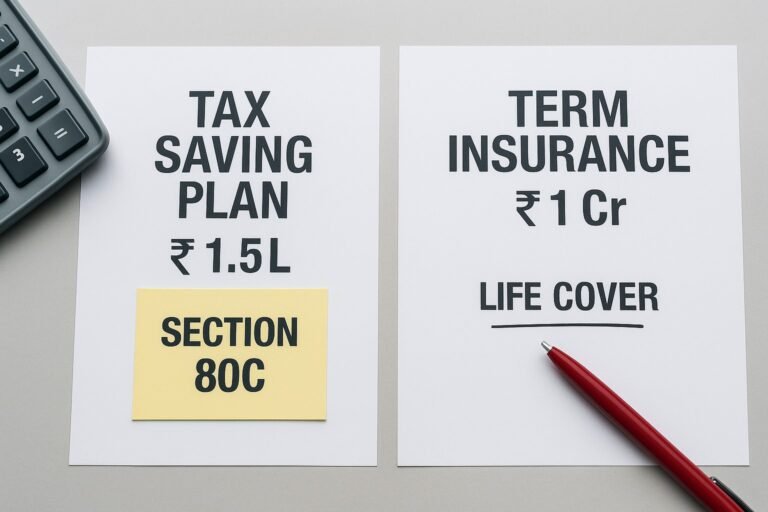

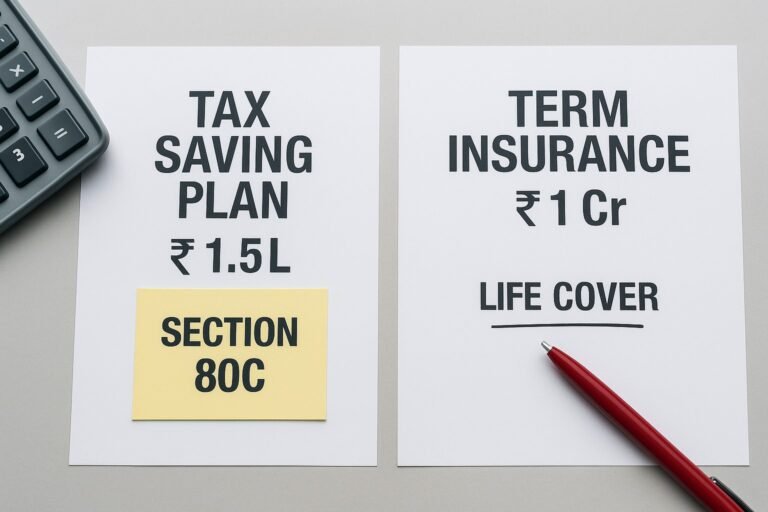

Why Buying Life Insurance Just to Save Tax Is a Costly Mistake

Life insurance helps with taxes — but that shouldn’t be the only reason to buy it. Here’s why choosing insurance just for Section 80C deduction is risky.

Life insurance helps with taxes — but that shouldn’t be the only reason to buy it. Here’s why choosing insurance just for Section 80C deduction is risky.

Before buying any life or health insurance plan, check for these 5 key details in the brochure: IRDAI code, sum assured, exclusions, and more.

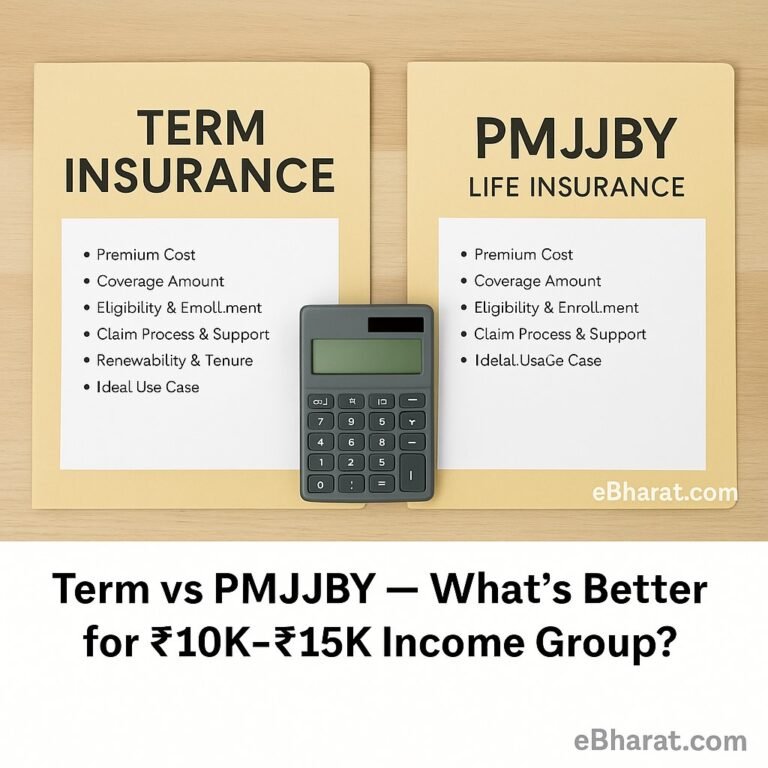

With limited income, which is better — a basic term plan or PMJJBY? This side-by-side guide compares cost, coverage, and suitability for small-income families.

Can’t afford a ₹5,000 term plan right now? Start smaller. Here’s how to still protect your family with ₹400–₹1,000/year options.

Earning ₹15K–₹20K/month? These life insurance plans offer real protection for your family — starting at just ₹1/day.

Looking for affordable life insurance with a ₹20K–₹30K income? Compare PMJJBY, LIC Micro Plans, and basic term plans to choose the best protection for your budget.

₹1 crore term plans are popular in India, but are they enough? Learn how to evaluate your actual life cover need based on income, liabilities, and family size.

Life insurance is essential, but how much cover is enough? This guide helps you calculate the right amount based on your income, expenses, and responsibilities.