Mumbai | Oct 9, 2025, 13:15 IST

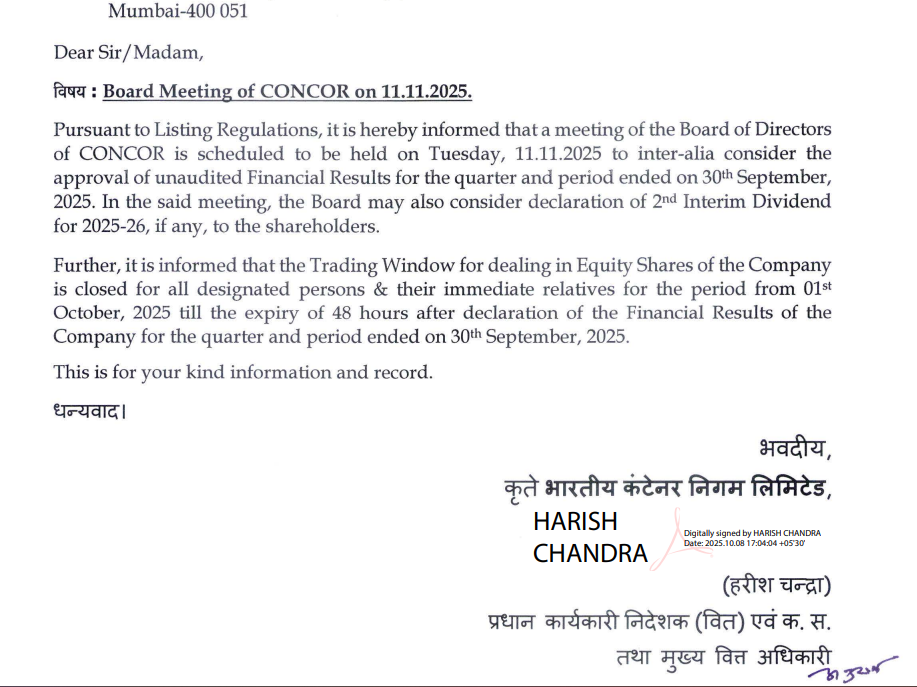

Container Corporation of India Ltd (CONCOR), the country’s largest containerized logistics company, has announced that its Board of Directors will convene in the coming days to review and approve its financial performance for Q2 FY26, according to an official NSE filing. The meeting will also cover other standard business matters required under SEBI regulations.

Filing Highlights

In its stock exchange disclosure, CONCOR said the agenda for the upcoming board meeting includes:

- Review and approval of the unaudited financial statements for Q2 FY26.

- Discussions around operational performance, freight volumes, and cost trends.

- Consideration of additional corporate matters, if any, subject to board approval.

The meeting is part of the mandatory quarterly cycle under SEBI’s Listing Obligations and Disclosure Requirements (LODR).

Why It Matters

As a logistics bellwether, CONCOR’s results serve as a proxy for trade activity and rail freight efficiency across India. With operations spanning more than 60 container terminals and a strong EXIM (export-import) focus, the company’s performance is closely linked to India’s trade ecosystem.

Its quarterly earnings often provide insights into:

- Containerized trade flows and cargo demand.

- Rail logistics competitiveness vs. road transport.

- Infrastructure utilization at key ports and inland depots.

- Policy tailwinds from the National Logistics Policy and Gati Shakti masterplan.

Given the government’s continued push for multimodal logistics and supply chain efficiency, CONCOR’s financial updates are followed by institutional investors, analysts, and industry stakeholders.

Recent Business Context

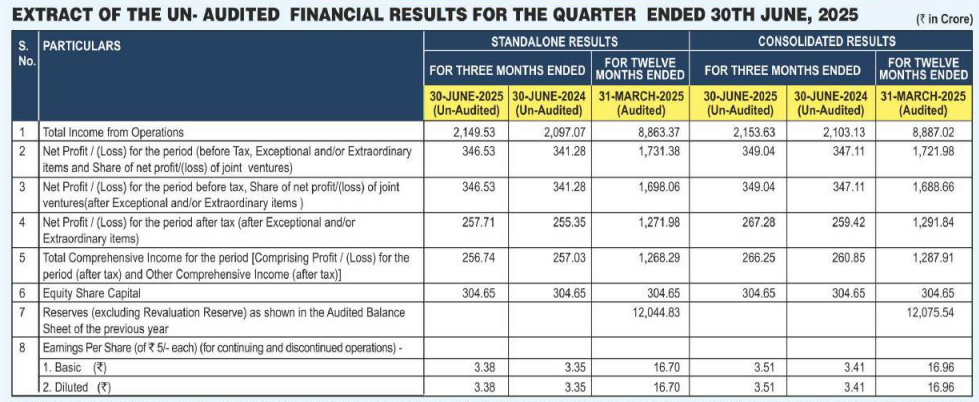

- In Q1 FY26, CONCOR delivered steady performance, with resilience in EXIM volumes despite global shipping disruptions. Domestic cargo handling also saw healthy traction, supported by higher containerization in industrial hubs.

- The company has been scaling up its hub-and-spoke model by expanding inland container depots (ICDs) and private freight terminals.

- Digital initiatives, including smart tracking systems, online booking platforms, and AI-driven freight analytics, are helping improve cargo visibility and reduce turnaround times.

- Analysts expect Q2 results to reflect the dual impact of fuel surcharge revisions on rail freight and potential margin pressure from rising operating costs.

Investor Watchpoints

When CONCOR releases its Q2 results, market participants are likely to track:

- Revenue growth across EXIM and domestic segments.

- Operating margins and the company’s ability to pass on higher costs.

- Capex plans, particularly in expanding multimodal terminals and rail-linked depots.

- Outlook commentary, especially on global trade uncertainties and India’s manufacturing-led cargo growth.

- Strategic tie-ups for technology and international partnerships that could boost competitiveness.

Outlook

Logistics has emerged as a high-growth sector in India’s infrastructure story, with rail freight expected to play a central role in reducing logistics costs to ~8% of GDP by 2030. CONCOR, with its strong market share, extensive infrastructure, and government backing, is well-positioned to benefit from these structural changes.

The upcoming board meeting, therefore, will not only finalize quarterly financials but also set the tone for operational priorities, investments, and strategic direction for the second half of FY26.