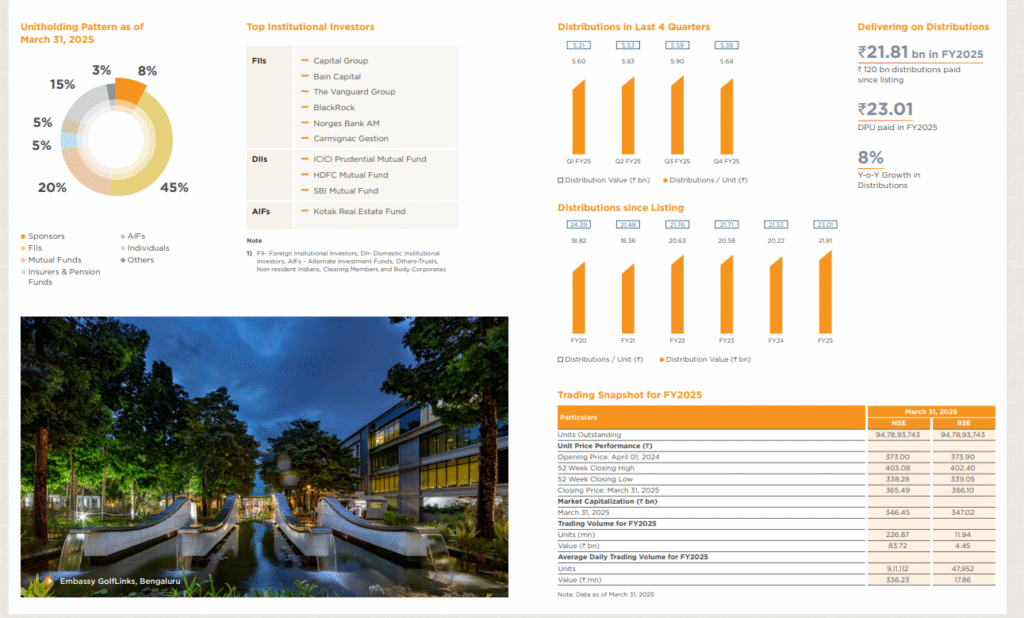

About Embassy REIT

Launched in 2019, Embassy REIT was India’s first listed real estate investment trust and remains the largest in the segment. Its portfolio includes Grade-A office parks across Bengaluru, Pune, Noida, and Mumbai, with marquee tenants from the technology and financial sectors. The REIT has consistently reported high occupancy levels, stable rental escalations, and robust distribution yields.

For unitholders, the key attraction of Embassy REIT has been its steady quarterly distributions and its ability to refinance and expand despite interest rate volatility. Corporate governance and board independence remain critical metrics for global institutional investors who are increasingly active in India’s REIT space.

Competitive & Regulatory Context

India’s REIT market now includes peers such as Mindspace Business Parks REIT and Brookfield India REIT, making governance standards an important differentiator. With SEBI tightening disclosure norms and investors demanding higher transparency, even routine board changes gain attention.

In this case, Kathpalia’s resignation is framed as a natural outcome of stake dilution, a common feature when sponsor groups or associated shareholders rebalance their holdings.

What to Watch

- Board refresh: Whether the Manager appoints a new director or inducts more independents to ensure a balanced board.

- Distribution guidance: Any commentary in upcoming quarterly updates on payouts, leasing, or capex post this change.

- Stakeholder reshuffle: If the dilution reflects broader sponsor-level realignments, investors may look for clarity in upcoming filings.

- Market reaction: While operational impact is minimal, perception of governance continuity could weigh on unitholder sentiment in the short term.

Outlook

Arvind Kathpalia’s resignation is unlikely to alter Embassy REIT’s day-to-day operations, but governance watchers will track how the board fills the vacancy and maintains compliance. For investors, the focus remains on leasing momentum, yield stability, and the REIT’s ability to manage debt amid fluctuating global rates.

Embassy REIT’s disclosure underscores the evolving governance landscape in India’s REIT market, where even routine stake-driven board exits are watched closely for their signalling value.