₹25,000 Monthly Income? Here’s the Best Life Cover for You

Earning ₹25,000 a month and wondering how much life insurance you need? Here’s a simple breakdown of what cover amount suits your income, goals, and family.

Earning ₹25,000 a month and wondering how much life insurance you need? Here’s a simple breakdown of what cover amount suits your income, goals, and family.

Most Indians either over-insure or under-insure themselves. Here’s a clear way to calculate the life insurance cover that fits your income, family needs, and future goals.

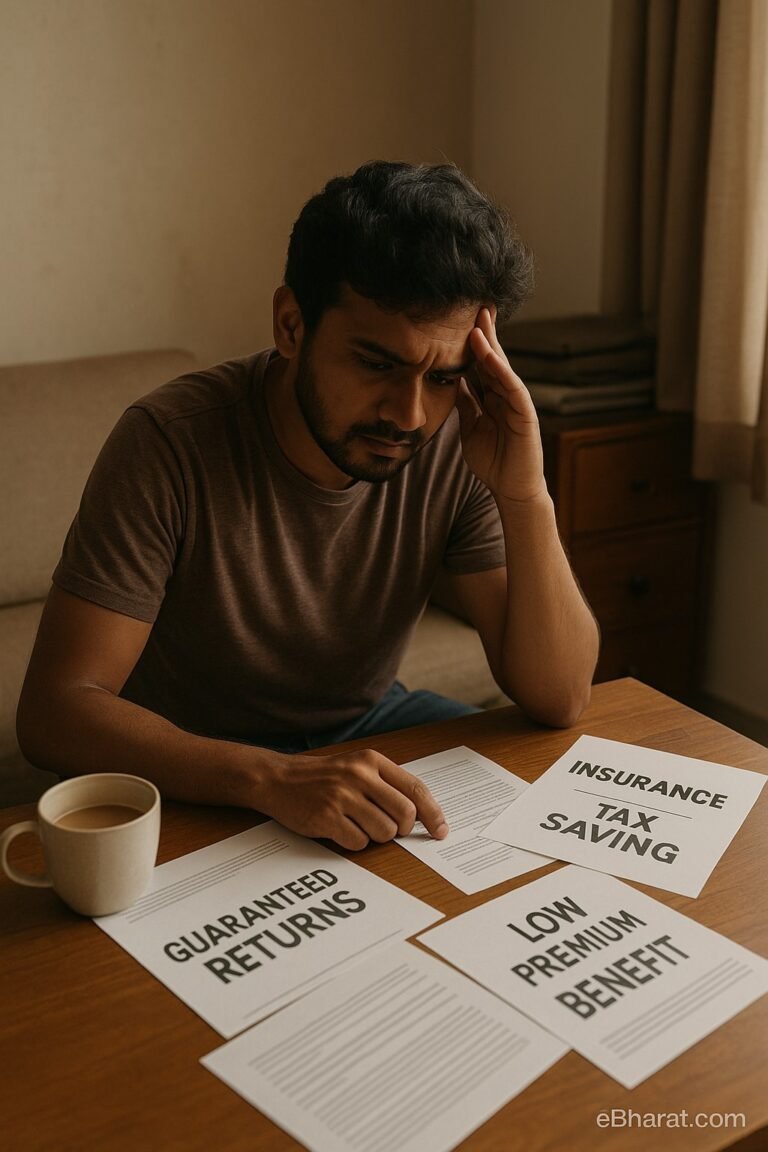

Ever been offered an insurance plan over WhatsApp that promises “guaranteed returns”? Or heard an agent say, “This scheme is closing tomorrow, sir — sign quickly!” If yes, then there’s one name you must know before you say yes to…

Many Indians fall for emotional pitches, urgency traps, and low-cover plans when buying insurance. Learn how to avoid the 3 most common mistakes and protect your future wisely.

Many Indians still live without life insurance. Here’s what that means for your family, finances, and future when a crisis strikes.

Most Indian families ignore life insurance for housewives. But what happens to the home if something happens to her? Here's the truth every family should know.

From “I don’t need insurance” to “I’ll get returns,” these myths hurt real families every day. Let’s bust 5 common insurance mistakes Indians still believe.

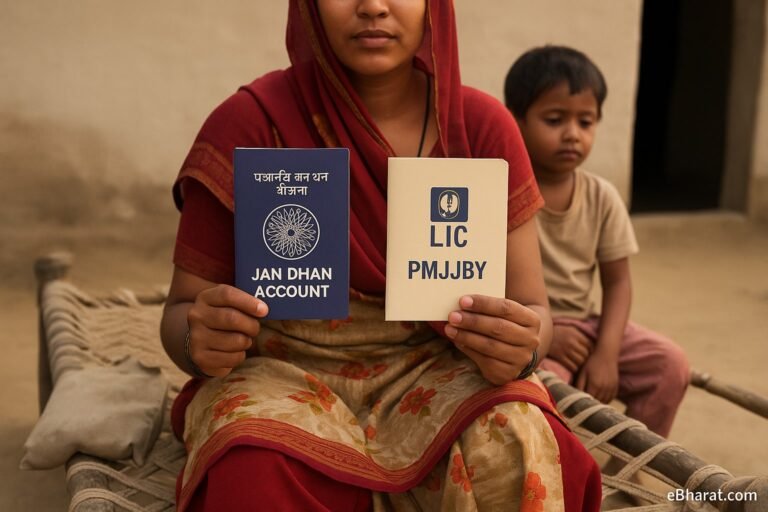

Have a Jan Dhan account? With just ₹436/year, you can activate life insurance under PMJJBY and secure ₹2 lakh cover for your family. Here's how to use both together.

The Aam Aadmi Bima Yojana (AABY) offers ₹30,000 life cover to rural workers and their families. Here’s who qualifies and how to apply under this low-cost social scheme.

PMJJBY and PMSBY are two of India’s most affordable insurance schemes. Here’s how they differ in premium, coverage, eligibility, and whether you should enrol in both.