SWP Withdrawal Planner — A 2025 Guide

A Systematic Withdrawal Plan (SWP) allows investors to withdraw fixed amounts from mutual funds. Here’s how to plan withdrawals, calculate tax, and avoid running out of money.

A Systematic Withdrawal Plan (SWP) allows investors to withdraw fixed amounts from mutual funds. Here’s how to plan withdrawals, calculate tax, and avoid running out of money.

Don’t rely only on social media tips. Use official sources — RBI, MOSPI, NSE/BSE, SEBI — for accurate data and regulatory updates. Here’s how each helps investors in India.

Brokerage is not the only cost in stock trading. Learn about STT, stamp duty, GST, SEBI charges, and hidden fees every Indian trader must know in 2025.

Gold investing is popular in India, but should you buy Gold ETFs, SGBs, or Digital Gold? Here’s a 2025 comparison of returns, tax rules, liquidity, and risks.

India’s railways and logistics sector is booming with freight corridors, infra push, and private investment. Here’s how investors can benefit from this theme in 2025.

Every investment carries risk. Here’s a simple framework for Indian investors — understand default risk, liquidity risk, and platform risk before you invest.

Upstox Pro offers flat ₹20 brokerage, powerful charting, and free APIs. This 2025 review covers charges, platform benefits, and prospected users.

Sovereign Gold Bonds can be used as collateral for loans. Here’s a guide on how loan against SGBs works, its pros & cons, and the RBI’s LTV rules in 2025.

Goal-based investing is simple with corpus tracking and SIP backsolve tools. Here’s how investors in India can calculate monthly SIPs to meet financial targets.

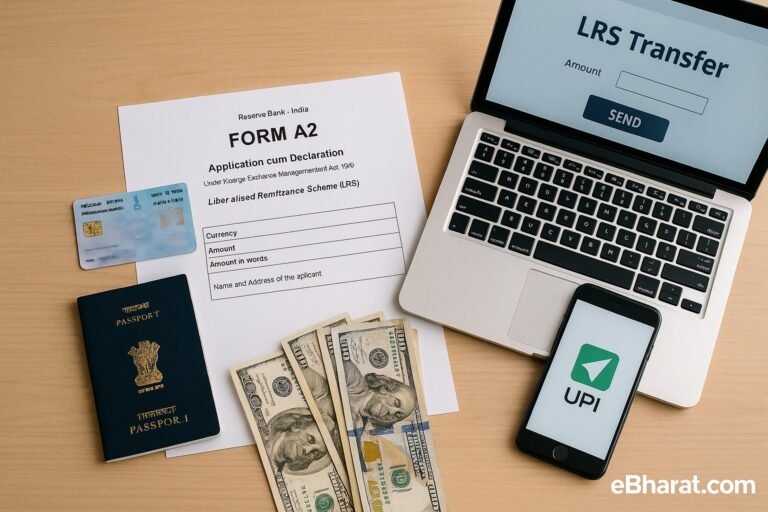

India’s Liberalised Remittance Scheme (LRS) allows residents to send up to USD 250,000 abroad annually. Here’s a guide for investors — limits, forms, and banks that support LRS.