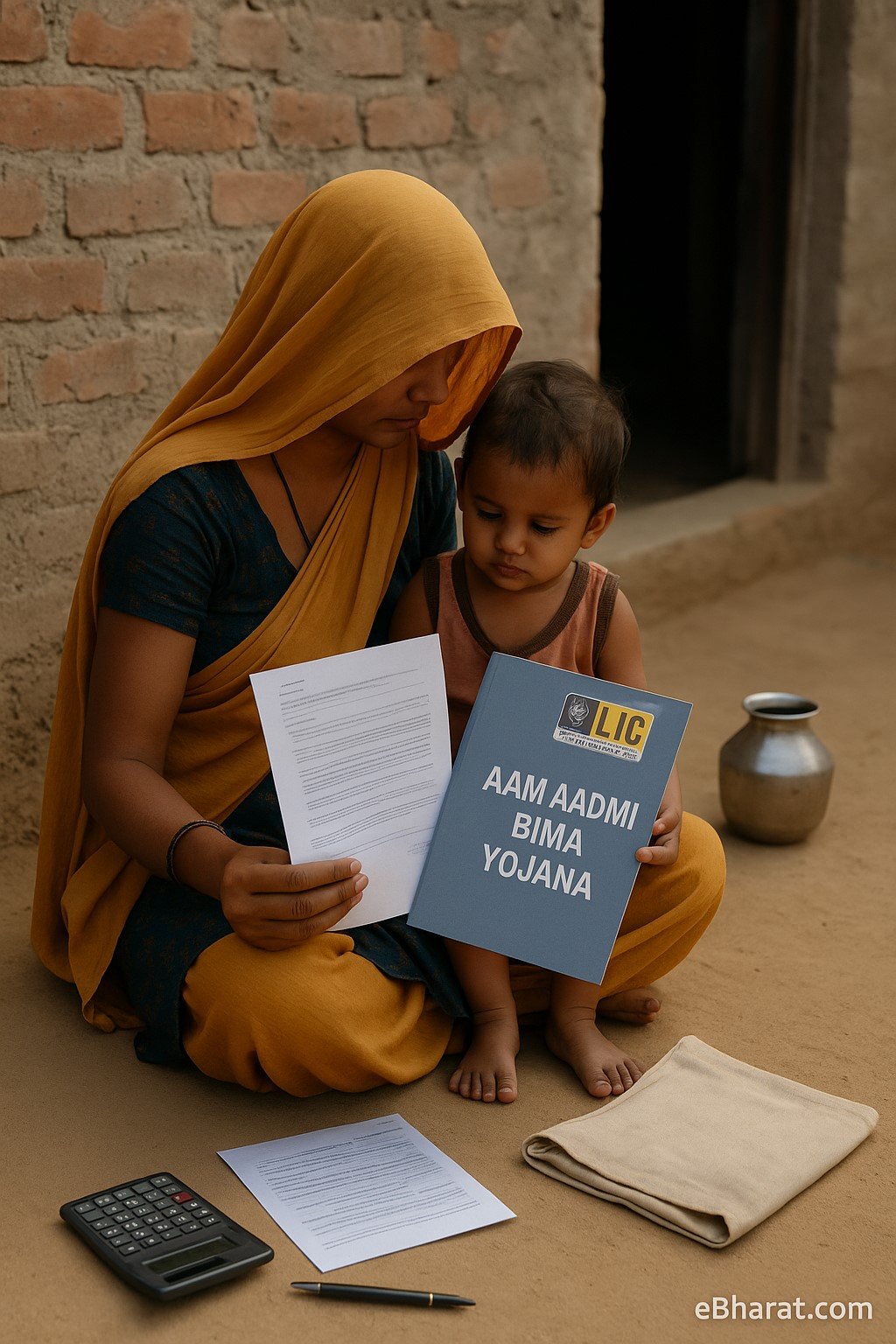

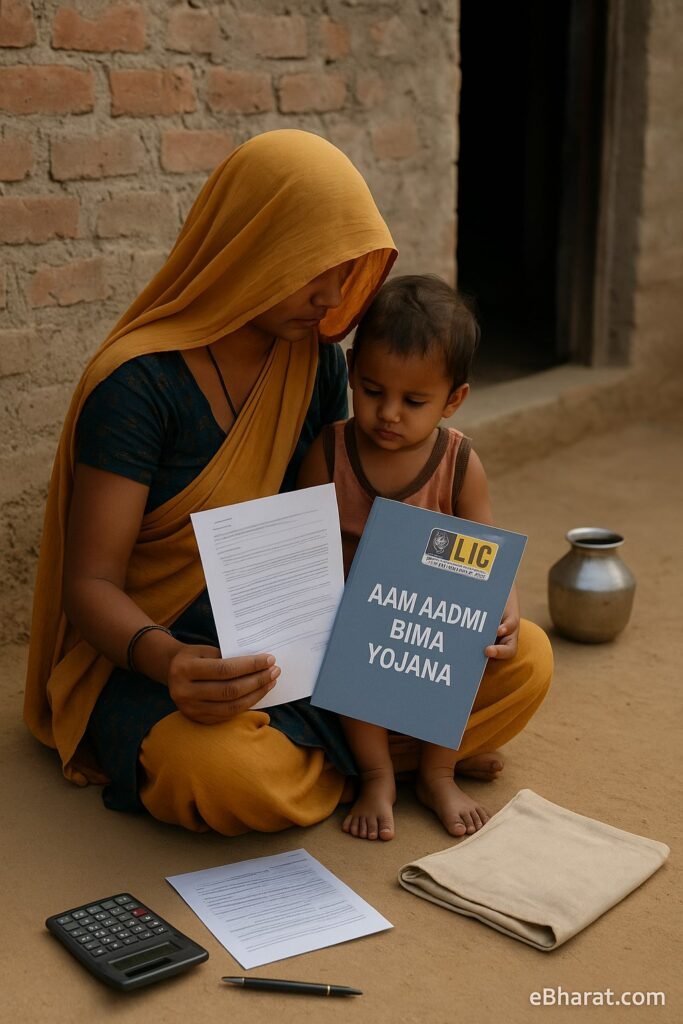

If you’ve ever wondered how rural workers or daily wage earners in India protect their families financially, there’s one lesser-known yet powerful scheme that still matters: the Aam Aadmi Bima Yojana (AABY).

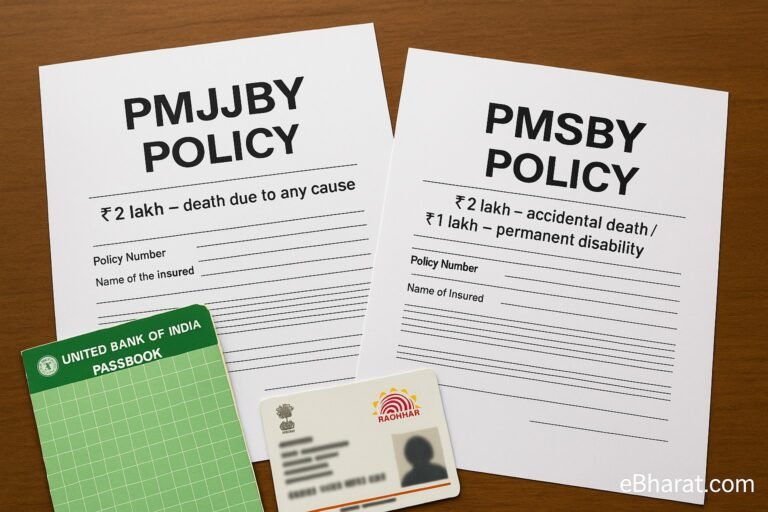

Launched by the Government of India and run by LIC, this life insurance plan was specifically created for the working poor — especially those in the unorganised sector and rural areas. While newer schemes like PMJJBY and PMSBY are more popular today, AABY continues to serve families that often fall through the cracks.

Let’s explore what AABY covers, who it’s for, and whether it’s still worth enrolling.

Key Benefits of AABY

AABY provides basic life and accident insurance to protect low-income households. Here’s what the nominee gets in case of unfortunate events:

- ₹30,000 if the insured person dies from natural causes

- ₹75,000 if they die due to an accident

- ₹75,000 for permanent total disability (like losing both eyes or both limbs)

- ₹37,500 for partial disability (like losing one eye or one hand)

But that’s not all — AABY also offers a scholarship benefit of ₹100/month per child, for up to 2 children in Classes 9 to 12.

It may not sound like a lot — but for many families, this amount provides essential support during emergencies.

Who Is Eligible for AABY?

The scheme is meant for people below the poverty line (BPL) or from approved occupational categories, especially those working in informal sectors.

You can apply if you:

- Are between 18 and 59 years old

- Belong to a rural landless household, OR

- Work in one of the 47 approved job types such as:

- Rickshaw puller

- Fisherman

- Street vendor

- Construction worker

- Weaver or handloom worker

- Member of a Self Help Group (SHG)

These workers are often not eligible for standard insurance — so AABY acts as a social security lifeline.

What Does It Cost?

The total annual premium is ₹200 per person. But the good news?

- 50% is paid by the Central Government

- The remaining 50% is usually paid by the State Government or a Nodal Agency

This means most eligible families don’t need to pay anything themselves — or at most, pay a nominal amount.

It’s one of the rare schemes where coverage is provided practically free or at a symbolic cost.

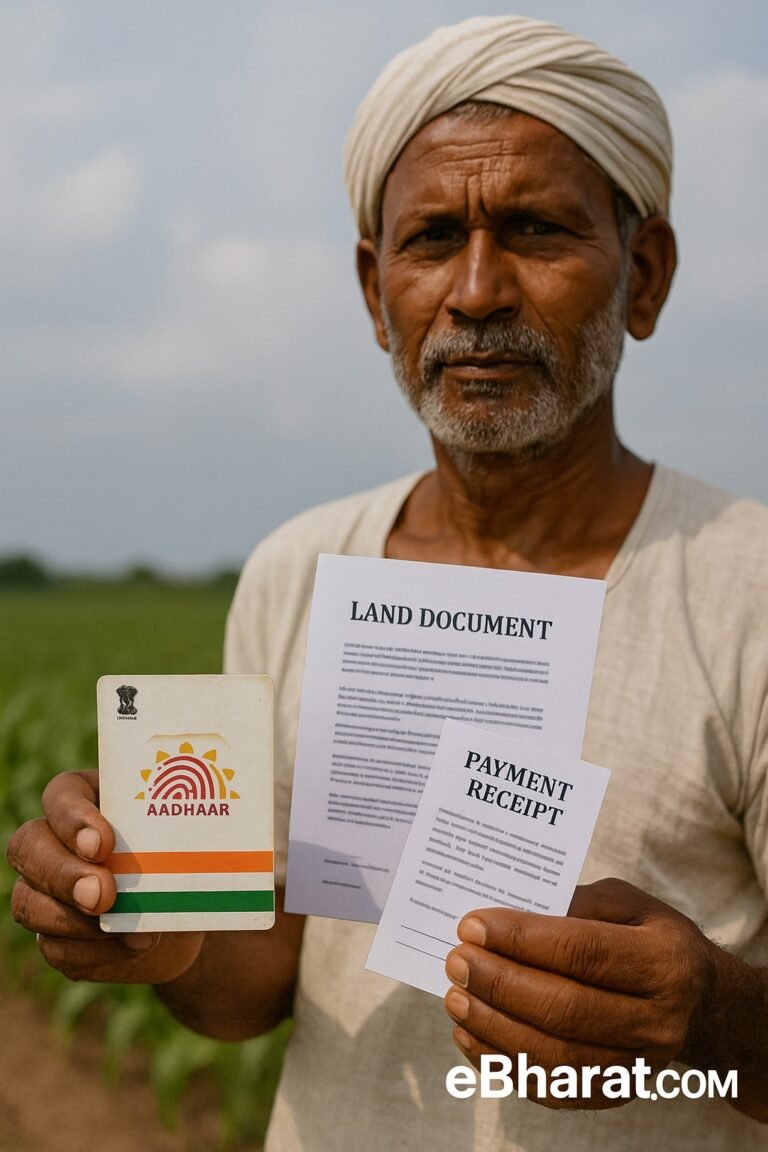

How to Enroll in AABY

Enrollment isn’t done through apps or bank portals — it’s a community-driven process.

You can sign up through:

- Local Gram Panchayats

- SHG federations

- Rural welfare boards

- Or Nodal Agencies appointed by LIC

You’ll need to submit:

- Aadhaar card

- Age proof (ration card, voter ID, etc.)

- Occupational certificate (if applicable)

- Family details

Some states use SECC (Socio-Economic Caste Census) data for automatic mapping and outreach.

Is AABY Still Active in 2025?

Yes, it is. But the visibility has reduced.

With the rise of PMJJBY and PMSBY, many banks and officials now promote those schemes due to easier digital processes and bank account linkage.

However, AABY is still implemented in several states — especially for SHG members, welfare board beneficiaries, or certain rural groups. If you’re unsure, check with your local Panchayat or LIC nodal agency to see if you or your group qualifies.

Why AABY Still Matters

For rural and informal workers earning less than ₹10,000/month, buying private insurance may not be possible. AABY is not a full replacement for a term plan — but it gives families a dignified fallback during hard times.

- It’s government-backed

- Premium is low or zero

- Nominee support is guaranteed

- Scholarship adds extra value

Final Thought

If you or someone in your family is part of a rural occupation, works in construction, or is linked to an SHG — don’t ignore AABY. It’s simple, honest insurance meant for real people — and still works quietly in the background, protecting millions.

Even if you’ve heard of PMJJBY or PMSBY, AABY could be a hidden lifeline you didn’t know you had access to.

Let your community know — because awareness saves lives.