Finally — Faster, Smarter Help for Policyholders in India

If you’ve ever had to chase your insurance company for weeks — just to get a simple claim processed or a refund clarified — you’re not alone.

But now, there’s good news on the horizon.

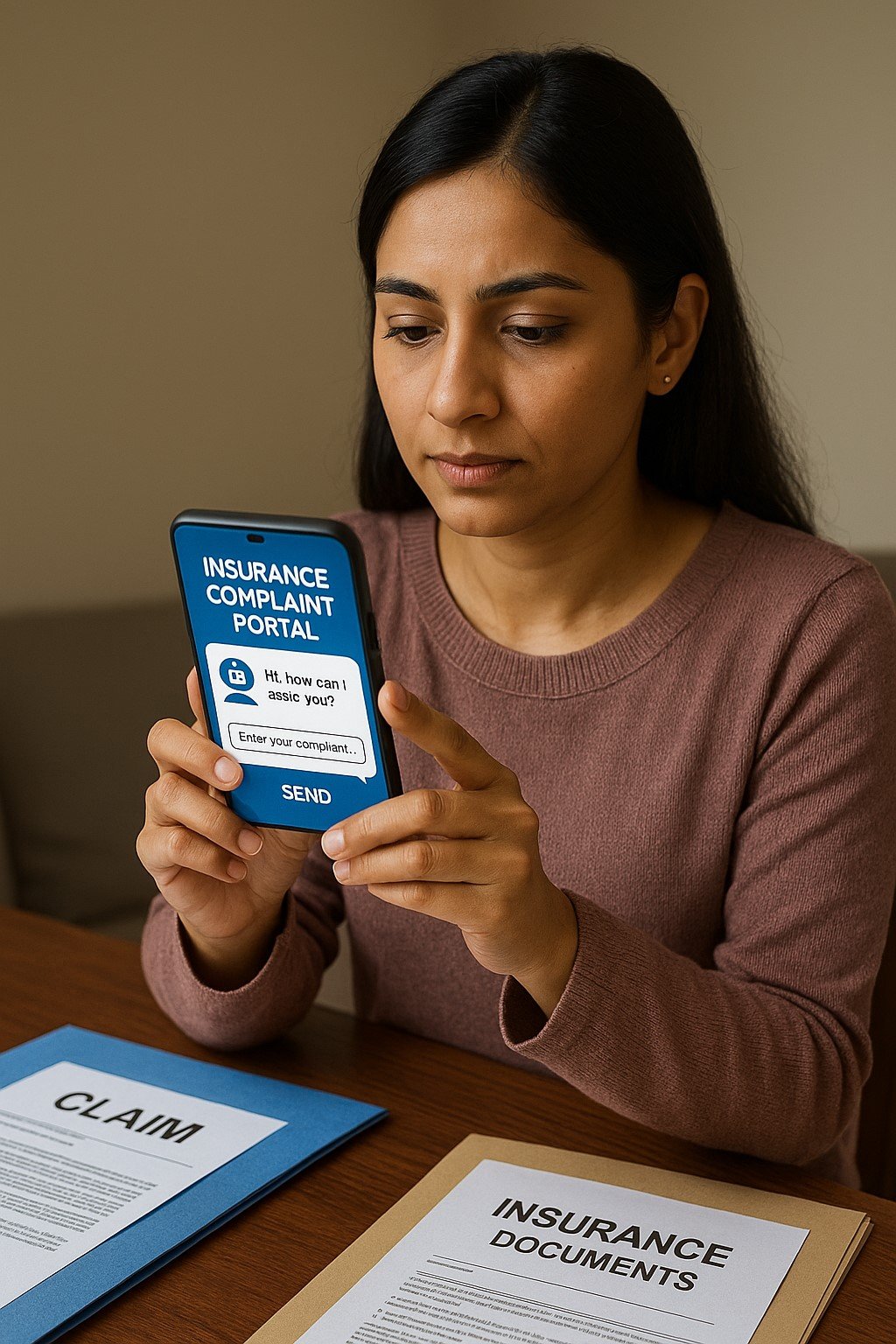

In a major digital leap for India’s insurance sector, the Indian government, along with IRDAI, is preparing to roll out an AI-powered insurance grievance redressal portal in 2025. This new platform is expected to make complaints easier to file, faster to resolve, and far more transparent — no more running to branches or mailing repeated reminders.

What Will This AI Grievance Portal Actually Do?

This is not just another complaint form — it’s an intelligent, end-to-end system designed to transform how your insurance grievances are handled.

Here’s what’s coming:

- AI-based complaint categorization to instantly tag and sort issues

- Smart routing to the correct department or insurer desk

- Time-bound auto-escalation if your issue isn’t resolved in time

- Live tracking so you always know your complaint status

- Alerts via SMS and email for every step taken on your case

- Fraud & trend detection to identify repetitive problems or insurer delays

Think of it as the Swiggy-style tracking system for your complaint — but built for life, health, motor, and all types of insurance.

What Kind of Complaints Can You File?

You’ll be able to lodge complaints for almost anything that insurance buyers commonly struggle with:

- Delayed or rejected claims

- Mis-selling by agents (false promises, wrong plans)

- Refunds not processed

- Unjust deductions in health or motor claims

- Policy lapsed due to communication issues

- Poor or no customer service from your insurer

And the best part? You can file these online or through the app, without ever stepping into an insurance office.

Why This Is a Game-Changer for You

Today, many complaints in India go unresolved simply because:

- They get stuck in paperwork or lost in follow-ups

- Customers don’t know how to escalate

- Insurers delay responses without any consequence

This AI system levels the playing field for everyday customers by offering:

- A ticket number with a defined resolution timeline

- Automatic escalation to IRDAI if insurers don’t reply in time

- Full transparency, so no one can ignore your case

- Better oversight — the system tracks how responsive each insurer is

This puts pressure on insurance companies to fix issues fast or face action.

Will It Replace Existing Complaint Channels?

Not entirely. The AI grievance portal will work alongside:

- IRDAI’s current Integrated Grievance Management System (IGMS)

- The Insurance Ombudsman system

- Each insurer’s own customer service portals

You can still reach out to your insurer directly. But if they delay or don’t respond, the AI system will automatically push the complaint forward — to either IRDAI or the ombudsman — without you having to follow up manually.

What IRDAI Says About This Move

This initiative is part of IRDAI’s larger mission: “Insurance for All by 2047.”

In their latest announcement, IRDAI confirmed that technology-driven complaint resolution is one of the key pillars of this vision — especially as more Indians than ever are buying insurance, across urban and rural regions.

The portal will launch in phases starting mid-2025, beginning with large metros and expanding across states.

Final Word: A Win for Every Policyholder

India’s insurance industry is evolving — and the launch of this AI-powered grievance portal is a giant step in the right direction.

It’s a tool for empowerment, putting the customer in control of their insurance experience.

Whether you’re dealing with a delayed claim, misleading advice, or poor service — help is coming, and it’s smart, fast, and trackable.